Question: Mae Refiners, Incorporated, processes sugar cane that it purchases from farmers. Sugar cane is processed in batches. A batch of sugar cane costs $60 to

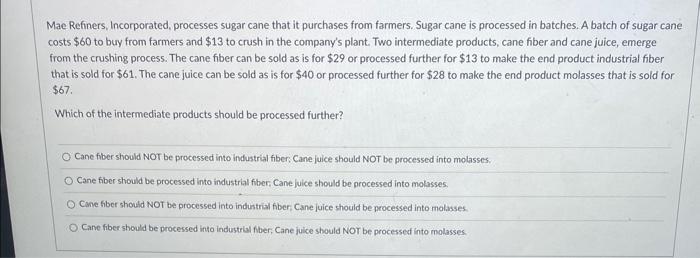

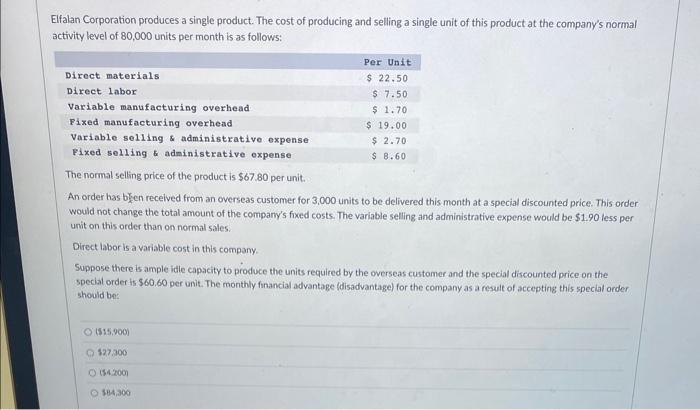

Mae Refiners, Incorporated, processes sugar cane that it purchases from farmers. Sugar cane is processed in batches. A batch of sugar cane costs $60 to buy from farmers and $13 to crush in the company's plant. Two intermediate products, cane fiber and cane juice, emerge from the crushing process. The cane fiber can be sold as is for $29 or processed further for $13 to make the end product industrial fiber that is sold for $61. The cane juice can be sold as is for $40 or processed further for $28 to make the end product molasses that is sold for $67. Which of the intermediate products should be processed further? Cane fiber should NOT be processed into industrial fiber. Cane juice should NOT be processed into molasses. Cane fiber should be processed into industrial fiber, Cane juice should be grocessed into molasses. Cane fiber should NOT be processed into industrial fiber Cane juice should be processed into molases Cane fiber should be processed into industral fiber, Cane juice should NOT be processed into molasses. Elfalan Corporation produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 80,000 units per month is as follows: The normal selling price of the product is $67.80 per unit. An order has bjen recelved from an overseas customer for 3,000 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $1.90 less per unit on this order than on normal sales. Direct labor is a variable cost in this company. Suppose there is ample idie capacity to produce the units required by the overseas customer and the special discounted price on the special order is $60.60 per unit. The monthly financial advantage (disadvantage) for the company as a result of accepting this special order. should be: (515,000) $27.700 (54.200) 884,a00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts