Question: Mabry Technologies began leasing computer servers with eight-year terms on January 1, 2020. The lease has an implicit rate of 6% and requires eight equal

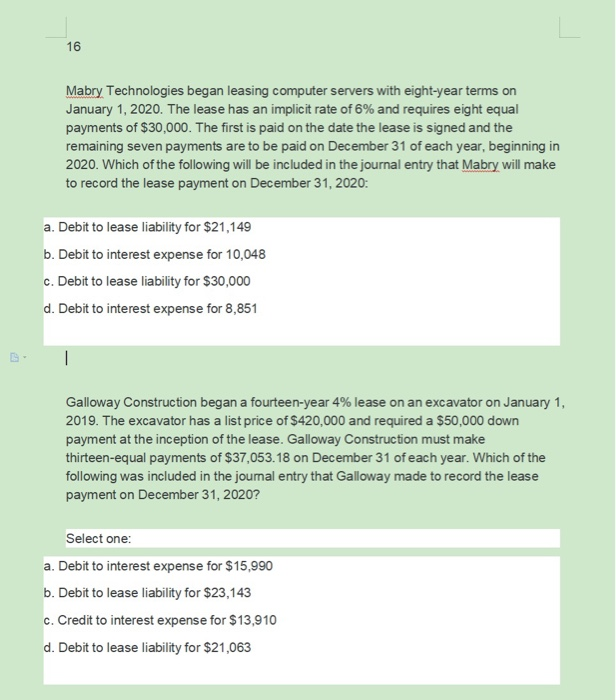

Mabry Technologies began leasing computer servers with eight-year terms on January 1, 2020. The lease has an implicit rate of 6% and requires eight equal payments of $30,000. The first is paid on the date the lease is signed and the remaining seven payments are to be paid on December 31 of each year, beginning in 2020. Which of the following will be included in the journal entry that Mabry will make to record the lease payment on December 31, 2020: a. Debit to lease liability for $21,149 b. Debit to interest expense for 10,048 c. Debit to lease liability for $30,000 d. Debit to interest expense for 8,851 Galloway Construction began a fourteen-year 4% lease on an excavator on January 1, 2019. The excavator has a list price of $420,000 and required a $50,000 down payment at the inception of the lease. Galloway Construction must make thirteen-equal payments of $37,053.18 on December 31 of each year. Which of the following was included in the journal entry that Galloway made to record the lease payment on December 31, 2020? Select one: a. Debit to interest expense for $15,990 b. Debit to lease liability for $23,143 c. Credit to interest expense for $13,910 d. Debit to lease liability for $21,063

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts