Question: Machine A was purchased five years ago for $200,000 and produces an annual cash flow of $60,000. It has no salvage value but is expected

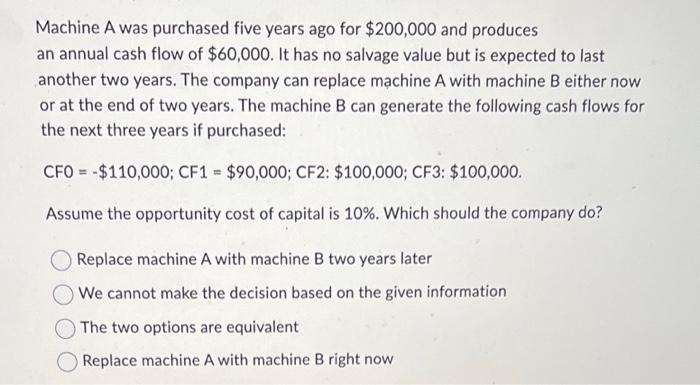

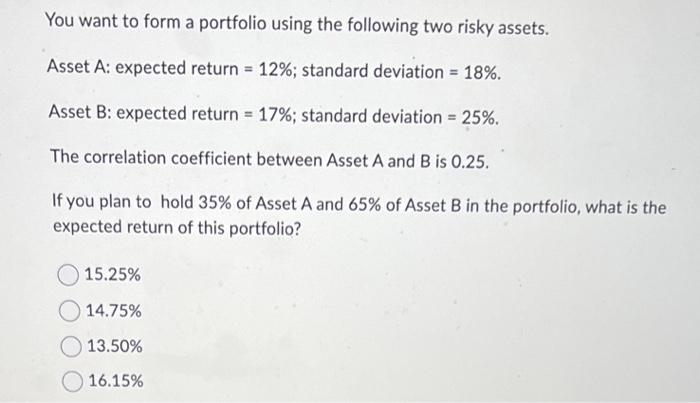

Machine A was purchased five years ago for $200,000 and produces an annual cash flow of $60,000. It has no salvage value but is expected to last another two years. The company can replace machine A with machine B either now or at the end of two years. The machine B can generate the following cash flows for the next three years if purchased: CF0=$110,000;CF1=$90,000;CF2:$100,000;CF3:$100,000 Assume the opportunity cost of capital is 10%. Which should the company do? Replace machine A with machine B two years later We cannot make the decision based on the given information The two options are equivalent Replace machine A with machine B right now You want to form a portfolio using the following two risky assets. Asset A: expected return =12%; standard deviation =18%. Asset B: expected return =17%; standard deviation =25%. The correlation coefficient between Asset A and B is 0.25. If you plan to hold 35% of Asset A and 65\% of Asset B in the portfolio, what is the expected return of this portfolio? 15.25% 14.75\% 13.50% 16.15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts