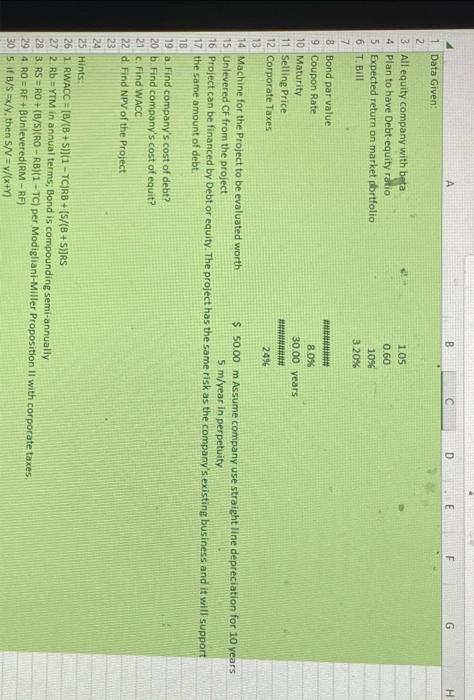

Question: Machine for the Project to be evaluated worth $50.00m Assume company use straight line depreciation for 10 year: Unlevered CF from the project 5m/ year

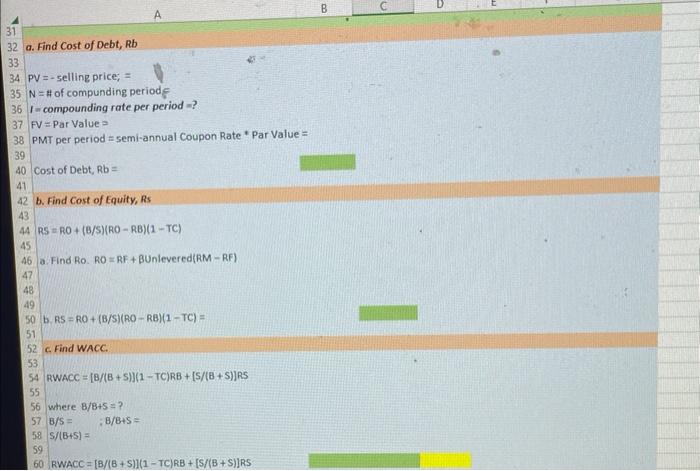

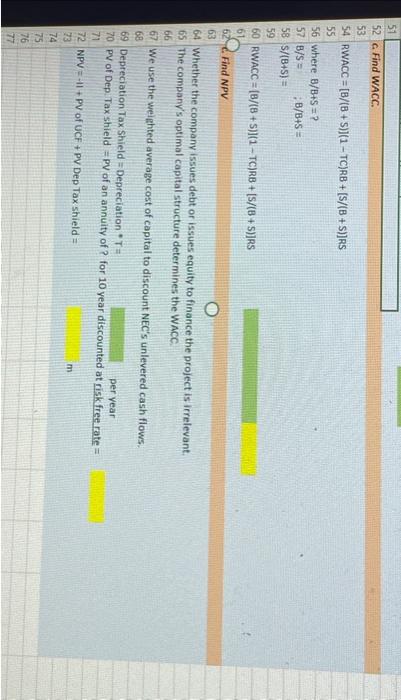

Machine for the Project to be evaluated worth $50.00m Assume company use straight line depreciation for 10 year: Unlevered CF from the project 5m/ year in perpetuity Project can be financed by Debt or equity. The project has the same risk as the company's existing business and it will support the same amount of debt. a. Find company's cost of debt? b. Find company's cost of equit? c. Find WACC d. Find NPV of the Project Hints: 1. RWACC =[B/(B+5)](1TC)RB+[S/(B+5)]RS 2. Rb = YTM in annual terms; Bond is compounding semi-annually 3. RS =RO+(B/S)(RORB)(1TC) per Modigliani-Miller Proposition il with corporate taxes. 4. R0=RF+ Unlevered (RM RF) 5. If B/S=x/y, then s/N=y/(x+) a. Find Cost of Debt, Rb PV = - selling price; = N= H of compunding periode I = compounding rate per period =? FV= Par Value = PMT per period = semi-annual Coupon Rate * Par Value = Cost of Debt, Rb = b. Find Cost of Equity, Rs RS=RO+(B/S)(RORB)(1TC) a. Find Ro. RO = RF + Unlevered(RM RF) b. RS=RO+(B/S)(RORB)(1TC)= c. Find WACC. RWACC=[B/(B+S)](1TC)RB+[S/(B+S)]RS where B/B+S= ? B/5=;8/B+5= 5/(B+5)= RWACC =[B/(B+S)](1TC)RB+[S/(B+S)]RS c. Find WACC. RWACC =[B/(B+5)](1TC)RB+[S/(B+S)]RS where 8/B+S= ? B/S=;B/B+S= s/(B+S)= RWACC ={B/(8+S)](1TC)RB+[S/(B+5)]RS C. Find NPV Whether the company issues debt or issues equity to finance the project is irrelevant. The company's optimal capital structure determines the WACC. We use the weighted average cost of capital to discount NEC's unlevered cash flows. Depreciation Tax Shield = Depreciation T= PV of Dep. Tax shield = PV of an annuity of ? for 10 year discounted at risk free rate = NPV=11+ PV of UCF+ PV Dep Tax shield = Machine for the Project to be evaluated worth $50.00m Assume company use straight line depreciation for 10 year: Unlevered CF from the project 5m/ year in perpetuity Project can be financed by Debt or equity. The project has the same risk as the company's existing business and it will support the same amount of debt. a. Find company's cost of debt? b. Find company's cost of equit? c. Find WACC d. Find NPV of the Project Hints: 1. RWACC =[B/(B+5)](1TC)RB+[S/(B+5)]RS 2. Rb = YTM in annual terms; Bond is compounding semi-annually 3. RS =RO+(B/S)(RORB)(1TC) per Modigliani-Miller Proposition il with corporate taxes. 4. R0=RF+ Unlevered (RM RF) 5. If B/S=x/y, then s/N=y/(x+) a. Find Cost of Debt, Rb PV = - selling price; = N= H of compunding periode I = compounding rate per period =? FV= Par Value = PMT per period = semi-annual Coupon Rate * Par Value = Cost of Debt, Rb = b. Find Cost of Equity, Rs RS=RO+(B/S)(RORB)(1TC) a. Find Ro. RO = RF + Unlevered(RM RF) b. RS=RO+(B/S)(RORB)(1TC)= c. Find WACC. RWACC=[B/(B+S)](1TC)RB+[S/(B+S)]RS where B/B+S= ? B/5=;8/B+5= 5/(B+5)= RWACC =[B/(B+S)](1TC)RB+[S/(B+S)]RS c. Find WACC. RWACC =[B/(B+5)](1TC)RB+[S/(B+S)]RS where 8/B+S= ? B/S=;B/B+S= s/(B+S)= RWACC ={B/(8+S)](1TC)RB+[S/(B+5)]RS C. Find NPV Whether the company issues debt or issues equity to finance the project is irrelevant. The company's optimal capital structure determines the WACC. We use the weighted average cost of capital to discount NEC's unlevered cash flows. Depreciation Tax Shield = Depreciation T= PV of Dep. Tax shield = PV of an annuity of ? for 10 year discounted at risk free rate = NPV=11+ PV of UCF+ PV Dep Tax shield =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts