Question: Machine Replacement Decision A company is considering replacing an old piece of machinery, which cost $601,800 and has $349,800 of accumulated depreciation to date, with

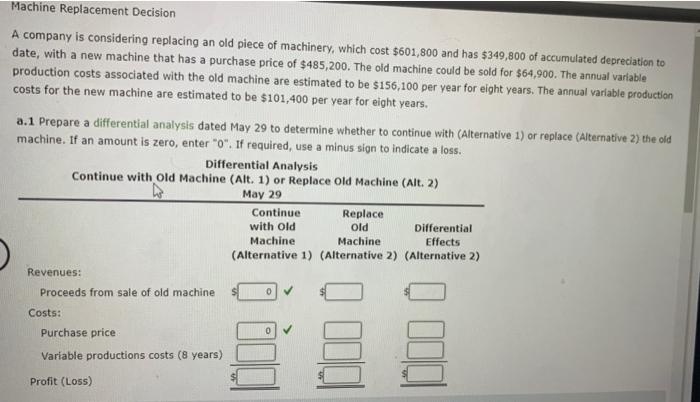

Machine Replacement Decision A company is considering replacing an old piece of machinery, which cost $601,800 and has $349,800 of accumulated depreciation to date, with a new machine that has a purchase price of $485,200. The old machine could be sold for $64,900. The annual variable production costs associated with the old machine are estimated to be $156,100 per year for eight years. The annual variable production costs for the new machine are estimated to be $101,400 per year for eight years. a.1 Prepare a differential analysis dated May 29 to determine whether to continue with (Alternative 1) or replace (Alternative 2) the old machine. If an amount is zero, enter " 0. If required, use a minus sign to indicate a loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts