Question: M5 Chapter 9 Homework Saved Check my work mode : This shows what is correct or incorrect for the work you have completed so f

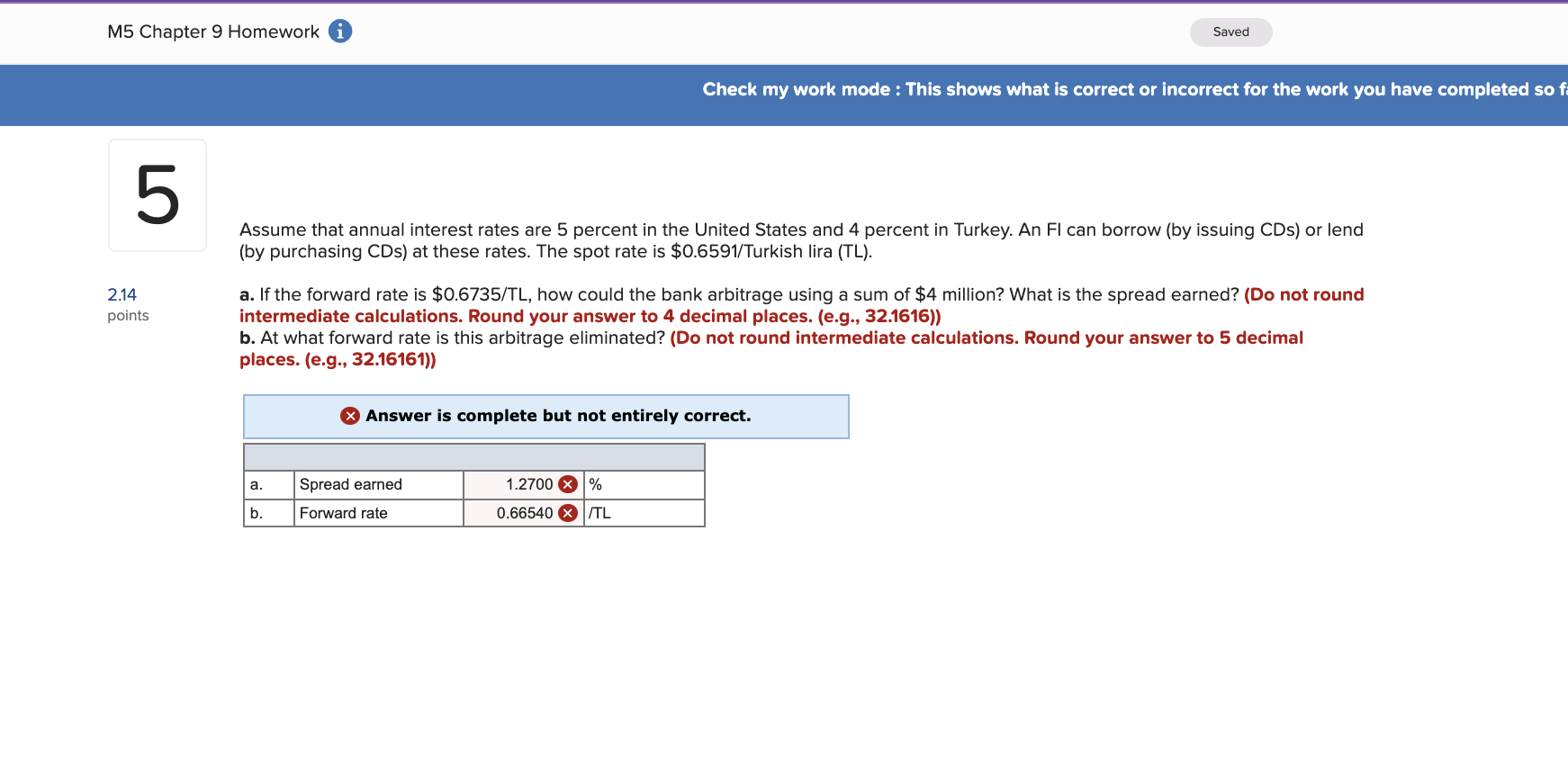

M5 Chapter 9 Homework Saved Check my work mode : This shows what is correct or incorrect for the work you have completed so f 5 Assume that annual interest rates are 5 percent in the United States and 4 percent in Turkey. An Fl can borrow (by issuing CDs) or lend (by purchasing CDs) at these rates. The spot rate is $0.6591/Turkish lira (TL). 2.14 points a. If the forward rate is $0.6735/TL, how could the bank arbitrage using a sum of $4 million? What is the spread earned? (Do not round intermediate calculations. Round your answer to 4 decimal places. (e.g., 32.1616)) b. At what forward rate is this arbitrage eliminated? (Do not round intermediate calculations. Round your answer to 5 decimal places. (e.g., 32.16161)) Answer is complete but not entirely correct. a. Spread earned 1.2700 X % b. Forward rate 0.66540 X/TL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts