Question: M4-14 through M4-17 Reporting an Income Statement, Reporting a Statement of Retained Earnings, Reporting a Balance Sheet and Recording Closing Journal Entries [LO 4-4, LO

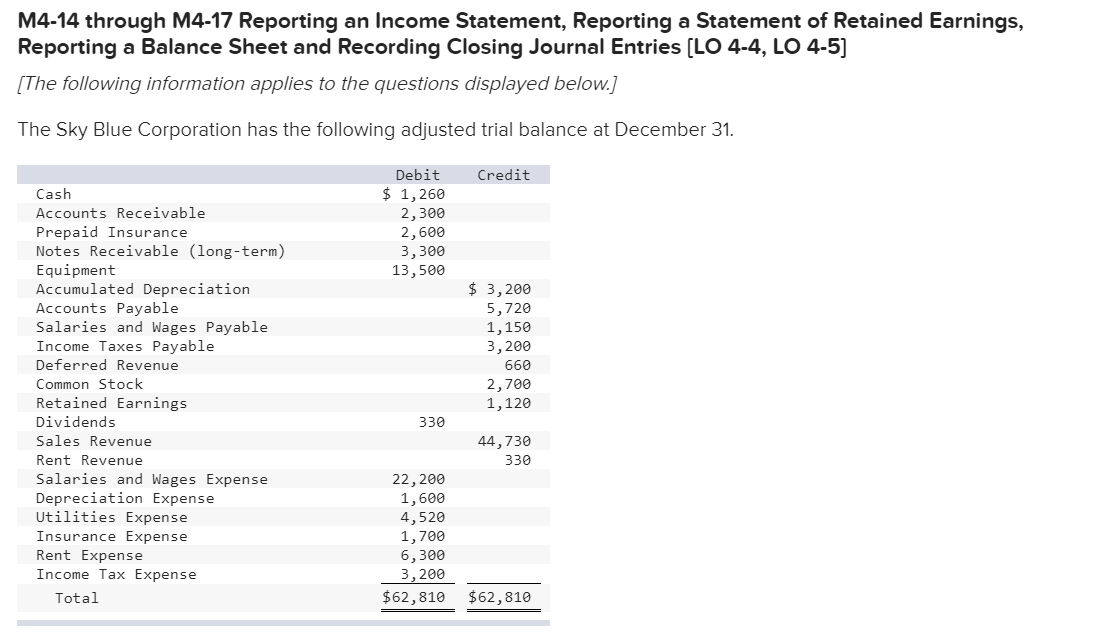

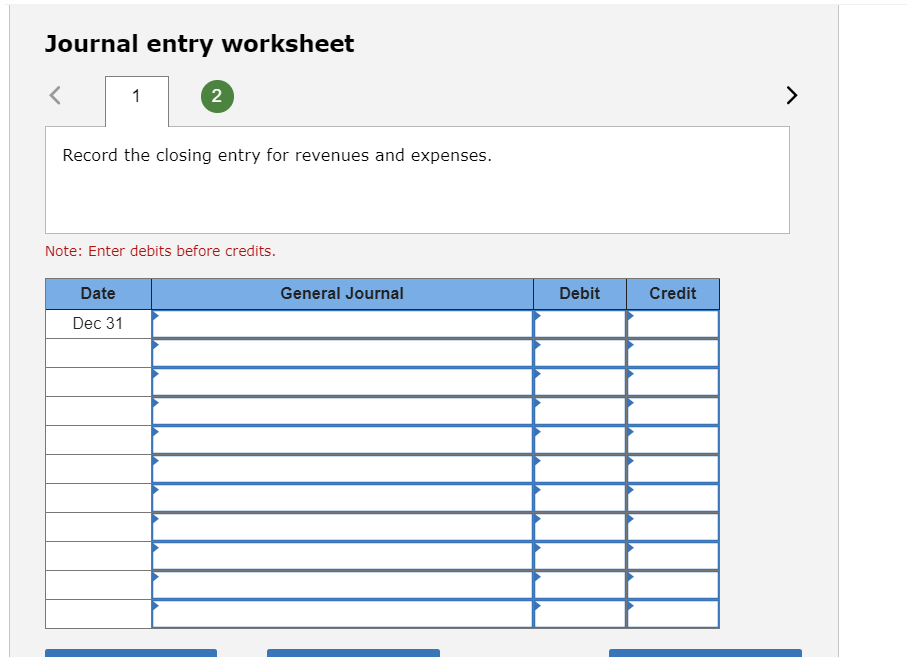

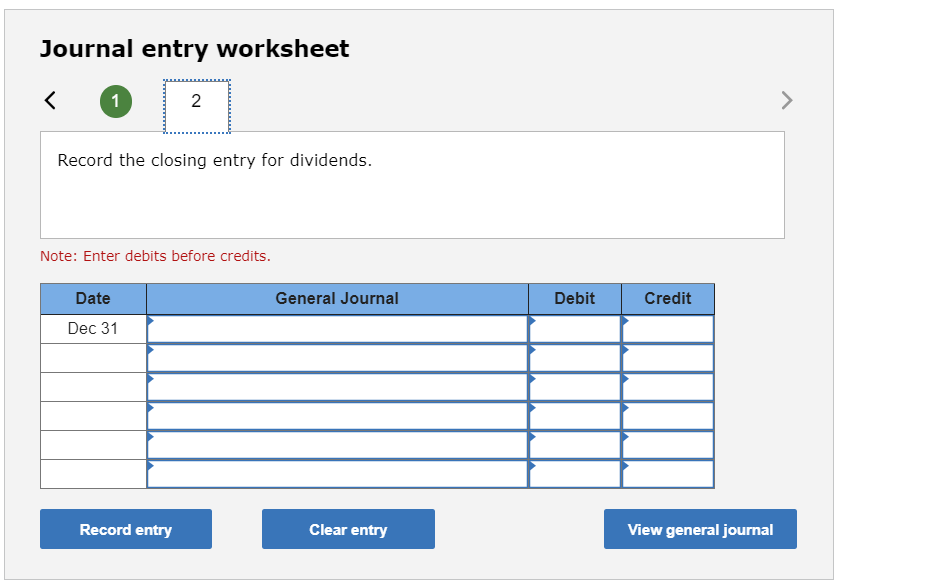

M4-14 through M4-17 Reporting an Income Statement, Reporting a Statement of Retained Earnings, Reporting a Balance Sheet and Recording Closing Journal Entries [LO 4-4, LO 4-5) (The following information applies to the questions displayed below.) The Sky Blue Corporation has the following adjusted trial balance at December 31. Credit Debit $ 1,260 2,300 2,600 3,300 13,500 Cash Accounts Receivable Prepaid Insurance Notes Receivable (long-term) Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Income Taxes Payable Deferred Revenue Common Stock Retained Earnings Dividends Sales Revenue Rent Revenue Salaries and Wages Expense Depreciation Expense Utilities Expense Insurance Expense Rent Expense Income Tax Expense Total $ 3,200 5,720 1,150 3,200 660 2,700 1,120 330 44,730 330 22,200 1,600 4,520 1,700 6,300 3,200 $62,810 $62,810 Journal entry worksheet 1 2 > Record the closing entry for revenues and expenses. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts