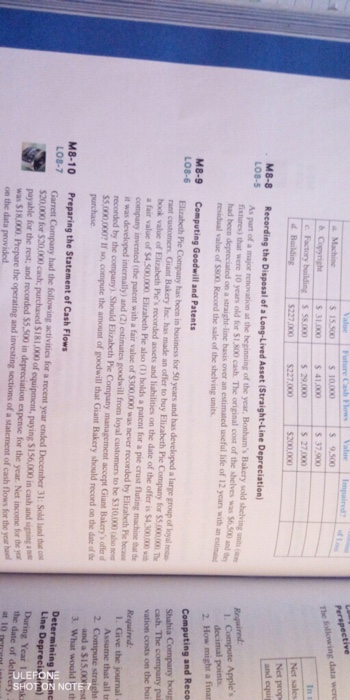

Question: Machine Perspective $ 9.500 The following data were $ 37.900 Factory building & Building $ 27.000 $200.000 5227.000 Net sales M8-8 LO8-5 Net prop and

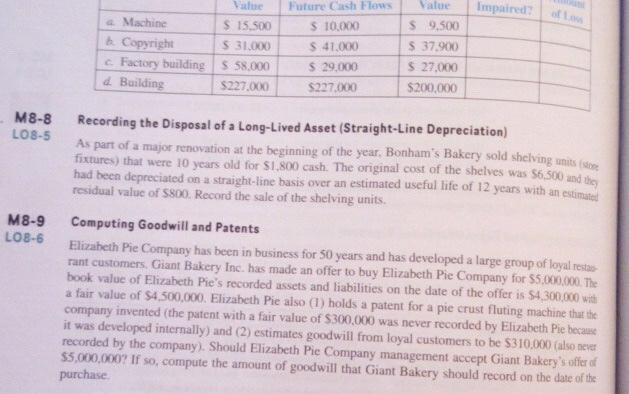

Machine Perspective $ 9.500 The following data were $ 37.900 Factory building & Building $ 27.000 $200.000 5227.000 Net sales M8-8 LO8-5 Net prop and equi Recording the Disposal of a Long-Lived Asset Straight-Line Depreciation) As part of a major renovation at the beginning of the year. Bonhams Bakery Sold Shelving Thures that were 10 years old for cash The onlot of the shelves was so had been deprecated on a straightline has over an estimated use of 12 years with an residual value of Sc Record the sale of the shelving units Required: 1. Compute Apple's decimal points 2. How might a finan M8-9 LO8-6 Computing Goodwill and Patents Elizabeth Pe Company has been in business for 50 years and has developed a large group of loyal mant customers Giant Bakery Inc. has made an offer to buy Elizabeth Pie Company for 55. The book value of Elizabeth Ple's recorded assets and liabilities on the date of the offer is $4.300.00 a fair value of $4.500.000. Elizabeth Pie also (1) holds a patient for a pie crust fluting machin e company invented the patient with a fair value of $300,000 was never recorded by Elizabeth Pe became it was developed internally) and (2) estimates goodwill from loyal customers to be $310.000 recorded by the company. Should Elizabeth Pe Company management accept Giant Bakery's card 55.000.000? If so, compute the amount of goodwill that Giant Bakery should record on the date purchase Computing and Reco Shahia Company boug cash. The company po vation costs on the bu M8-10 LO8-7 Preparing the Statement of Cash Flows Garrett Company had the following activities for a recent year ended December 31: Sold land $20,000 for $20.000 cash purchased $181.000 of equipment, paying $156,000 in cash and payable for the rest and recorded $5.500 is depreciation expense for the year. Net income for was $18.000. Prepare the operating and investing sections of a statement of cash flows for the you on the data provided Required: 1. Give the journal Assume that all tr 2. Compute straight and a $15.00 3. What would lot Determining ZRC Line Deprecisoinn) During Year the date of delivery. - 10 Drent Impaired Machine Copyright Factory building & Building Value S 15.500 $ 31,000 S 58.000 $227,000 Future Cash Flow $ 10.000 $ 41,000 $ 29,000 $227.000 Value S 9,500 $ 37,900 $27.000 $200,000 M8-8 LO8-5 Recording the Disposal of a Long-Lived Asset (Straight-Line Depreciation) As part of a major renovation at the beginning of the year. Bonham's Bakery sold shelving units fixtures) that were 10 years old for $1.800 cash. The original cost of the shelves was $6,500 and had been depreciated on a straight-line basis over an estimated useful life of 12 years with an estima residual value of $800. Record the sale of the shelving units. M8-9 LO8-6 Computing Goodwill and Patents Elizabeth Pie Company has been in business for 50 years and has developed a large group of loyal resto rant customers. Giant Bakery Inc. has made an offer to buy Elizabeth Pie Company for $5,000,000. The book value of Elizabeth Pie's recorded assets and liabilities on the date of the offer is $4,300,000 with a fair value of $4,500,000. Elizabeth Pie also (1) holds a patent for a pie crust fluting machine that the company invented (the patent with a fair value of $300,000 was never recorded by Elizabeth Pie because it was developed internally) and (2) estimates goodwill from loyal customers to be $310.000 (also never recorded by the company). Should Elizabeth Pie Company management accept Giant Bakery's offer of $5,000,000? If so, compute the amount of goodwill that Giant Bakery should record on the date of the purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts