Question: m EXTRA PRACTICE ounz WITH WORKED-OUT SOLUTIONS 1. m EXTRA PRACTICE our: wITH WORKED-OUT SOLUTIONS Complete the following without a table (round each calculation to

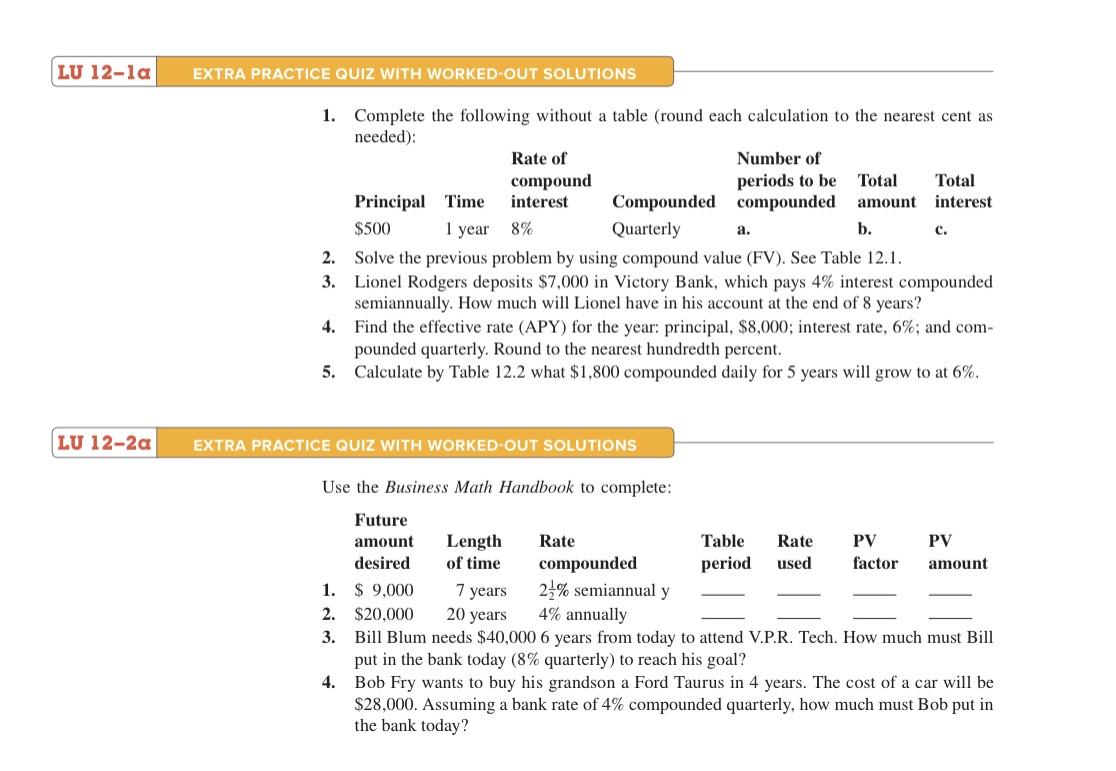

m EXTRA PRACTICE ounz WITH WORKED-OUT SOLUTIONS 1. m EXTRA PRACTICE our: wITH WORKED-OUT SOLUTIONS Complete the following without a table (round each calculation to the nearest cent as needed): Rate of Number of compound periods to be Total Total Principal Time interest Compounded compounded amount interest $500 1 year 8% Quarterly a. I). c. Solve the previous problem by using compound value (FV). See Table 12.1. Lionel Rodgers deposits $7.000 in Victory Bank. which pays 4% interest compounded semiannually. How much will Lionel have in his account at the end oi'8 years? Find the effective rate (APY) for the year: principal. $8,000; interest rate. 6%; and corn pounded quarterly. Round to the nearest hundredth percent. Calculate by Table 12.2 what $1,300 compounded daily for 5 years will grow to at 6%. Use the Business Mark Handbook to complete: 5\"!\" Future amount Length Rate Table Rate PV PV desired of time compounded period used factor amount S 9,000 7 years 2%% semiannual y _ _ _ _ $20,000 20 years 4% annually Bill Blum needs $40,000 6 years from today to attend V.P.R. Tech. How much must Bill put in the bank today (3% quarterly) to reach his goal? Bob Fry wants to buy his grandson a Ford Taurus in 4 years. The cost of a car will be $28,000. Assuming a bank rate of 4% compounded quarterly, how much must Bob put in the bank today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts