Question: M E M O R A N D U M To: Student From: Paul Partner Subject: Claire Clients Tax Return March 1, 2021 Today I

M E M O R A N D U M

To: Student

From: Paul Partner

Subject: Claire Clients Tax Return

March 1, 2021

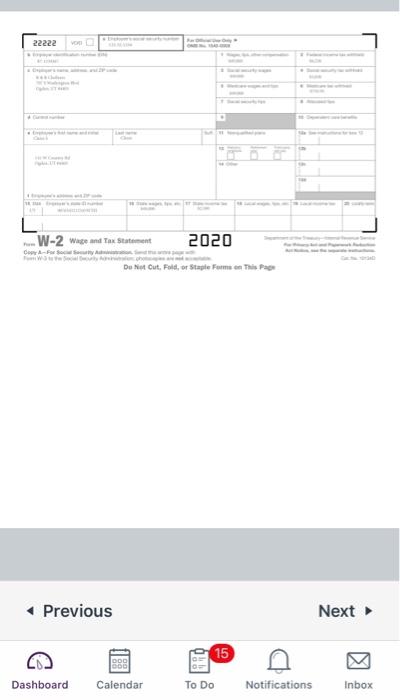

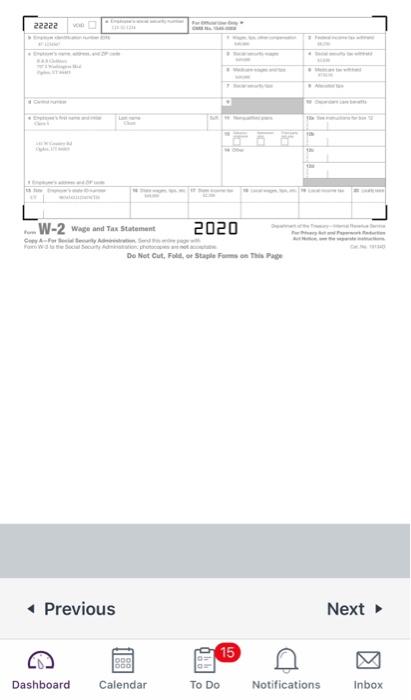

Today I met with Claire Client, a new client, who was referred to me last week. She has hired our firm to prepare her 2020 tax return and I would like you to get things rolling. She works as a salesperson at R & R Clothiers, where she is paid a base wage, plus commission. She is divorced with no children and is a single-filing taxpayer. She owns a condo (no mortgage) here in Ogden. She will take the standard deduction since her itemized deductions do not exceed $12,400. Included here are her W-2 (wages and salary) and the Form 1099-INT (interest income). Please use them to complete the Form 1040. Also included here are the tax tables for purposes of calculating the tax.

Claire does not wish to contribute to the presidential election campaign.

Please assume that if no information is provided as to a particular line, then that line should be left blank.

Please download Form 1040 and open it in Adobe Reader to save the information you enter.

22222 W-2 wage and Tax Statement 2020 - Www Do Not Cut, Fold, or Sale Forme This Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts