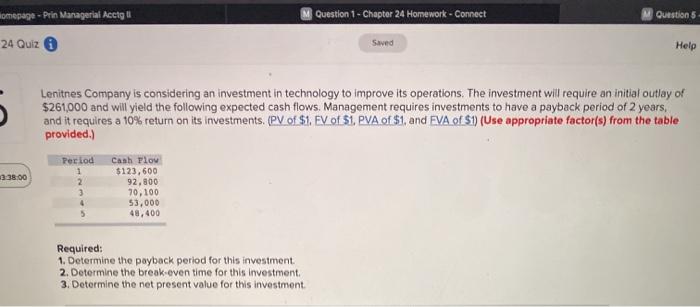

Question: M Question 1- Chapter 24 Homework - Connect Question 5 Homepage - Prin Managerial Acctg 24 Quiz Saved Help Lenitnes Company is considering an investment

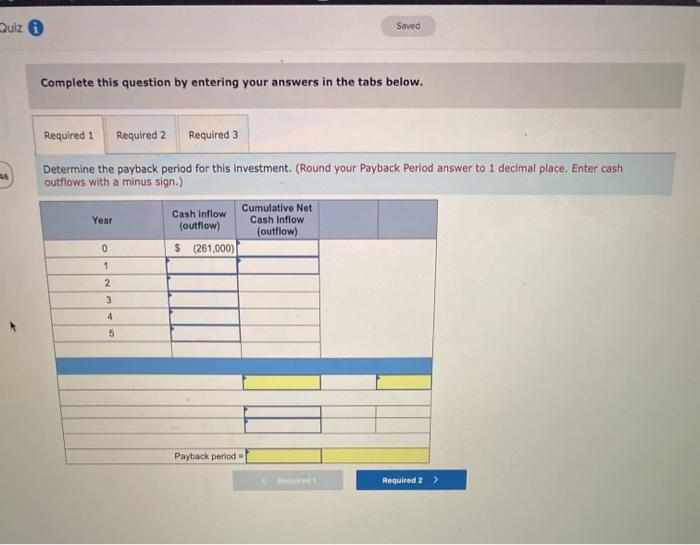

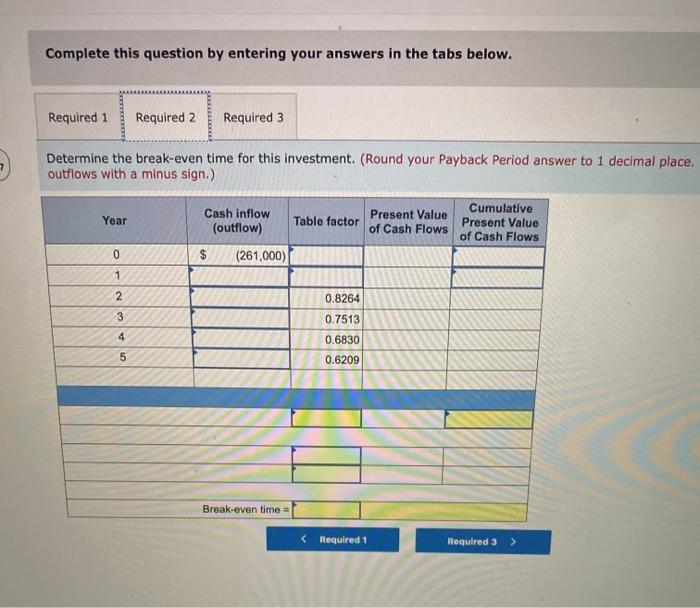

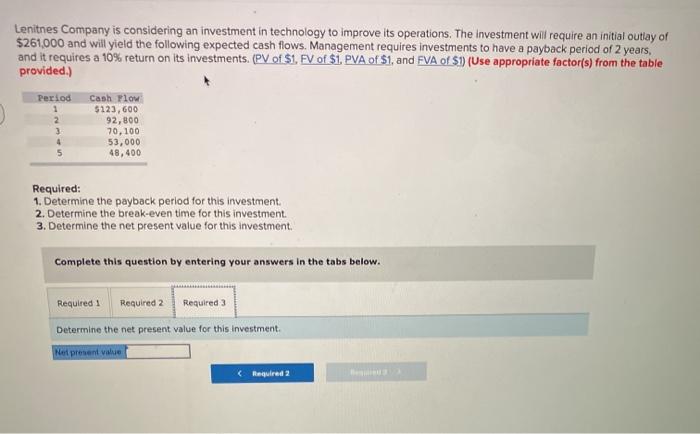

M Question 1- Chapter 24 Homework - Connect Question 5 Homepage - Prin Managerial Acctg 24 Quiz Saved Help Lenitnes Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $261,000 and will yield the following expected cash flows. Management requires investments to have a payback period of 2 years, and it requires a 10% return on its investments. (PV of $1. EV of $1. PVA of $1 and FVA of $1) (Use appropriate factor(s) from the table provided.) 3:38:00 Period 1 2 3 Cash Flow $123,600 92.800 70,100 53,000 48,400 Required: 1. Determine the payback period for this investment. 2. Determine the break-even time for this investment 3. Determine the net present value for this investment Quiz Saved Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 36 Determine the payback period for this investment. (Round your Payback period answer to 1 decimal place. Enter cash outflows with a minus sign.) Cash inflow Cumulative Net Year Cash Inflow (outflow) (outflow) $ (261.000) 0 1 2 3 4 5 Payback period Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the break-even time for this investment. (Round your Payback period answer to 1 decimal place. outflows with a minus sign.) Year Cash inflow (outflow) Table factor Present Value of Cash Flows Cumulative Present Value of Cash Flows 0 $ (261,000) 1 2 3 0.8264 0.7513 0.6830 4 5 0.6209 Break-even time Lenitnes Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $261,000 and will yield the following expected cash flows. Management requires investments to have a payback period of 2 years and it requires a 10% return on its investments. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the table provided.) Period 1 2 3 4 Cash Flow $123,600 92,800 70, 100 53,000 48,400 Required: 1. Determine the payback period for this investment 2. Determine the break-even time for this investment 3. Determine the net present value for this investment Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the net present value for this investment. Net prenent value Required 2 M Question 1- Chapter 24 Homework - Connect Question 5 Homepage - Prin Managerial Acctg 24 Quiz Saved Help Lenitnes Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $261,000 and will yield the following expected cash flows. Management requires investments to have a payback period of 2 years, and it requires a 10% return on its investments. (PV of $1. EV of $1. PVA of $1 and FVA of $1) (Use appropriate factor(s) from the table provided.) 3:38:00 Period 1 2 3 Cash Flow $123,600 92.800 70,100 53,000 48,400 Required: 1. Determine the payback period for this investment. 2. Determine the break-even time for this investment 3. Determine the net present value for this investment Quiz Saved Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 36 Determine the payback period for this investment. (Round your Payback period answer to 1 decimal place. Enter cash outflows with a minus sign.) Cash inflow Cumulative Net Year Cash Inflow (outflow) (outflow) $ (261.000) 0 1 2 3 4 5 Payback period Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the break-even time for this investment. (Round your Payback period answer to 1 decimal place. outflows with a minus sign.) Year Cash inflow (outflow) Table factor Present Value of Cash Flows Cumulative Present Value of Cash Flows 0 $ (261,000) 1 2 3 0.8264 0.7513 0.6830 4 5 0.6209 Break-even time Lenitnes Company is considering an investment in technology to improve its operations. The investment will require an initial outlay of $261,000 and will yield the following expected cash flows. Management requires investments to have a payback period of 2 years and it requires a 10% return on its investments. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the table provided.) Period 1 2 3 4 Cash Flow $123,600 92,800 70, 100 53,000 48,400 Required: 1. Determine the payback period for this investment 2. Determine the break-even time for this investment 3. Determine the net present value for this investment Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the net present value for this investment. Net prenent value Required 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts