Question: M Inbox - sgrav4054@stud x m Chapter 3 - Case in Point X My Home x redshelf.com/app/ecom/f x ) Paraphrasing Tool - QuillE X *Dashboard

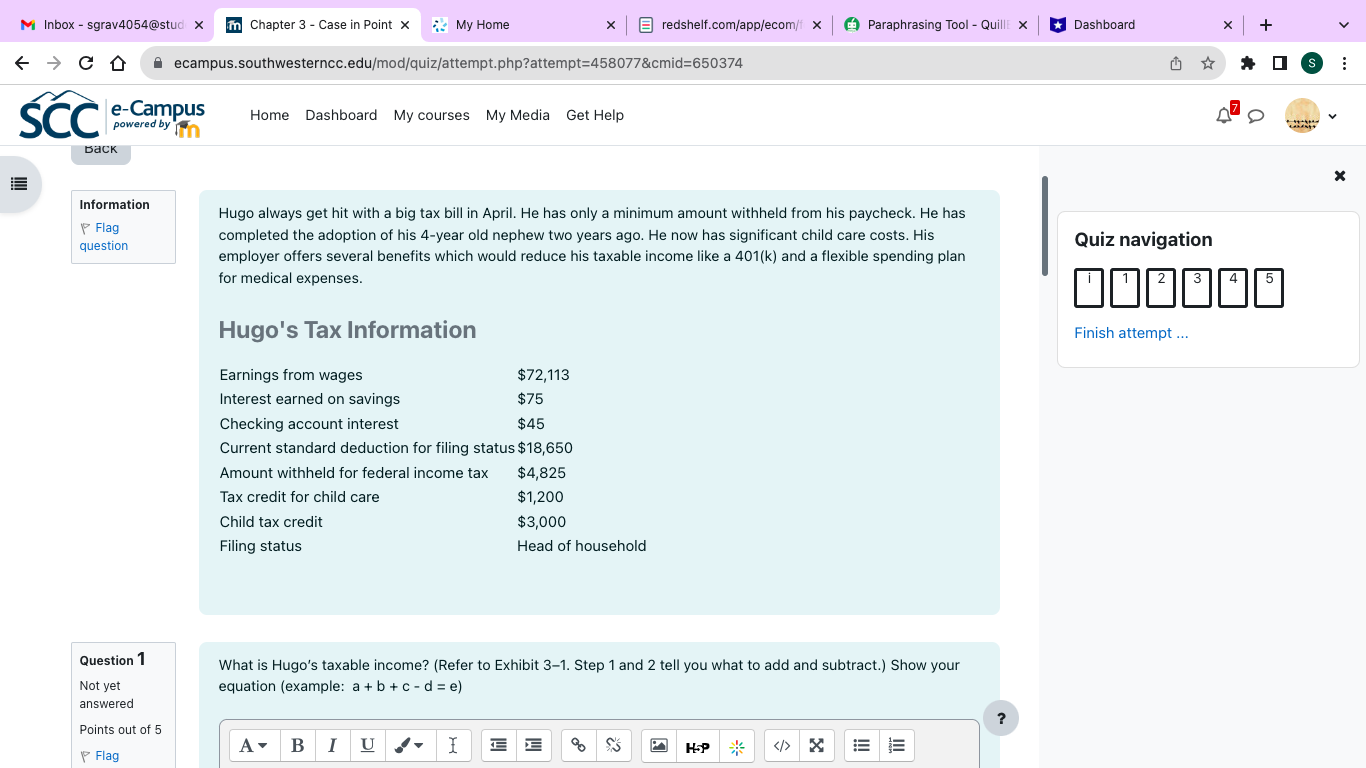

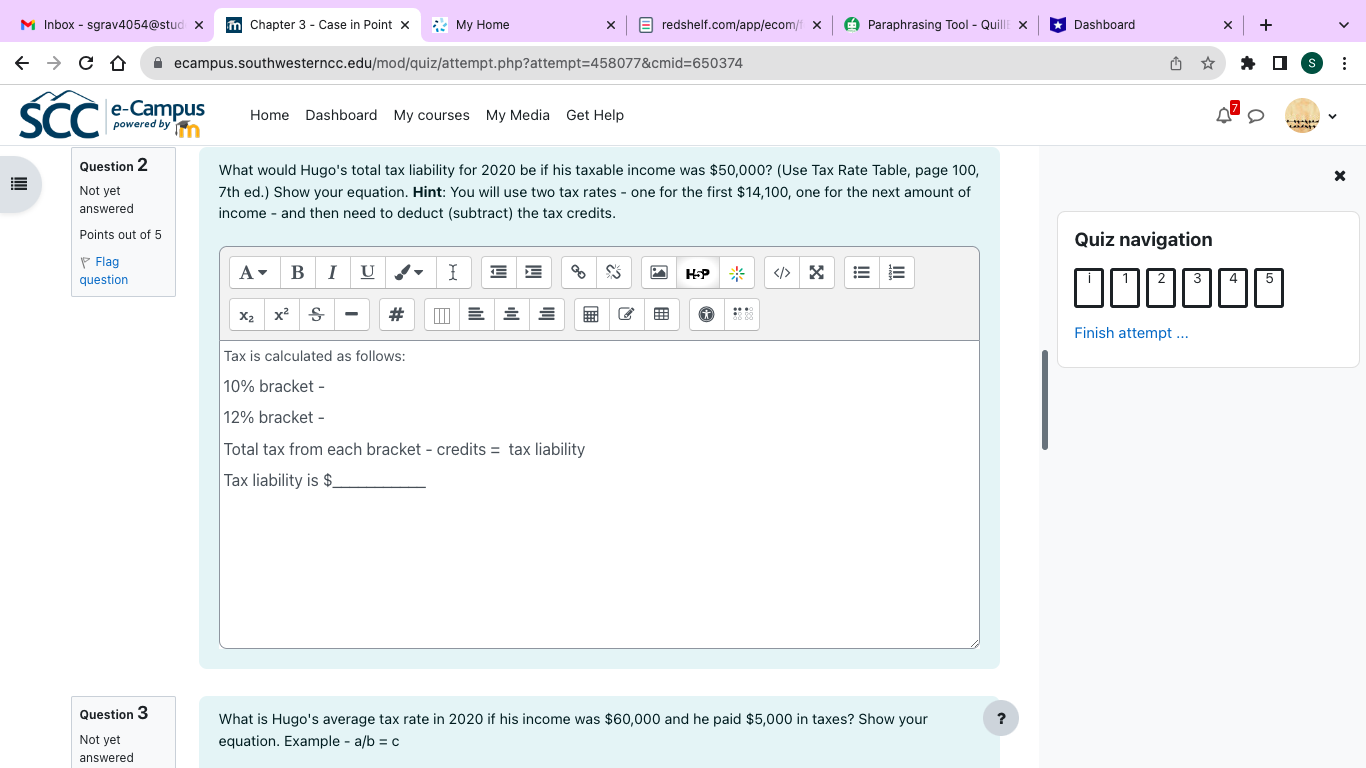

M Inbox - sgrav4054@stud x m Chapter 3 - Case in Point X My Home x redshelf.com/app/ecom/f x ) Paraphrasing Tool - QuillE X *Dashboard X ecampus.southwesterncc.edu/mod/quiz/attempt.php?attempt=458077&cmid=650374 S SCC e-Campus powered by fin Home Dashboard My courses My Media Get Help Back X Information Hugo always get hit with a big tax bill in April. He has only a minimum amount withheld from his paycheck. He has Flag completed the adoption of his 4-year old nephew two years ago. He now has significant child care costs. His question Quiz navigation employer offers several benefits which would reduce his taxable income like a 401(k) and a flexible spending plan for medical expenses. 4 Hugo's Tax Information Finish attempt ... Earnings from wages $72,113 Interest earned on savings $75 Checking account interest $45 Current standard deduction for filing status $18,650 Amount withheld for federal income tax $4,825 Tax credit for child care $1,200 Child tax credit $3,000 Filing status Head of household Question 1 What is Hugo's taxable income? (Refer to Exhibit 3-1. Step 1 and 2 tell you what to add and subtract.) Show your Not yet equation (example: a + b + c - d = e) answered ? Points out of 5 A v B I U E Go SAS (/> Flag IEM Inbox - sgrav4054@stud x m Chapter 3 - Case in Point X My Home x redshelf.com/app/ecom/f x ) Paraphrasing Tool - QuillE X *Dashboard X ecampus.southwesterncc.edu/mod/quiz/attempt.php?attempt=458077&cmid=650374 S SCC e-Campus powered by Tin Home Dashboard My courses My Media Get Help Question 2 What would Hugo's total tax liability for 2020 be if his taxable income was $50,000? (Use Tax Rate Table, page 100, X Not yet 7th ed.) Show your equation. Hint: You will use two tax rates - one for the first $14,100, one for the next amount of answered income - and then need to deduct (subtract) the tax credits. Points out of 5 Quiz navigation Flag A v question B U SX HSP 4 X2 x2 S Finish attempt ... Tax is calculated as follows: 10% bracket - 12% bracket - Total tax from each bracket - credits = tax liability Tax liability is $_ Question 3 What is Hugo's average tax rate in 2020 if his income was $60,000 and he paid $5,000 in taxes? Show your ? Not yet equation. Example - a/b = c answered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts