Question: made by the consulting group was to shift loyalty program spending toward higher-value customers (i.e., distinguishing among customers of the same Frequent Flyer segment) and

made by the consulting group was to shift loyalty program spending toward higher-value customers (i.e., distinguishing among customers of the same Frequent Flyer segment) and no longer spend money on the Inactive and the bottom 80% of the Silver member segments. Each of the above data blocks has a corresponding Transition Matrix (e.g., Transition matrix (current) that should be used for analysis.

Question 1 (advanced) One of the recurring questions Jrgensten faces is What is the return on investment of the loyalty program? Using the data blocks labeled (No Loyalty Program), what answer (or answers) would you give to that question? Notice that your answer might vary, depending on the time horizon taken into account. Use a 15% discount rate and explain your choices.

Question 2 The results of the ZENITHs consultants analysis and efforts to optimize customer lifetime value are shown in the data blocks Segment data (optimization) and Transition matrix (optimization). What do they recommend, and what are the key insights from their analysis? Are they recommending an increase or a decrease in the overall loyalty program budget? According to their recommendations, how should the budget be allocated?

Question 5 (advanced) What would you recommend to the Board? Why? How would you justify your strategy? You can follow ZENITHs recommendations, adapt them, or ignore them altogether, but you must make up your mind now and propose a plan for the next year. What would it be?

File Tools View Document - Word Northern Aero Loyalty Program (CLV) The airline industry Background In the early and mid-2000s, the airline industry suffered through one of the worst periods of its history, First, the terrorist attacks on the World Trade Center on September 11, 2001, created huge repercussions for the airline industry. People were afraid to travel; meanwhile, reinforced security procedures made traveling even more of a hassle and generated additional costs that ultimately increased airline fares. Other frightening factors also influenced the airline industry shortly thereafter, includ- ing the SARS pandemic (a respiratory disease in humans, with a mortality rate of 9.6%) between 2002 and 2003. As a result, many people simply were too afraid to fly. In June 2008, 35-year-old Jannick Jrgensten was rehearsing the presentation he was going to make during an Executive Board Meeting, scheduled to take place in just a few hours. He had been hired as the new Northern Aero Chief Market- ing Officer (CMO) three years ago, in charge of managing the loyalty program of this modest but profitable and growing airline company cstablished in Scandina via (Northern Europe). He could still remember the discussion he had on his first day on the job with David Vlock, former CMO of the company, who was retiring after many years of good and loyal service: "You will have a difficult job, young man," Vlock told him. "Customers are not loyal anymore. They just want more for less and will switch to a better offer in the blink of an eye. The airline industry is in deep trouble. Our company managed to do pretty well so far, but I have no idea where we are going. It just costs too much money to keep customers loyal today." Vlock was right; loyalty programs were expensive. Coming from a back- ground in the service industry, Jrgensten was amazed to learn that when a cus- tomer walked into one of the airline's lounges, it cost the company about $50. Was it worth it? Was the company spending its marketing and loyalty program dollars wisely? And could it do more with less? To find the answer to these ques tions, he had undertaken a major project during the past few months, aided by a group of customer relationship management (CRM) and information technology (IT) consultants from ZENITH Consulting. Today, he was deliver the results of his investigations (and his recommendations) to the Board. The results were un- cxpected, and the recommendations he planned to make definitely would chal lenge the conventional wisdom. It was going to be a long day. Second, the increase in gas prices (mostly due to the war in Iraq and the geopo litical turmoil in that strategic region of the world, and a severe economic slow- down negatively impacted the airline industry. As in any recession, most compa- nies cut expenses, especially traveling costs. Third, technologies were evolving rapidly. The Internet allowed travelers to search more easily for the lowest fares and made them more price sensitive and more likely to scarch for deals. Other technologies, such as the increased adop tion of videoconferencing and Web conferencing, also represented potential threats to airline revenues and margins. The situation for business traveler seg- ments was even worse. Traditionally, large companies would cut deals with air- line companies to fulfill their traveling needs. But as larger companies imple- mented Intranet and outsourcing solutions to manage the travel options of their Screens 1.2 of 12 Focus E re HE A 40 1:00 PM 3/28/2022 ) File Tools View Document - Word The Frequent Flyer Program employees, they could select flights from various airline companies, often at lower costs, Major companics such as Dell or Cisco managed to reduce their travel budgets by 25% by implementing such programs Fourth, the deregulation of the airline industry, which began in the early 1980s, had encouraged the emergence of an increasing number of competitors, many of the competing on price across borders. Together, these factors dramatically squeezed the operating margins of most airline companies, and by the mid- 2000s, many of them had filed for bankruptcy, including major players in Europe and the United States. By 2008, companies were struggling with very low mar- gins; many of them still suffered net losses. It was a difficult time for the airline industry During turbulent times in the early and mid-2000s, some airline companies posi- tioned themselves as low-cost operators, competing primarily on prices, others tried to differentiate themselves from the competition and focused on increas ing their customer loyalty. Northern Aero, partly due to its geographical location and loyal customer base, took the latter approach and decided to focus primarily on differentiation and loyalty. Its Frequent Flyer Program, launched in 1992, had become a flagship element of the company's marketing strategy. Northern Aero grouped its Frequent Flyers into three categories based on the number of miles they accumulated with the company over the preceding 12 months (In Northern Aero's program, miles accumulate as a function of the number of miles traveled, independent of the price paid for the tickel): Northern Acro Silver Members (more than zero but less than 25,000 miles per year). Gold Members (between 25,000 and 100,000 miles per year). . Platinum Members > 100,000 miles per year). Northern Aero, one of the oldest airline companies in Europe, established in Scandinavia, had finally become profitable again after several tough years. The company owned 75 long carrier planes and was acquiring 25 more to meet in- creasing demand and, more importantly, serve additional destinations. In 1999, il joined OneWorld, a major alliance of carriers, which allowed the company to rationalize costs and serve customers better by providing connections (through alliance partners) to destinations it did not serve itself. Northern Aero embraced new technologies rather quickly compared with its competitors. Beginning in 1997, it opened its first online reservation services. In 2002, it cxpcrimented with electronic check-ins and then expanded the service two years later. The company now uses cell phone messages to alert customers in real-time about confirmed reservations and upgrades or expected delays. The company maintained a list of approximately 58,000 active or recently active members registered in its Frequent Flyer Program, along with a database con- taining all the transactions these members had engaged in with Northern Aero and its partners since 1992. Frequent Flyers received rewards for their loyalty through different mechanisms, including: Priority access during the boarding process.. Access to reserved lounges, with a bar, free Internet connections, relaxation areas, and so forth. Rewards, such as free upgrades. Screens 3-4 of 12 Focus ke 1409 H A 00 1:00 PM 3/28/2022 ) File Tools View Document - Word Recognition and special care. Members also received regular contact from up to 30 targeted marketing campaigns a year, through e mails, mobile messages, Web only offers, regular mail, and other printed material. Campaigns included a variety of approaches, such as Point accrual campaigns (buy a ticket, get double the points). Point and cash campaigns (buy a ticket using half cash and half miles). . Point redemption cam- paigns (buy a ticket for fewer miles than the amount usually required). convince the Board (and myself) that all this money is worth it and well spent. But frankly," he said as he stood over the table, Icaned forward, and lowered the tone of his voice to a whisper, as if to share a highly guarded secret, "I have no idea myself." He sat down and continued. "You see, this company is growing and is profitable. And in this business, not that many achieve these results. So, we must be doing something right. But I am flying blind here, and for the CMO of an airline company," he smiled, "that is not a good idea." "The Frequent Flyer Pro gram is not about good deals or a promotion-of-the-month. We are building long-term relationships. We are investing in customer loyalty. The benefits will be reaped for years to come, but the costs are endured today. And sometimes, wonder if it is a good investment. It is like putting money in a long-term savings account, not knowing the interest payment you will receive at the end. So, my question is as follows: What is the return on investment of my Frequent Flyer Program? How much additional revenue does it generate? Can you help us get an answer?" The program (and the associated marketing campaigns) was very costly for the company. Was it worth it? Could it be improved? Customer Lifetime Value Man- agement During the summer of 2006, Jrgensten organized a business meeting with several top ZENITH Consultants. ZENITH had been working with the com- pany since 2002, mostly to manage and outsource part of Northern Aero's i nccds. Today, Jrgensten and three collaborators would meet with Mohamed Naabi and Josh Samuelson, two consultants from the ZENITH Research and De- velopment Labs, located in Milan, Italy, which specializes in CRM and quantita- tive analysis. They met in one of the brightly lit, elegantly furnished conference rooms of Northern Aero's headquarters. "Gentlemen," Jrgensten said, I have a very simple question for you. Well, at least, I thought it was a very simple ques- tion at first, but clearly, it is not that simple. I know the reputation of ZENITH in marketing analytics and CRM solutions, and you probably have the resources and expertise we need to get answers to my questions. Besides, you are already familiar with our information system architecture." Naabi remained silent for a few seconds and then began his response: "Mr. Jr gensten, ZENITH would be pleased to work with you to resolve this issue. First, lel me rephrase your question and check thal we are both on the same page here. You are investing money today in a loyalty program in order to increase your customer base's loyalty and spending levels. By nurturing them, rewarding them, and communicating with them with appropriate offers, you hope they will stay in business with you longer and keep Northern Aero as their preferred choice. In other words, you invest today to maximize the lifetime value of your customers, and you would I to measure that lifetime value, and how it is im- pacted by your loyalty program." "That is exactly it," replied Jrgensten. "OK, then you must realize that your question, which is fundamental, is only the tip of "Anyway, I have a Frequent Flyer Program that costs us a fortune. I know how much it costs me, that figure is right in front of my face every day. And I have to Screens 5.0 of 12 FOCUS 1409 H A 1:00 PM 3/20/2022 ) File Tools View Document - Word the iceberg," warned Naabi. "Let me predict that, once we have determined how much money your Frequent Flyer Program gencrates for the company, the next question will be, how can it generate more? Measuring customer lifetime value can be hard and challenging, though today we have well-known techniques to measure it; managing customer lifetime value is ultimately what really matters. You probably do not invest enough resources in some key customers who given their profile and potential value, should deserve more of your attention. You may spend too much money to retain others who are not really profitable. The global budget allocated to your loyalty program might be refined. How much to spend on a loyalty program, and how to allocate that budget across customers, or segments of customers, to maximize their lifetime value for the firm -- that's the real question?" "And you believe you could help us here?" asked Jrgensten. "Of course," replied Naabi, smiling. "I think you will enjoy the ride." Understand- ing the Model Aero recently but were active members prior to a year ago. Since then, they have stopped traveling with the company. . Lost customers are inactive custom ers that have shown no activity for at least two years. Any inactive member is considered "lost" if no activity is recorded for a second consecutive year. The Platinum, Gold, and silver definitions might not be the best ones to define managerially relevant segments. For instance, customers who fly overseas might be of much greater value to Northern Aero than custom- ers who only fly within Scandinavia. Among the silver members, some might fly only during summer vacations, whereas others may fly occasionally but all year long. In addition, these segments are defined according to the number of miles flown, regardless of the prices paid for these miles. A "bargain hunter" who flies 40,000 miles a year might be worth much less to the company than a business- person who flies 15,000 miles a year but pays the full price every time. However, the entire company organization is built around these three segments (e.g., cus- tomer service, reward bonuses and structure), and it would be extremely disrup- tive to modify that structure. Consequently, ZENITH decided to keep these sim ple segment definitions as a foundation but refined the categorization using value segmentation. Within each segment, the assessed monetary value of each member groups them into two subcategories: Segment definition The customer lifetime value model is based on eight segments, which can be de- scribed as follow: Platinum (x2) customers have traveled more than 100,000 miles with Northern Aero last year.. Gold (x2) customers have traveled between 25,000 and 100,000 miles within the last 12 months. Silver (x2) members have traveled less than 25,000 miles last year, but with some activity, even if it is only one flight. Many airline companies define these customers as "regular" members and assign Silver slalus only after a specific mileage threshold. This segmentation is not whal Northern Aero has chosen. Inactive members have not traveled with Northern Top 20% represent the 20% most valuable customers of each segment in terms of yearly net contribution for yield).. Bottom 80% represent the other 80% of the customers within each segment. Although not ideal, this approach was not overly disruptive, remained easy to implement, and helped capture some of the heterogeneity in cach segment. Segment description Each segment can be de scribed by the following key figures: Screens 7-8 of 12 Focus E re H Ett A A 1:09 PM 3/20/2022 ) File Tools View Document - Word Number of customers. Gross margins (discussed subsequently). Marketing costs for the next period, which are set to 0 (scc the customer lifetime value tu Transition matrix The transition matrix shows the likelihood that a customer in a particular seg ment will "migrale" lo other segments during the next year. For instance, in the following transition matrix, 39% of the Platinum (top 20%) customers will remain in the same segment next year; 13% will remain Platinum members but fall into a lower margin range, and 31% will become inactive customers Lorial for examples of other contexts in which this designation would not be ac- curate). Average miles per year. Passenger yield per mile, which represents the gross margin of a mile flown by this customer, after accounting for all costs, except those related to the loyalty program. Passenger yield per year, which represents the average miles times passenger yield per mile.. Loyalty program costs, which indicate how much money Northern Aero invests per year in the loyalty program for each segment of customers. Only costs that could be cut are taken into account (other costs have already been subtracted from the yearly yield). For instance, Platinum member exclusive lounges are expensive, but it would be almost impossible for Northern Aero to close them and eliminate the associated costs. Customers have come to expect them, and the company does not really have a choice anymore. The costs listed within this category are those linked to printed catalogs, personalized mails, e-mails, and phone calls; market- ing campaigns; gifts and certificates; and coupons and special rebates. These ac- tions tend to strengthen relationships but are not necessarily expected by cus- tomers. As a first step, because Northern Acro had not used a top 20% versus bottom 80% distinction before, the loyalty program costs are identical across both calegories; within each mernber category, both top and bottom customers have been treated identically. Gross margins equal the yield per year minus the loyalty program costs. Similarly, an inactive customer will become either (a) active again or (b) lost and considered lost forever. Data Organization The Engines data blocks contain all of the data necessary for analysis.: 1. Segment Data (current) shows the current situation, in terms of gross margins with the loyalty program in place. This first data block has been estimated using observed data. The next two are based on a simulation of customers' reactions to marketing efforts. These figures have been estimated econometrically using response functions and marketing models. 2. Segment data (no loyalty program) shows what would happen if Northern Aero stopped all promotional and marketing campaigns. All marketing costs would be cut; the transition matrix would be affected. 3. Segment data (optimi zation) summarizes the results provided by the ZENITH consulting team, includ ing both the optimal spending levels for each segment (estimated with a dis- count rate of 15%) and the resulting transition matrix. One of the Screens 9-10 of 12 D. Focus BE ke H 1:09 PM 3/20/2022 ) File Tools View Document - Word Northern Aero Loyalty Program (CLV) The airline industry Background In the early and mid-2000s, the airline industry suffered through one of the worst periods of its history, First, the terrorist attacks on the World Trade Center on September 11, 2001, created huge repercussions for the airline industry. People were afraid to travel; meanwhile, reinforced security procedures made traveling even more of a hassle and generated additional costs that ultimately increased airline fares. Other frightening factors also influenced the airline industry shortly thereafter, includ- ing the SARS pandemic (a respiratory disease in humans, with a mortality rate of 9.6%) between 2002 and 2003. As a result, many people simply were too afraid to fly. In June 2008, 35-year-old Jannick Jrgensten was rehearsing the presentation he was going to make during an Executive Board Meeting, scheduled to take place in just a few hours. He had been hired as the new Northern Aero Chief Market- ing Officer (CMO) three years ago, in charge of managing the loyalty program of this modest but profitable and growing airline company cstablished in Scandina via (Northern Europe). He could still remember the discussion he had on his first day on the job with David Vlock, former CMO of the company, who was retiring after many years of good and loyal service: "You will have a difficult job, young man," Vlock told him. "Customers are not loyal anymore. They just want more for less and will switch to a better offer in the blink of an eye. The airline industry is in deep trouble. Our company managed to do pretty well so far, but I have no idea where we are going. It just costs too much money to keep customers loyal today." Vlock was right; loyalty programs were expensive. Coming from a back- ground in the service industry, Jrgensten was amazed to learn that when a cus- tomer walked into one of the airline's lounges, it cost the company about $50. Was it worth it? Was the company spending its marketing and loyalty program dollars wisely? And could it do more with less? To find the answer to these ques tions, he had undertaken a major project during the past few months, aided by a group of customer relationship management (CRM) and information technology (IT) consultants from ZENITH Consulting. Today, he was deliver the results of his investigations (and his recommendations) to the Board. The results were un- cxpected, and the recommendations he planned to make definitely would chal lenge the conventional wisdom. It was going to be a long day. Second, the increase in gas prices (mostly due to the war in Iraq and the geopo litical turmoil in that strategic region of the world, and a severe economic slow- down negatively impacted the airline industry. As in any recession, most compa- nies cut expenses, especially traveling costs. Third, technologies were evolving rapidly. The Internet allowed travelers to search more easily for the lowest fares and made them more price sensitive and more likely to scarch for deals. Other technologies, such as the increased adop tion of videoconferencing and Web conferencing, also represented potential threats to airline revenues and margins. The situation for business traveler seg- ments was even worse. Traditionally, large companies would cut deals with air- line companies to fulfill their traveling needs. But as larger companies imple- mented Intranet and outsourcing solutions to manage the travel options of their Screens 1.2 of 12 Focus E re HE A 40 1:00 PM 3/28/2022 ) File Tools View Document - Word The Frequent Flyer Program employees, they could select flights from various airline companies, often at lower costs, Major companics such as Dell or Cisco managed to reduce their travel budgets by 25% by implementing such programs Fourth, the deregulation of the airline industry, which began in the early 1980s, had encouraged the emergence of an increasing number of competitors, many of the competing on price across borders. Together, these factors dramatically squeezed the operating margins of most airline companies, and by the mid- 2000s, many of them had filed for bankruptcy, including major players in Europe and the United States. By 2008, companies were struggling with very low mar- gins; many of them still suffered net losses. It was a difficult time for the airline industry During turbulent times in the early and mid-2000s, some airline companies posi- tioned themselves as low-cost operators, competing primarily on prices, others tried to differentiate themselves from the competition and focused on increas ing their customer loyalty. Northern Aero, partly due to its geographical location and loyal customer base, took the latter approach and decided to focus primarily on differentiation and loyalty. Its Frequent Flyer Program, launched in 1992, had become a flagship element of the company's marketing strategy. Northern Aero grouped its Frequent Flyers into three categories based on the number of miles they accumulated with the company over the preceding 12 months (In Northern Aero's program, miles accumulate as a function of the number of miles traveled, independent of the price paid for the tickel): Northern Acro Silver Members (more than zero but less than 25,000 miles per year). Gold Members (between 25,000 and 100,000 miles per year). . Platinum Members > 100,000 miles per year). Northern Aero, one of the oldest airline companies in Europe, established in Scandinavia, had finally become profitable again after several tough years. The company owned 75 long carrier planes and was acquiring 25 more to meet in- creasing demand and, more importantly, serve additional destinations. In 1999, il joined OneWorld, a major alliance of carriers, which allowed the company to rationalize costs and serve customers better by providing connections (through alliance partners) to destinations it did not serve itself. Northern Aero embraced new technologies rather quickly compared with its competitors. Beginning in 1997, it opened its first online reservation services. In 2002, it cxpcrimented with electronic check-ins and then expanded the service two years later. The company now uses cell phone messages to alert customers in real-time about confirmed reservations and upgrades or expected delays. The company maintained a list of approximately 58,000 active or recently active members registered in its Frequent Flyer Program, along with a database con- taining all the transactions these members had engaged in with Northern Aero and its partners since 1992. Frequent Flyers received rewards for their loyalty through different mechanisms, including: Priority access during the boarding process.. Access to reserved lounges, with a bar, free Internet connections, relaxation areas, and so forth. Rewards, such as free upgrades. Screens 3-4 of 12 Focus ke 1409 H A 00 1:00 PM 3/28/2022 ) File Tools View Document - Word Recognition and special care. Members also received regular contact from up to 30 targeted marketing campaigns a year, through e mails, mobile messages, Web only offers, regular mail, and other printed material. Campaigns included a variety of approaches, such as Point accrual campaigns (buy a ticket, get double the points). Point and cash campaigns (buy a ticket using half cash and half miles). . Point redemption cam- paigns (buy a ticket for fewer miles than the amount usually required). convince the Board (and myself) that all this money is worth it and well spent. But frankly," he said as he stood over the table, Icaned forward, and lowered the tone of his voice to a whisper, as if to share a highly guarded secret, "I have no idea myself." He sat down and continued. "You see, this company is growing and is profitable. And in this business, not that many achieve these results. So, we must be doing something right. But I am flying blind here, and for the CMO of an airline company," he smiled, "that is not a good idea." "The Frequent Flyer Pro gram is not about good deals or a promotion-of-the-month. We are building long-term relationships. We are investing in customer loyalty. The benefits will be reaped for years to come, but the costs are endured today. And sometimes, wonder if it is a good investment. It is like putting money in a long-term savings account, not knowing the interest payment you will receive at the end. So, my question is as follows: What is the return on investment of my Frequent Flyer Program? How much additional revenue does it generate? Can you help us get an answer?" The program (and the associated marketing campaigns) was very costly for the company. Was it worth it? Could it be improved? Customer Lifetime Value Man- agement During the summer of 2006, Jrgensten organized a business meeting with several top ZENITH Consultants. ZENITH had been working with the com- pany since 2002, mostly to manage and outsource part of Northern Aero's i nccds. Today, Jrgensten and three collaborators would meet with Mohamed Naabi and Josh Samuelson, two consultants from the ZENITH Research and De- velopment Labs, located in Milan, Italy, which specializes in CRM and quantita- tive analysis. They met in one of the brightly lit, elegantly furnished conference rooms of Northern Aero's headquarters. "Gentlemen," Jrgensten said, I have a very simple question for you. Well, at least, I thought it was a very simple ques- tion at first, but clearly, it is not that simple. I know the reputation of ZENITH in marketing analytics and CRM solutions, and you probably have the resources and expertise we need to get answers to my questions. Besides, you are already familiar with our information system architecture." Naabi remained silent for a few seconds and then began his response: "Mr. Jr gensten, ZENITH would be pleased to work with you to resolve this issue. First, lel me rephrase your question and check thal we are both on the same page here. You are investing money today in a loyalty program in order to increase your customer base's loyalty and spending levels. By nurturing them, rewarding them, and communicating with them with appropriate offers, you hope they will stay in business with you longer and keep Northern Aero as their preferred choice. In other words, you invest today to maximize the lifetime value of your customers, and you would I to measure that lifetime value, and how it is im- pacted by your loyalty program." "That is exactly it," replied Jrgensten. "OK, then you must realize that your question, which is fundamental, is only the tip of "Anyway, I have a Frequent Flyer Program that costs us a fortune. I know how much it costs me, that figure is right in front of my face every day. And I have to Screens 5.0 of 12 FOCUS 1409 H A 1:00 PM 3/20/2022 ) File Tools View Document - Word the iceberg," warned Naabi. "Let me predict that, once we have determined how much money your Frequent Flyer Program gencrates for the company, the next question will be, how can it generate more? Measuring customer lifetime value can be hard and challenging, though today we have well-known techniques to measure it; managing customer lifetime value is ultimately what really matters. You probably do not invest enough resources in some key customers who given their profile and potential value, should deserve more of your attention. You may spend too much money to retain others who are not really profitable. The global budget allocated to your loyalty program might be refined. How much to spend on a loyalty program, and how to allocate that budget across customers, or segments of customers, to maximize their lifetime value for the firm -- that's the real question?" "And you believe you could help us here?" asked Jrgensten. "Of course," replied Naabi, smiling. "I think you will enjoy the ride." Understand- ing the Model Aero recently but were active members prior to a year ago. Since then, they have stopped traveling with the company. . Lost customers are inactive custom ers that have shown no activity for at least two years. Any inactive member is considered "lost" if no activity is recorded for a second consecutive year. The Platinum, Gold, and silver definitions might not be the best ones to define managerially relevant segments. For instance, customers who fly overseas might be of much greater value to Northern Aero than custom- ers who only fly within Scandinavia. Among the silver members, some might fly only during summer vacations, whereas others may fly occasionally but all year long. In addition, these segments are defined according to the number of miles flown, regardless of the prices paid for these miles. A "bargain hunter" who flies 40,000 miles a year might be worth much less to the company than a business- person who flies 15,000 miles a year but pays the full price every time. However, the entire company organization is built around these three segments (e.g., cus- tomer service, reward bonuses and structure), and it would be extremely disrup- tive to modify that structure. Consequently, ZENITH decided to keep these sim ple segment definitions as a foundation but refined the categorization using value segmentation. Within each segment, the assessed monetary value of each member groups them into two subcategories: Segment definition The customer lifetime value model is based on eight segments, which can be de- scribed as follow: Platinum (x2) customers have traveled more than 100,000 miles with Northern Aero last year.. Gold (x2) customers have traveled between 25,000 and 100,000 miles within the last 12 months. Silver (x2) members have traveled less than 25,000 miles last year, but with some activity, even if it is only one flight. Many airline companies define these customers as "regular" members and assign Silver slalus only after a specific mileage threshold. This segmentation is not whal Northern Aero has chosen. Inactive members have not traveled with Northern Top 20% represent the 20% most valuable customers of each segment in terms of yearly net contribution for yield).. Bottom 80% represent the other 80% of the customers within each segment. Although not ideal, this approach was not overly disruptive, remained easy to implement, and helped capture some of the heterogeneity in cach segment. Segment description Each segment can be de scribed by the following key figures: Screens 7-8 of 12 Focus E re H Ett A A 1:09 PM 3/20/2022 ) File Tools View Document - Word Number of customers. Gross margins (discussed subsequently). Marketing costs for the next period, which are set to 0 (scc the customer lifetime value tu Transition matrix The transition matrix shows the likelihood that a customer in a particular seg ment will "migrale" lo other segments during the next year. For instance, in the following transition matrix, 39% of the Platinum (top 20%) customers will remain in the same segment next year; 13% will remain Platinum members but fall into a lower margin range, and 31% will become inactive customers Lorial for examples of other contexts in which this designation would not be ac- curate). Average miles per year. Passenger yield per mile, which represents the gross margin of a mile flown by this customer, after accounting for all costs, except those related to the loyalty program. Passenger yield per year, which represents the average miles times passenger yield per mile.. Loyalty program costs, which indicate how much money Northern Aero invests per year in the loyalty program for each segment of customers. Only costs that could be cut are taken into account (other costs have already been subtracted from the yearly yield). For instance, Platinum member exclusive lounges are expensive, but it would be almost impossible for Northern Aero to close them and eliminate the associated costs. Customers have come to expect them, and the company does not really have a choice anymore. The costs listed within this category are those linked to printed catalogs, personalized mails, e-mails, and phone calls; market- ing campaigns; gifts and certificates; and coupons and special rebates. These ac- tions tend to strengthen relationships but are not necessarily expected by cus- tomers. As a first step, because Northern Acro had not used a top 20% versus bottom 80% distinction before, the loyalty program costs are identical across both calegories; within each mernber category, both top and bottom customers have been treated identically. Gross margins equal the yield per year minus the loyalty program costs. Similarly, an inactive customer will become either (a) active again or (b) lost and considered lost forever. Data Organization The Engines data blocks contain all of the data necessary for analysis.: 1. Segment Data (current) shows the current situation, in terms of gross margins with the loyalty program in place. This first data block has been estimated using observed data. The next two are based on a simulation of customers' reactions to marketing efforts. These figures have been estimated econometrically using response functions and marketing models. 2. Segment data (no loyalty program) shows what would happen if Northern Aero stopped all promotional and marketing campaigns. All marketing costs would be cut; the transition matrix would be affected. 3. Segment data (optimi zation) summarizes the results provided by the ZENITH consulting team, includ ing both the optimal spending levels for each segment (estimated with a dis- count rate of 15%) and the resulting transition matrix. One of the Screens 9-10 of 12 D. Focus BE ke H 1:09 PM 3/20/2022 )Step by Step Solution

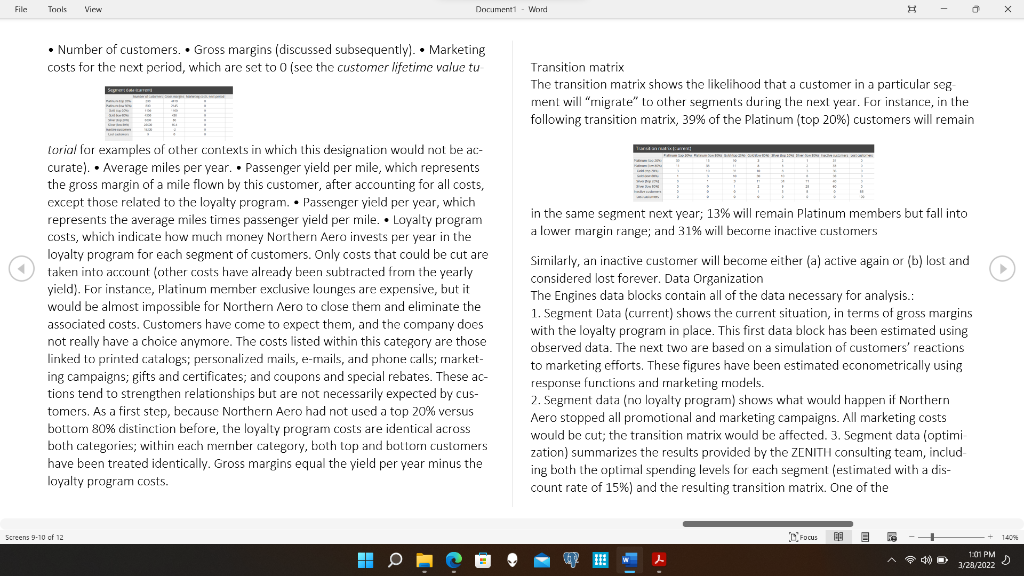

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts