Question: M-403%20(1).pdf Question 2: Calculation - 5 marks Below is the financial data of Walmart for the year 2013 and 2014. Determine the following for the

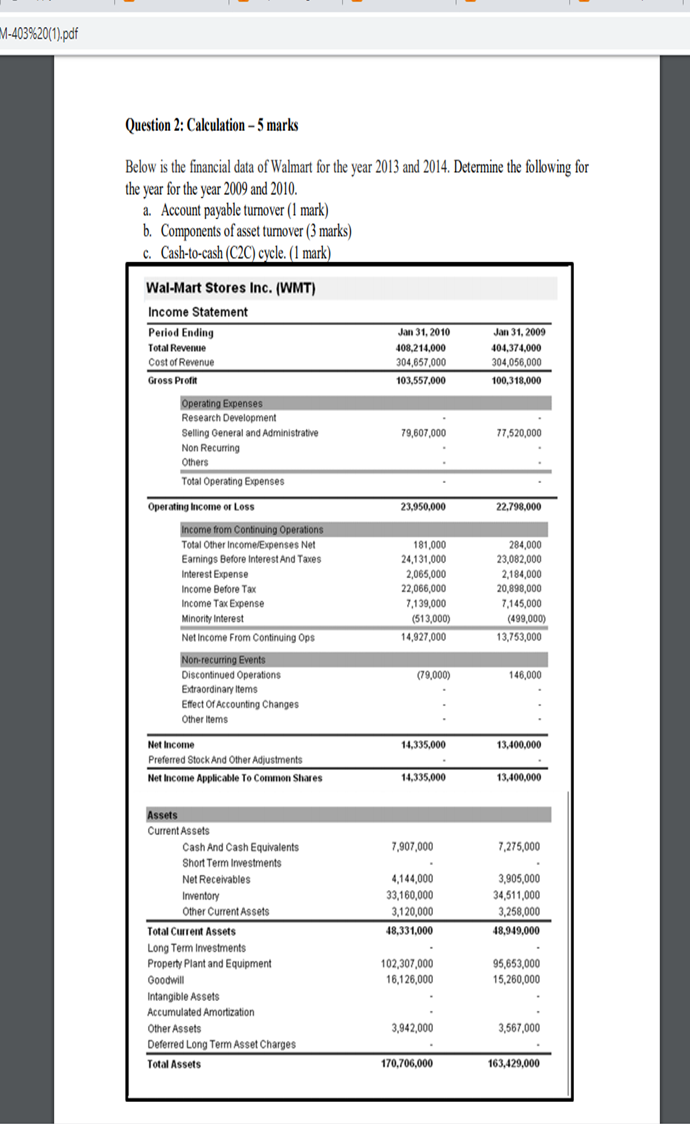

"M-403%20(1).pdf Question 2: Calculation - 5 marks Below is the financial data of Walmart for the year 2013 and 2014. Determine the following for the year for the year 2009 and 2010. a. Account payable turnover (1 mark) b. Components of asset turnover (3 marks) c. Cash-to-cash (C2C) cycle. (1 mark) Wal-Mart Stores Inc. ( WMT) Income Statement Period Ending Total Reverne Cost of Revenue Gross Profit Jan 31, 2010 408,214.000 304,657,000 103,557,000 Jan 31, 2009 404,374,000 304,056,000 100,318,000 79,607,000 77,520,000 23,950,000 22,798,000 Operating Expenses Research Development Selling General and Administrative Non Recurring Others Total Operating Expenses Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Minority interest Net Income From Continuing Ops Non-recurring Events Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items 181,000 24,131,000 2,065,000 22,066,000 7,139,000 (513,000) 14,927,000 284,000 23,082,000 2,184,000 20,898,000 7,145,000 (499,000) 13,753,000 (79,000) 146,000 14,335,000 13,400,000 Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 14,335,000 13,400,000 7,907,000 7,275,000 4,144,000 33,160,000 3,120,000 48,331,000 3,905,000 34,511,000 3,258,000 48.949.000 Assets Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Other Current Assets Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Assets 102,307,000 16,126,000 95,653,000 15,260,000 3,942,000 3,567,000 170,706,000 163,429,000 "M-403%20(1).pdf Question 2: Calculation - 5 marks Below is the financial data of Walmart for the year 2013 and 2014. Determine the following for the year for the year 2009 and 2010. a. Account payable turnover (1 mark) b. Components of asset turnover (3 marks) c. Cash-to-cash (C2C) cycle. (1 mark) Wal-Mart Stores Inc. ( WMT) Income Statement Period Ending Total Reverne Cost of Revenue Gross Profit Jan 31, 2010 408,214.000 304,657,000 103,557,000 Jan 31, 2009 404,374,000 304,056,000 100,318,000 79,607,000 77,520,000 23,950,000 22,798,000 Operating Expenses Research Development Selling General and Administrative Non Recurring Others Total Operating Expenses Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Minority interest Net Income From Continuing Ops Non-recurring Events Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items 181,000 24,131,000 2,065,000 22,066,000 7,139,000 (513,000) 14,927,000 284,000 23,082,000 2,184,000 20,898,000 7,145,000 (499,000) 13,753,000 (79,000) 146,000 14,335,000 13,400,000 Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 14,335,000 13,400,000 7,907,000 7,275,000 4,144,000 33,160,000 3,120,000 48,331,000 3,905,000 34,511,000 3,258,000 48.949.000 Assets Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Other Current Assets Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Assets 102,307,000 16,126,000 95,653,000 15,260,000 3,942,000 3,567,000 170,706,000 163,429,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts