Question: MAC3702 Assignment 2 ECP & Semester 2 Notes and additional information 1. Credit sales increased from 55% of turnover in 2020 to 65% of turnover

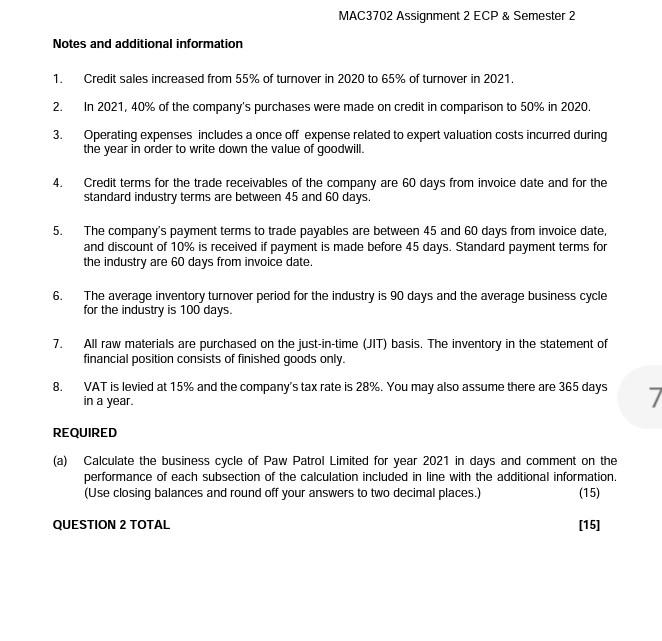

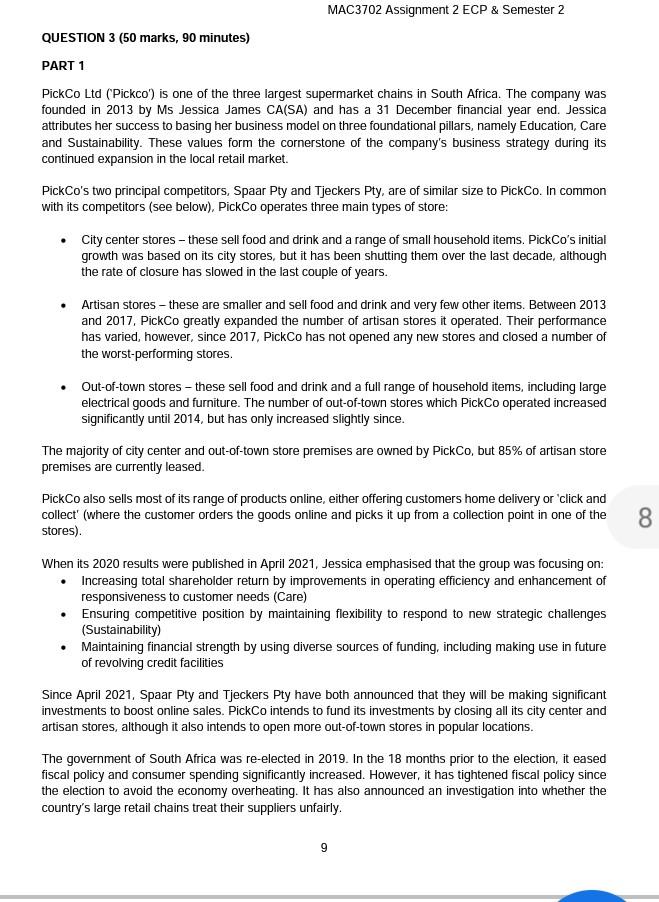

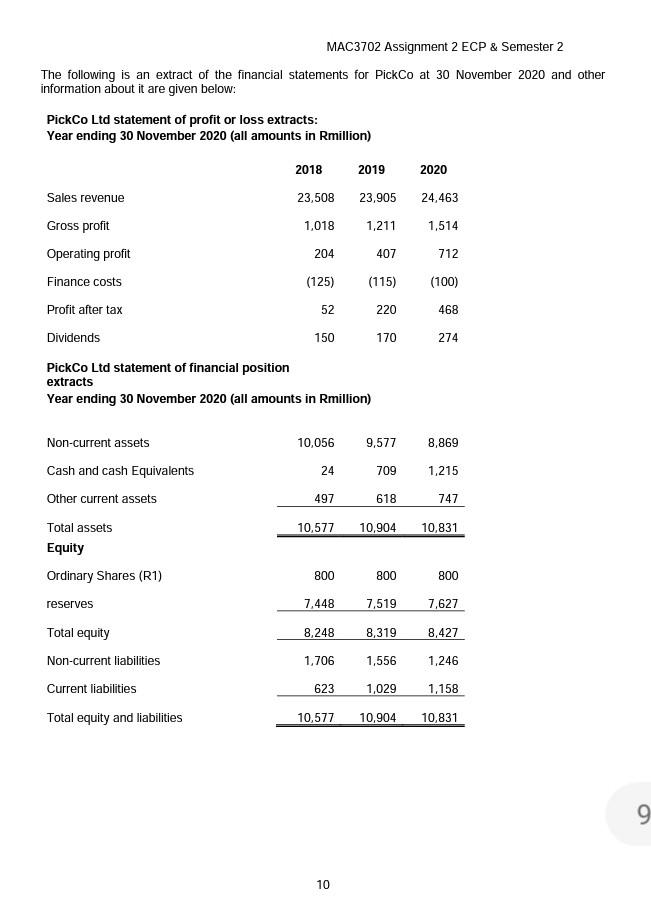

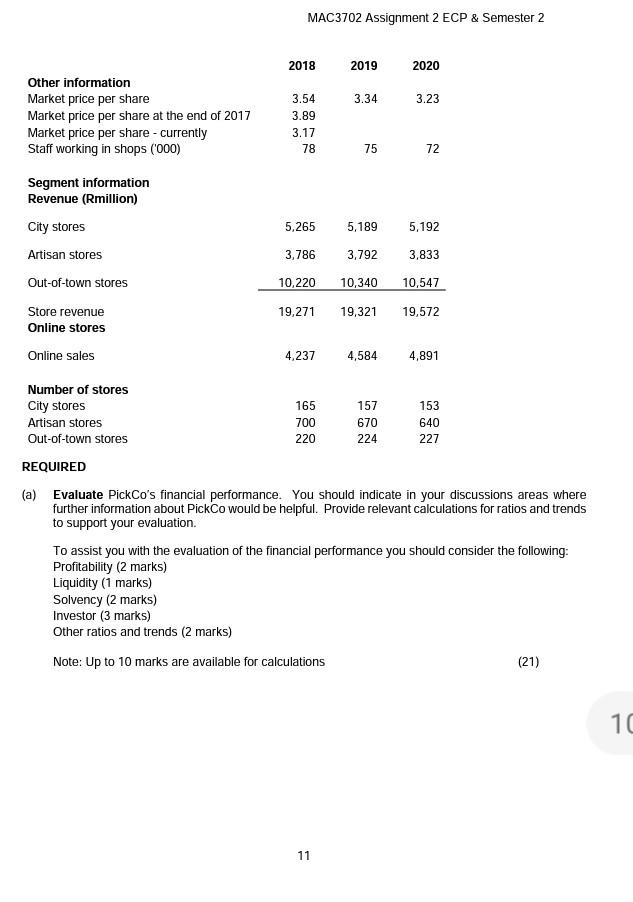

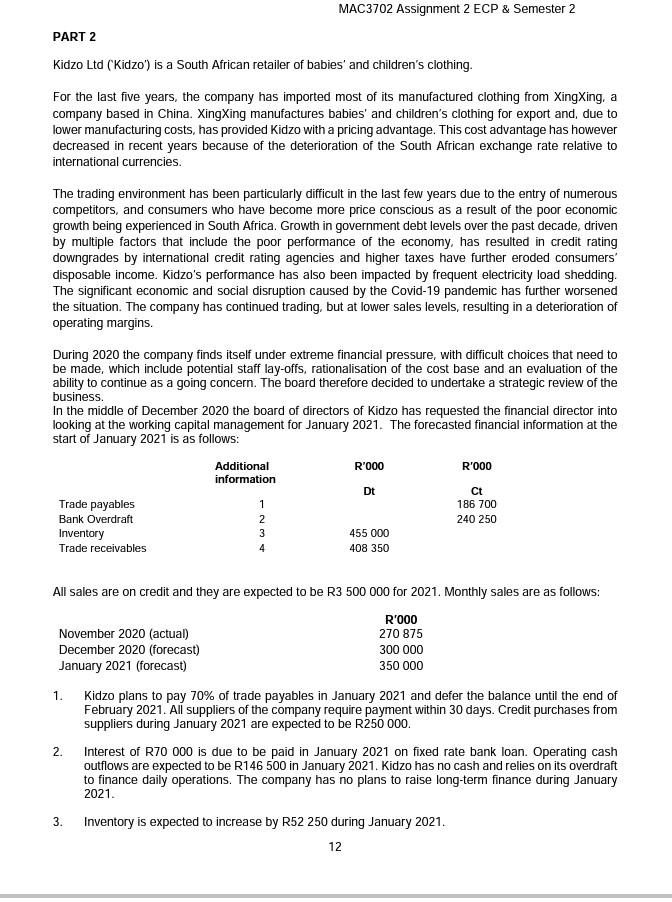

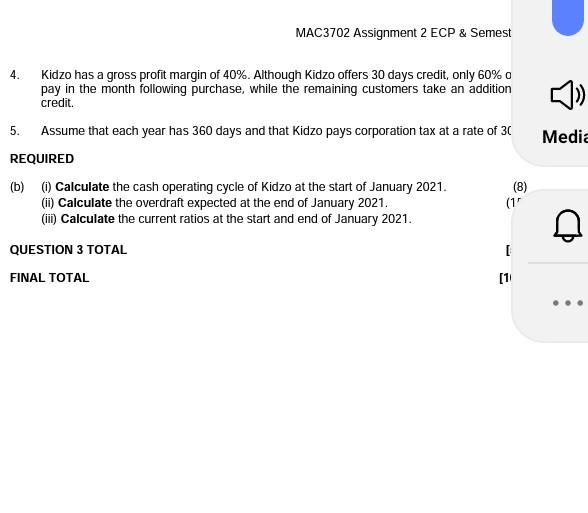

MAC3702 Assignment 2 ECP & Semester 2 Notes and additional information 1. Credit sales increased from 55% of turnover in 2020 to 65% of turnover in 2021. 2. In 2021, 40% of the company's purchases were made on credit in comparison to 50% in 2020. 3. Operating expenses includes a once off expense related to expert valuation costs incurred during the year in order to write down the value of goodwill. 4. Credit terms for the trade receivables of the company are 60 days from invoice date and for the standard industry terms are between 45 and 60 days. 5. The company's payment terms to trade payables are between 45 and 60 days from invoice date, and discount of 10% is received if payment is made before 45 days. Standard payment terms for the industry are 60 days from invoice date. 6. The average inventory turnover period for the industry is 90 days and the average business cycle for the industry is 100 days. 7. All raw materials are purchased on the just-in-time (JIT) basis. The inventory in the statement of financial position consists of finished goods only. 8. VAT is levied at 15% and the company's tax rate is 28%. You may also assume there are 365 days in a year. 7 REQUIRED (a) Calculate the business cycle of Paw Patrol Limited for year 2021 in days and comment on the performance of each subsection of the calculation included in line with the additional information. (Use closing balances and round off your answers to two decimal places.) (15) QUESTION 2 TOTAL [15] MAC3702 Assignment 2 ECP & Semester 2 The following is an extract of the financial statements for PickCo at 30 November 2020 and other information about it are given below: PickCo Ltd statement of profit or loss extracts: Year ending 30 November 2020 (all amounts in Rmillion) 2018 2019 2020 Sales revenue 23,508 23,905 24,463 Gross profit 1,018 1,211 1,514 Operating profit 204 407 712 Finance costs (125) (115) (100) Profit after tax 52 220 468 Dividends 150 170 274 PickCo Ltd statement of financial position extracts Year ending 30 November 2020 (all amounts in Rmillion) Non-current assets 10,056 9,577 8,869 Cash and cash Equivalents 24 709 1,215 Other current assets 497 618 747 Total assets 10,577 10,904 10,831 Equity Ordinary Shares (R1) 800 800 800 reserves 7,448 7,519 7,627 Total equity 8,248 8,319 8,427 Non-current liabilities 1,706 1,556 1,246 Current liabilities 623 1,029 1,158 Total equity and liabilities 10,577 10,904 10,831 9. 10 MAC3702 Assignment 2 ECP & Semester 2 2018 2019 2020 Other information 3.54 3.34 3.23 3.89 Market price per share Market price per share at the end of 2017 Market price per share - currently Staff working in shops ('000) 3.17 78 75 72 Segment information Revenue (Rmillion) City stores 5,265 5,189 5,192 Artisan stores 3,786 3,792 3,833 Out-of-town stores 10,220 10,340 10,547 19,271 19,321 19,572 Store revenue Online stores Online sales 4,237 4,584 4,891 Number of stores 165 157 153 City stores Artisan stores 700 640 670 224 Out-of-town stores 220 227 REQUIRED (a) Evaluate PickCo's financial performance. You should indicate in your discussions areas where further information about PickCo would be helpful. Provide relevant calculations for ratios and trends to support your evaluation. To assist you with the evaluation of the financial performance you should consider the following: Profitability (2 marks) Liquidity (1 marks) Solvency (2 marks) Investor (3 marks) Other ratios and trends (2 marks) Note: Up to 10 marks are available for calculations (21) 10 11 MAC3702 Assignment 2 ECP & Semester 2 PART 2 Kidzo Ltd (Kidzo') is a South African retailer of babies' and children's clothing. For the last five years, the company has imported most of its manufactured clothing from XingXing, a company based in China. XingXing manufactures babies' and children's clothing for export and due to lower manufacturing costs, has provided Kidzo with a pricing advantage. This cost advantage has however decreased in recent years because of the deterioration of the South African exchange rate relative to international currencies. The trading environment has been particularly difficult in the last few years due to the entry of numerous competitors, and consumers who have become more price conscious as a result of the poor economic growth being experienced in South Africa. Growth in government debt levels over the past decade, driven by multiple factors that include the poor performance of the economy, has resulted in credit rating downgrades by international credit rating agencies and higher taxes have further eroded consumers disposable income. Kidzo's performance has also been impacted by frequent electricity load shedding. The significant economic and social disruption caused by the Covid-19 pandemic has further worsened the situation. The company has continued trading, but at lower sales levels, resulting in a deterioration of operating margins. During 2020 the company finds itself under extreme financial pressure, with difficult choices that need to be made, which include potential staff lay-offs, rationalisation of the cost base and an evaluation of the ability to continue as a going concern. The board therefore decided to undertake a strategic review of the business In the middle of December 2020 the board of directors of Kidzo has requested the financial director into looking at the working capital management for January 2021. The forecasted financial information at the start of January 2021 is as follows: R'000 R'000 Additional information Dt Ct 186 700 1 2 240 250 Trade payables Bank Overdraft Inventory Trade receivables 3 455 000 408 350 4 All sales are on credit and they are expected to be R3 500 000 for 2021. Monthly sales are as follows: November 2020 (actual) December 2020 (forecast) January 2021 (forecast) R'000 270 875 300 000 350 000 1. Kidzo plans to pay 70% of trade payables in January 2021 and defer the balance until the end of February 2021. All suppliers of the company require payment within 30 days. Credit purchases from suppliers during January 2021 are expected to be R250 000. 2. Interest of R70 000 is due to be paid in January 2021 on fixed rate bank loan. Operating cash outflows are expected to be R146 500 in January 2021. Kidzo has no cash and relies on its overdraft to finance daily operations. The company has no plans to raise long-term finance during January 2021 3. Inventory is expected to increase by R52 250 during January 2021. 12 MAC3702 Assignment 2 ECP & Semest 4. Kidzo has a gross profit margin of 40%. Although Kidzo offers 30 days credit, only 60% pay in the month following purchase, while the remaining customers take an addition credit. 5. Assume that each year has 360 days and that Kidzo pays corporation tax at a rate of 30 Media REQUIRED (b) () Calculate the cash operating cycle of Kidzo at the start of January 2021. (ii) Calculate the overdraft expected at the end of January 2021. (iii) Calculate the current ratios at the start and end of January 2021. (8) (11 QUESTION 3 TOTAL [ FINAL TOTAL 11 MAC3702 Assignment 2 ECP & Semester 2 Notes and additional information 1. Credit sales increased from 55% of turnover in 2020 to 65% of turnover in 2021. 2. In 2021, 40% of the company's purchases were made on credit in comparison to 50% in 2020. 3. Operating expenses includes a once off expense related to expert valuation costs incurred during the year in order to write down the value of goodwill. 4. Credit terms for the trade receivables of the company are 60 days from invoice date and for the standard industry terms are between 45 and 60 days. 5. The company's payment terms to trade payables are between 45 and 60 days from invoice date, and discount of 10% is received if payment is made before 45 days. Standard payment terms for the industry are 60 days from invoice date. 6. The average inventory turnover period for the industry is 90 days and the average business cycle for the industry is 100 days. 7. All raw materials are purchased on the just-in-time (JIT) basis. The inventory in the statement of financial position consists of finished goods only. 8. VAT is levied at 15% and the company's tax rate is 28%. You may also assume there are 365 days in a year. 7 REQUIRED (a) Calculate the business cycle of Paw Patrol Limited for year 2021 in days and comment on the performance of each subsection of the calculation included in line with the additional information. (Use closing balances and round off your answers to two decimal places.) (15) QUESTION 2 TOTAL [15] MAC3702 Assignment 2 ECP & Semester 2 The following is an extract of the financial statements for PickCo at 30 November 2020 and other information about it are given below: PickCo Ltd statement of profit or loss extracts: Year ending 30 November 2020 (all amounts in Rmillion) 2018 2019 2020 Sales revenue 23,508 23,905 24,463 Gross profit 1,018 1,211 1,514 Operating profit 204 407 712 Finance costs (125) (115) (100) Profit after tax 52 220 468 Dividends 150 170 274 PickCo Ltd statement of financial position extracts Year ending 30 November 2020 (all amounts in Rmillion) Non-current assets 10,056 9,577 8,869 Cash and cash Equivalents 24 709 1,215 Other current assets 497 618 747 Total assets 10,577 10,904 10,831 Equity Ordinary Shares (R1) 800 800 800 reserves 7,448 7,519 7,627 Total equity 8,248 8,319 8,427 Non-current liabilities 1,706 1,556 1,246 Current liabilities 623 1,029 1,158 Total equity and liabilities 10,577 10,904 10,831 9. 10 MAC3702 Assignment 2 ECP & Semester 2 2018 2019 2020 Other information 3.54 3.34 3.23 3.89 Market price per share Market price per share at the end of 2017 Market price per share - currently Staff working in shops ('000) 3.17 78 75 72 Segment information Revenue (Rmillion) City stores 5,265 5,189 5,192 Artisan stores 3,786 3,792 3,833 Out-of-town stores 10,220 10,340 10,547 19,271 19,321 19,572 Store revenue Online stores Online sales 4,237 4,584 4,891 Number of stores 165 157 153 City stores Artisan stores 700 640 670 224 Out-of-town stores 220 227 REQUIRED (a) Evaluate PickCo's financial performance. You should indicate in your discussions areas where further information about PickCo would be helpful. Provide relevant calculations for ratios and trends to support your evaluation. To assist you with the evaluation of the financial performance you should consider the following: Profitability (2 marks) Liquidity (1 marks) Solvency (2 marks) Investor (3 marks) Other ratios and trends (2 marks) Note: Up to 10 marks are available for calculations (21) 10 11 MAC3702 Assignment 2 ECP & Semester 2 PART 2 Kidzo Ltd (Kidzo') is a South African retailer of babies' and children's clothing. For the last five years, the company has imported most of its manufactured clothing from XingXing, a company based in China. XingXing manufactures babies' and children's clothing for export and due to lower manufacturing costs, has provided Kidzo with a pricing advantage. This cost advantage has however decreased in recent years because of the deterioration of the South African exchange rate relative to international currencies. The trading environment has been particularly difficult in the last few years due to the entry of numerous competitors, and consumers who have become more price conscious as a result of the poor economic growth being experienced in South Africa. Growth in government debt levels over the past decade, driven by multiple factors that include the poor performance of the economy, has resulted in credit rating downgrades by international credit rating agencies and higher taxes have further eroded consumers disposable income. Kidzo's performance has also been impacted by frequent electricity load shedding. The significant economic and social disruption caused by the Covid-19 pandemic has further worsened the situation. The company has continued trading, but at lower sales levels, resulting in a deterioration of operating margins. During 2020 the company finds itself under extreme financial pressure, with difficult choices that need to be made, which include potential staff lay-offs, rationalisation of the cost base and an evaluation of the ability to continue as a going concern. The board therefore decided to undertake a strategic review of the business In the middle of December 2020 the board of directors of Kidzo has requested the financial director into looking at the working capital management for January 2021. The forecasted financial information at the start of January 2021 is as follows: R'000 R'000 Additional information Dt Ct 186 700 1 2 240 250 Trade payables Bank Overdraft Inventory Trade receivables 3 455 000 408 350 4 All sales are on credit and they are expected to be R3 500 000 for 2021. Monthly sales are as follows: November 2020 (actual) December 2020 (forecast) January 2021 (forecast) R'000 270 875 300 000 350 000 1. Kidzo plans to pay 70% of trade payables in January 2021 and defer the balance until the end of February 2021. All suppliers of the company require payment within 30 days. Credit purchases from suppliers during January 2021 are expected to be R250 000. 2. Interest of R70 000 is due to be paid in January 2021 on fixed rate bank loan. Operating cash outflows are expected to be R146 500 in January 2021. Kidzo has no cash and relies on its overdraft to finance daily operations. The company has no plans to raise long-term finance during January 2021 3. Inventory is expected to increase by R52 250 during January 2021. 12 MAC3702 Assignment 2 ECP & Semest 4. Kidzo has a gross profit margin of 40%. Although Kidzo offers 30 days credit, only 60% pay in the month following purchase, while the remaining customers take an addition credit. 5. Assume that each year has 360 days and that Kidzo pays corporation tax at a rate of 30 Media REQUIRED (b) () Calculate the cash operating cycle of Kidzo at the start of January 2021. (ii) Calculate the overdraft expected at the end of January 2021. (iii) Calculate the current ratios at the start and end of January 2021. (8) (11 QUESTION 3 TOTAL [ FINAL TOTAL 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts