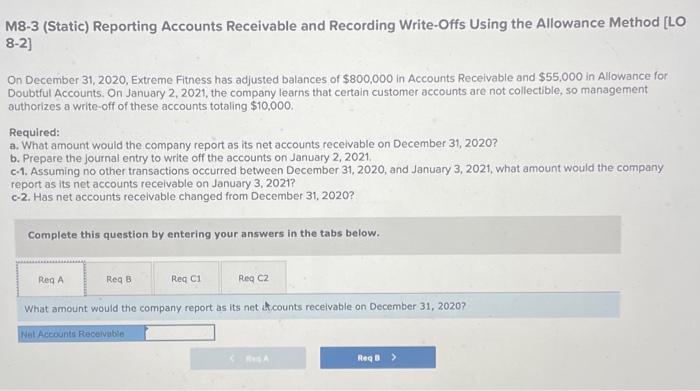

Question: M8-3 (Static) Reporting Accounts Receivable and Recording Write-Offs Using the Allowance Method [LO 8-2] On December 31,2020 , Extreme Fitness has adjusted balances of $800,000

![Method [LO 8-2] On December 31,2020 , Extreme Fitness has adjusted balances](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66ab69d1eb507_77766ab69d18bf67.jpg)

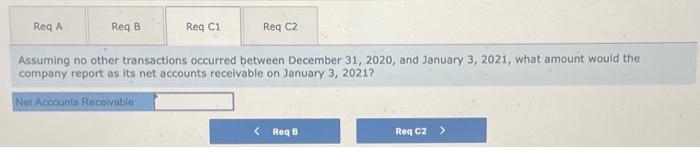

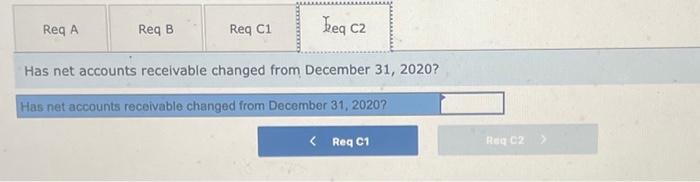

M8-3 (Static) Reporting Accounts Receivable and Recording Write-Offs Using the Allowance Method [LO 8-2] On December 31,2020 , Extreme Fitness has adjusted balances of $800,000 in Accounts Receivable and $55,000 in Allowance for Doubtful Accounts. On January 2,2021, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $10,000. Required: a. What amount would the company report as its net accounts recelvable on December 31, 2020? b. Prepare the journal entry to write off the accounts on January 2,2021. c-1. Assuming no other transactions occurred between December 31, 2020, and January 3,2021, what amount would the company report as its net accounts receivable on January 3,2021 ? c-2. Has net accounts recelvable changed from December 31,2020 ? Complete this question by entering your answers in the tabs below. What amount would the company report as its net it counts recelvable on December 31,2020 ? Prepare the journal entry to write off the accounts on January 2, 2021. (If no entry is required for a transaction/event, select "No Jol Entry Required" in the first account field.) Journal entry worksheet Record the $10,000 write-off of certain customer accounts which are not collectible. Note: Enter debits before credits. Assuming no other transactions occurred between December 31,2020 , and January 3, 2021, what amount would the company report as its net accounts recelvable on lanuary 3,2021 ? Has net accounts receivable changed from December 31,2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts