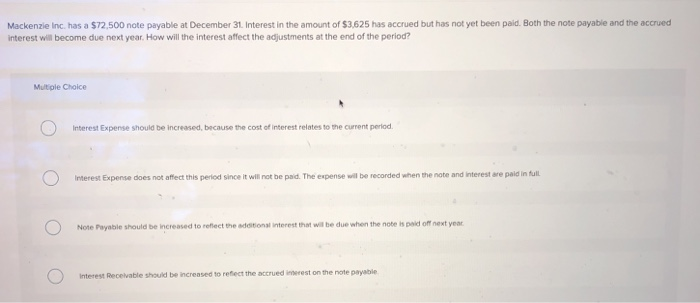

Question: Mackenzie Inc. has a $72,500 note payable at December 31. Interest in the amount of $3,625 has accrued but has not yet been paid. Both

Mackenzie Inc. has a $72,500 note payable at December 31. Interest in the amount of $3,625 has accrued but has not yet been paid. Both the note payable and the accrued interest will become due next year. How will the interest affect the adjustments at the end of the period? Multiple Choice Interest Expense should be increased, because the cost of interest relates to the current period. Interest Expense does not affect this period since it will not be paid. The expense will be recorded when the note and interest are paid in full Note Payable should be increased to reflect the additional interest that will be due when the note is paid off next year. Interest Receivable should be increased to reflect the accrued interest on the note payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts