Question: MACHINE TOOL, INC. MACHINE TOOL, INC. is engaged in the business of repairing industrial machinery. It began operations on January 1, 2015. PART 1 Go

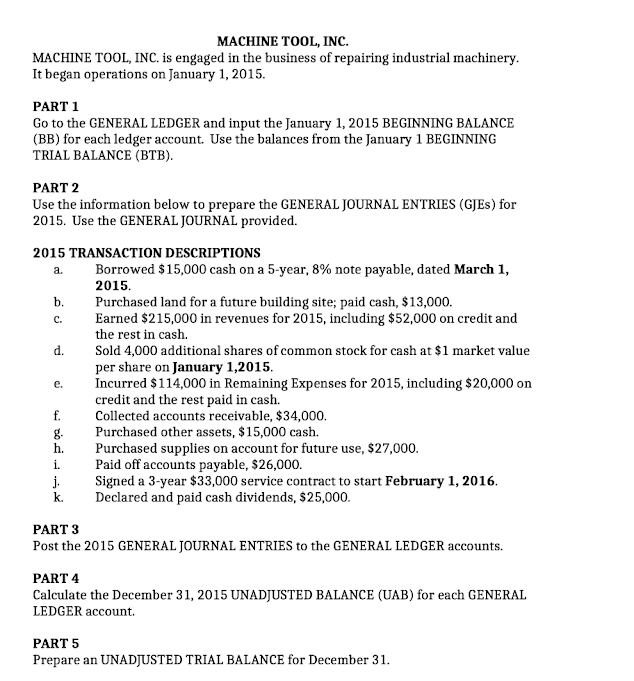

MACHINE TOOL, INC. MACHINE TOOL, INC. is engaged in the business of repairing industrial machinery. It began operations on January 1, 2015. PART 1 Go to the GENERAL LEDGER and input the January 1, 2015 BEGINNING BALANCE (BB) for each ledger account. Use the balances from the January 1 BEGINNING TRIAL BALANCE (BTB). a. C. PART 2 Use the information below to prepare the GENERAL JOURNAL ENTRIES (GJEs) for 2015. Use the GENERAL JOURNAL provided. 2015 TRANSACTION DESCRIPTIONS Borrowed $15,000 cash on a 5-year, 8% note payable, dated March 1, 2015. b. Purchased land for a future building site; paid cash, $13,000. Earned $215,000 in revenues for 2015, including $52,000 on credit and the rest in cash. d. Sold 4,000 additional shares of common stock for cash at $1 market value per share on January 1,2015. Incurred $114,000 in Remaining Expenses for 2015, including $20,000 on credit and the rest paid in cash. f. Collected accounts receivable, $34,000. g Purchased other assets, $15,000 cash. h. Purchased supplies on account for future use, $27,000. Paid off accounts payable, $26,000. j. Signed a 3-year $33,000 service contract to start February 1, 2016. k. Declared and paid cash dividends, $25,000. e. i. PART 3 Post the 2015 GENERAL JOURNAL ENTRIES to the GENERAL LEDGER accounts. PART 4 Calculate the December 31, 2015 UNADJUSTED BALANCE (UAB) for each GENERAL LEDGER account. PART 5 Prepare an UNADJUSTED TRIAL BALANCE for December 31. MACHINE TOOL, INC. MACHINE TOOL, INC. is engaged in the business of repairing industrial machinery. It began operations on January 1, 2015. PART 1 Go to the GENERAL LEDGER and input the January 1, 2015 BEGINNING BALANCE (BB) for each ledger account. Use the balances from the January 1 BEGINNING TRIAL BALANCE (BTB). a. C. PART 2 Use the information below to prepare the GENERAL JOURNAL ENTRIES (GJEs) for 2015. Use the GENERAL JOURNAL provided. 2015 TRANSACTION DESCRIPTIONS Borrowed $15,000 cash on a 5-year, 8% note payable, dated March 1, 2015. b. Purchased land for a future building site; paid cash, $13,000. Earned $215,000 in revenues for 2015, including $52,000 on credit and the rest in cash. d. Sold 4,000 additional shares of common stock for cash at $1 market value per share on January 1,2015. Incurred $114,000 in Remaining Expenses for 2015, including $20,000 on credit and the rest paid in cash. f. Collected accounts receivable, $34,000. g Purchased other assets, $15,000 cash. h. Purchased supplies on account for future use, $27,000. Paid off accounts payable, $26,000. j. Signed a 3-year $33,000 service contract to start February 1, 2016. k. Declared and paid cash dividends, $25,000. e. i. PART 3 Post the 2015 GENERAL JOURNAL ENTRIES to the GENERAL LEDGER accounts. PART 4 Calculate the December 31, 2015 UNADJUSTED BALANCE (UAB) for each GENERAL LEDGER account. PART 5 Prepare an UNADJUSTED TRIAL BALANCE for December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts