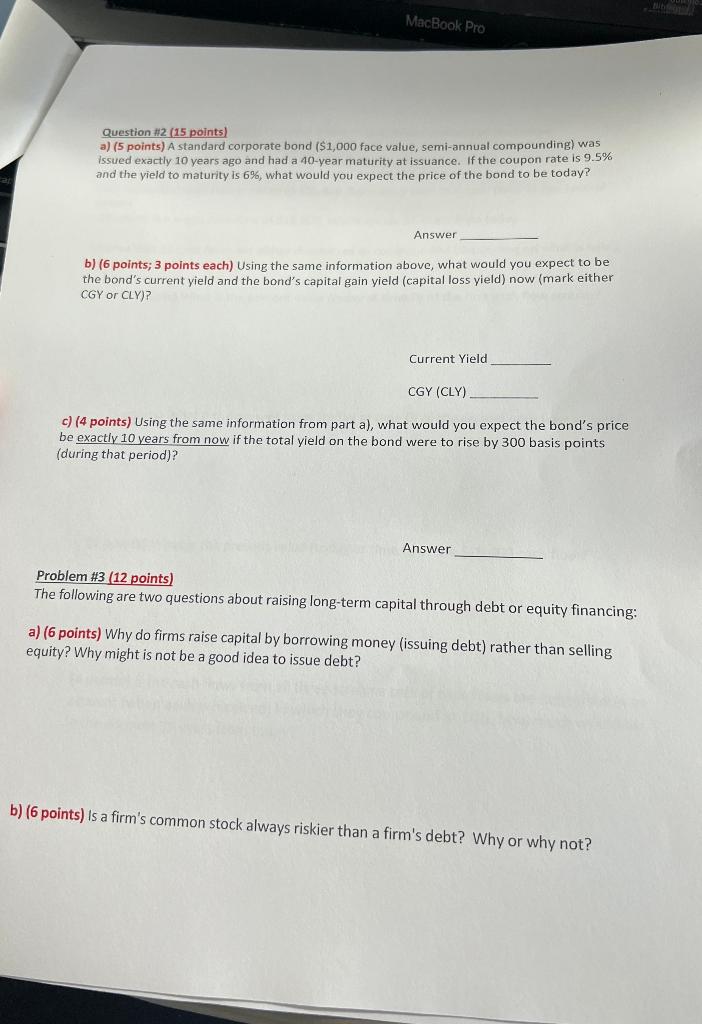

Question: MacBook Pro Question #2 (15 points) a) (5 points) A standard corporate bond ($1,000 face value, semi-annual compounding) was issued exactly 10 years ago and

MacBook Pro Question #2 (15 points) a) (5 points) A standard corporate bond ($1,000 face value, semi-annual compounding) was issued exactly 10 years ago and had a 40-year maturity at issuance. If the coupon rate is 9.5% and the yield to maturity is 6%, what would you expect the price of the bond to be today? Answer b) (6 points; 3 points each) Using the same information above, what would you expect to be the bond's current yield and the bond's capital gain yield (capital loss yield) now (mark either CGY or CLY)? Current Yield CGY (CLY) c) (4 points) Using the same information from part a), what would you expect the bond's price be exactly 10 years from now if the total yield on the bond were to rise by 300 basis points (during that period)? Answer Problem #3 (12 points) The following are two questions about raising long-term capital through debt or equity financing: a) (6 points) Why do firms raise capital by borrowing money (issuing debt) rather than selling equity? Why might is not be a good idea to issue debt? b) (6 points) is a firm's common stock always riskier than a firm's debt? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts