Question: Magellen Industries is analyzing a new project and has asked you to calculate the project's net income in A. the worst-case scenario; and in

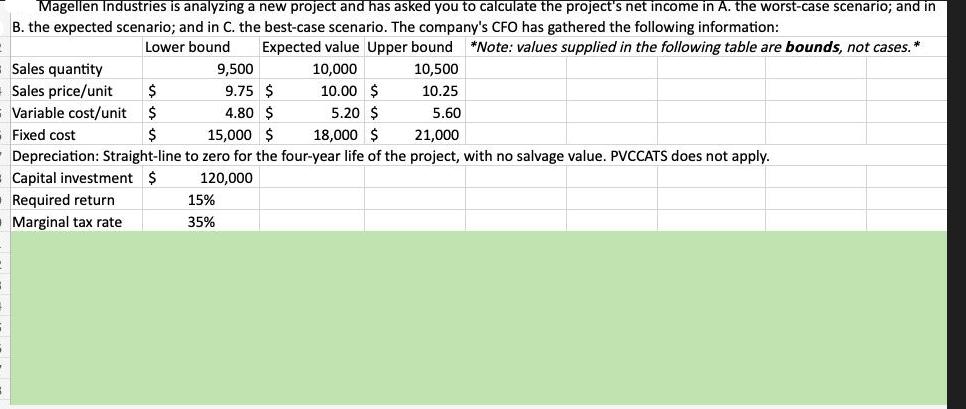

Magellen Industries is analyzing a new project and has asked you to calculate the project's net income in A. the worst-case scenario; and in B. the expected scenario; and in C. the best-case scenario. The company's CFO has gathered the following information: Lower bound Expected value Upper bound *Note: values supplied in the following table are bounds, not cases. 9,500 $ 9.75 $ 10,000 10.00 $ 10,500 10.25 $ 4.80 $ 15,000 $ 5.20 $ 5.60 18,000 $ 21,000 5 Variable cost/unit $ Sales quantity Sales price/unit Fixed cost Capital investment $ 120,000 Required return 15% Marginal tax rate 35% Depreciation: Straight-line to zero for the four-year life of the project, with no salvage value. PVCCATS does not apply.

Step by Step Solution

There are 3 Steps involved in it

Answer To calculate the net income in different scenarios we need to consider the sales quantity sales price per unit variable cost per unit fixed cos... View full answer

Get step-by-step solutions from verified subject matter experts