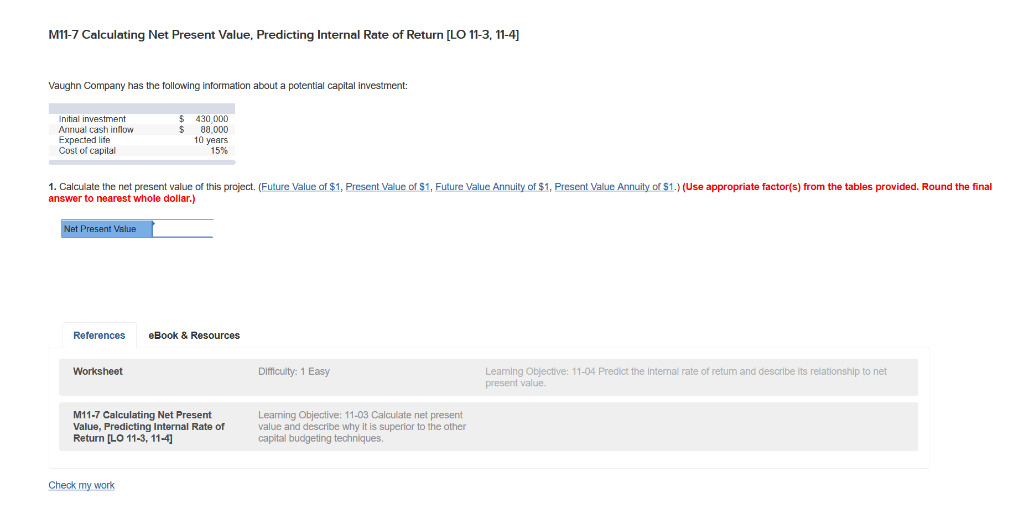

Question: M11-7 Calculating Net Present Value, Predicting Internal Rate of Return [LO 11-3, 11-4] Vaughn Company has the following information about a potential capital investment: $

M11-7 Calculating Net Present Value, Predicting Internal Rate of Return [LO 11-3, 11-4] Vaughn Company has the following information about a potential capital investment: $ 430 000 $ 88,000 10 years 15% Initial investment Annual cash inflow Expected life Cost of capilal 1. Calculate the net present value of this project. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of S1.) (Use appropriate factor(s) from the tables provided. Round the final answer to nearest whole dollar.) Present Value ReferenceseBook & Resources Difficulty: 1 Easy Leaming Objective: 11-04 Predlict the Internal rate of return and describe Its relationship to net present value. M11-7 Calculating Net Present Value, Predicting Internal Rate of Return [LO 11-3, 11-41 Leaming Objective: 11-03 Calculate net present value and describe why it is superior to the other capital budgeting techniques. Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts