Question: M INEKI M E AN Aalb A . KADS, Inc. has spent RM300,000 on research to develop a new computer game. The firm is planning

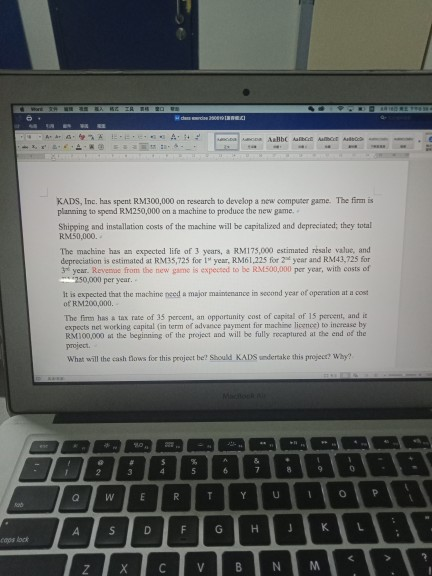

M INEKI M E AN Aalb A . KADS, Inc. has spent RM300,000 on research to develop a new computer game. The firm is planning to spend RM250,000 on a machine to produce the new game. Shipping and installation costs of the machine will be capitalized and depreciated; they total RM50,000. The machine has an expected life of 3 years, a RM175,000 estimated resale value, and depreciation is estimated at RM35,725 for 1 year, RM61,225 for 2 year and RM43,725 for 3 year. Revenge from the new game is expected to be RM500,000 per year, with costs of 250,00 per year. It is expected that the machine need a major maintenance in second year of operation at a cost of RM200,000. The firm w tax rate of 35 percent, an opportunity cost of capital of 15 percent, and it expects not working capital in term of advance payment for machine licence to increase by RM100,000 m the beginning of the project and will be fully recaptured at the end of the project What will the cash flows for this project be? Should KADS undertake this project? Why? TTC BNM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts