Question: Machine Replacement Decision A company is considering replacing an old plece of machinery, which cost $602,900 and has $350,000 of accumulated depreciation to date, with

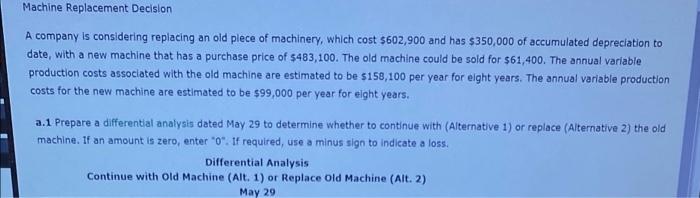

Machine Replacement Decision A company is considering replacing an old plece of machinery, which cost $602,900 and has $350,000 of accumulated depreciation to date, with a new machine that has a purchase price of $483,100. The old machine could be sold for $61,400. The annual variable production costs associated with the old machine are estimated to be $158,100 per year for eight years. The annual variable production costs for the new machine are estimated to be $99,000 per year for eight years. a.1 Prepare a differential analysis dated May 29 to determine whether to continue with (Alternative 1) or replace (Alternative 2) the old machine. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue with Old Machine (Alt. 1) or Replace Old Machine (Alt. 2) May 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts