Question: Macy's long-term liabilities include all the following except: O Her computer loan, payable in full in 18 months. Her furniture loan where payments only start

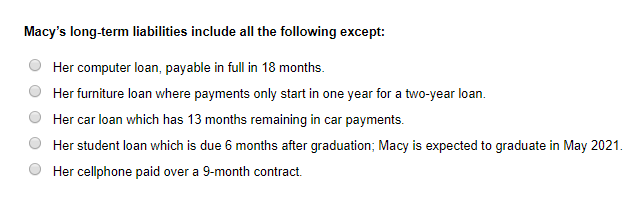

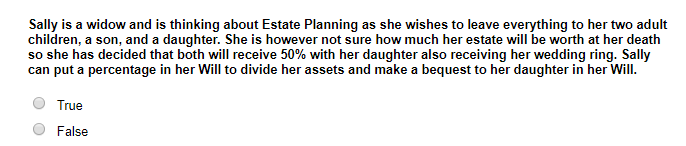

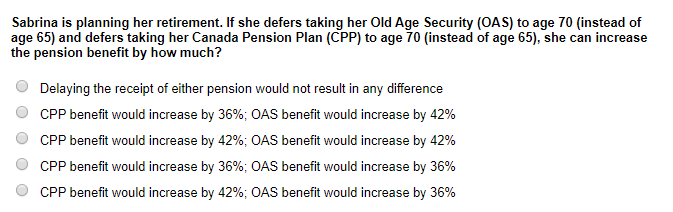

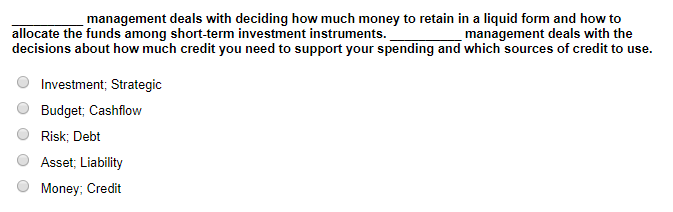

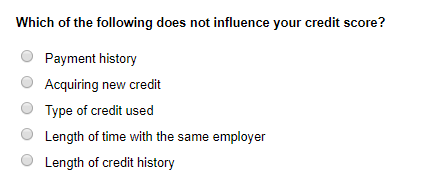

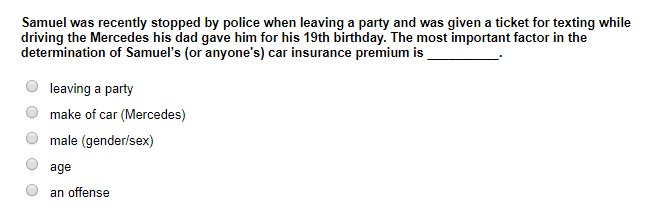

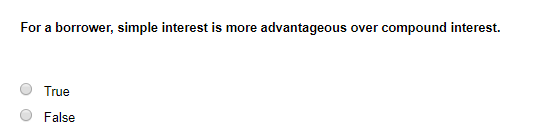

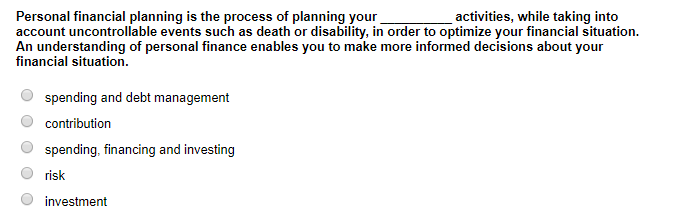

Macy's long-term liabilities include all the following except: O Her computer loan, payable in full in 18 months. Her furniture loan where payments only start in one year for a two-year loan. Her car loan which has 13 months remaining in car payments. Her student loan which is due 6 months after graduation; Macy is expected to graduate in May 2021. Her cellphone paid over a 9-month contract. Sally is a widow and is thinking about Estate Planning as she wishes to leave everything to her two adult children, a son, and a daughter. She is however not sure how much her estate will be worth at her death so she has decided that both will receive 50% with her daughter also receiving her wedding ring. Sally can put a percentage in her Will to divide her assets and make a bequest to her daughter in her Will. O True O False Sabrina is planning her retirement. If she defers taking her Old Age Security (OAS) to age 70 (instead of age 65) and defers taking her Canada Pension Plan (CPP) to age 70 (instead of age 65), she can increase the pension benefit by how much? Delaying the receipt of either pension would not result in any difference CPP benefit would increase by 36%; OAS benefit would increase by 42% CPP benefit would increase by 42%; OAS benefit would increase by 42% CPP benefit would increase by 36%; OAS benefit would increase by 36% CPP benefit would increase by 42%; OAS benefit would increase by 36% management deals with deciding how much money to retain in a liquid form and how to allocate the funds among short-term investment instruments. _ _management deals with the decisions about how much credit you need to support your spending and which sources of credit to use. Investment; Strategic Budget; Cashflow Risk; Debt Asset: Liability Money; Credit O Which of the following does not influence your credit score? O Payment history Acquiring new credit Type of credit used Length of time with the same employer Length of credit history Samuel was recently stopped by police when leaving a party and was given a ticket for texting while driving the Mercedes his dad gave him for his 19th birthday. The most important factor in the determination of Samuel's (or anyone's) car insurance premium is leaving a party make of car (Mercedes) male (gender/sex) age an offense For a borrower, simple interest is more advantageous over compound interest. True False Personal financial planning is the process of planning your activities, while taking into account uncontrollable events such as death or disability, in order to optimize your financial situation. An understanding of personal finance enables you to make more informed decisions about your financial situation. O spending and debt management contribution spending, financing and investing risk O O investment The Old Age Security (OAS) Clawback rate is 15% which requires the repayment of OAS pension benefits once your net income is over a maximum threshold; the Old Age Security (OAS) pension benefits must be repaid at 100% if your net income exceeds the minimum threshold. O O True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts