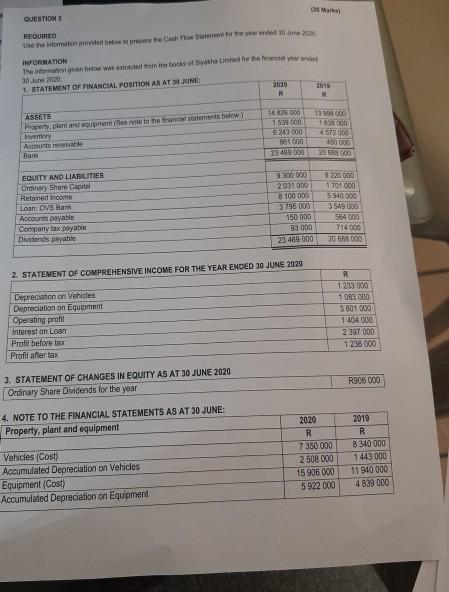

Question: Mahal QUESTION REQUIRED INFORMATION The given below where to the famed they 30 June STATEMENT OF FINANCIAL POSTONAS ATINE: 2000 F 2018 ASSETS Paper plant

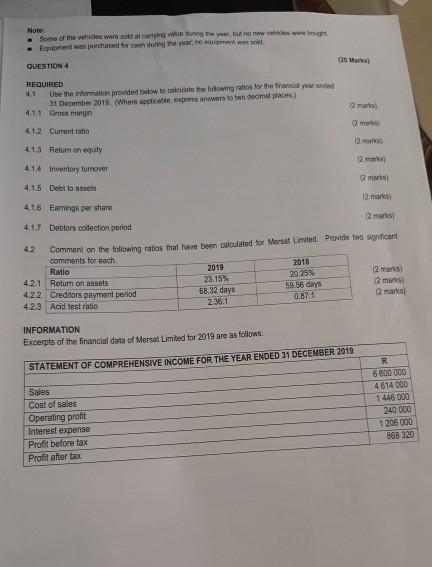

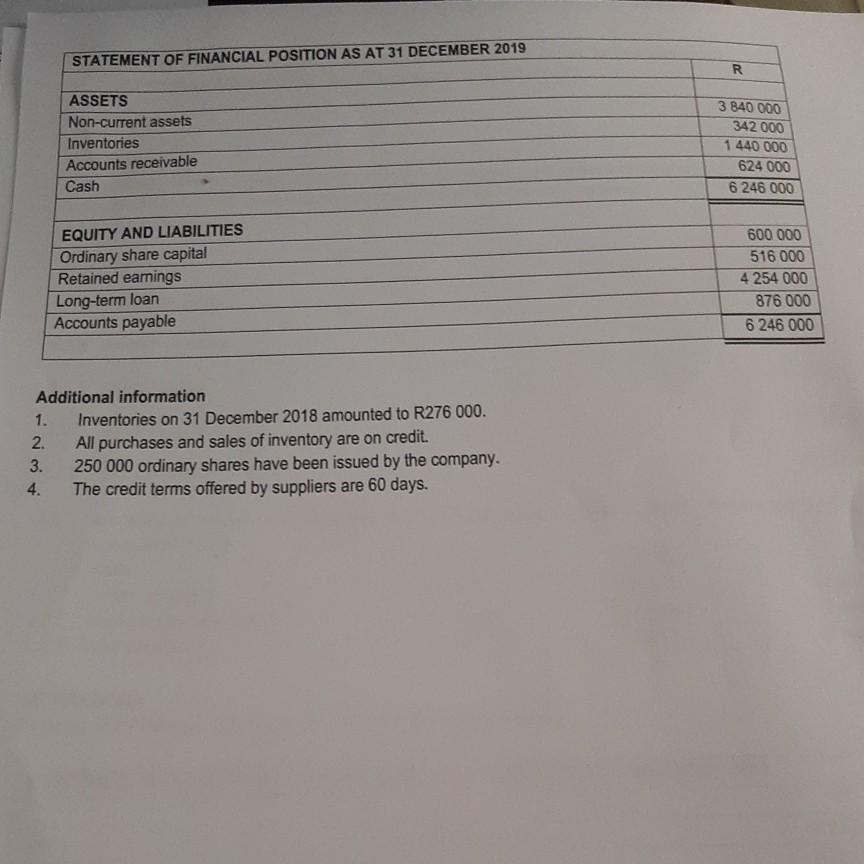

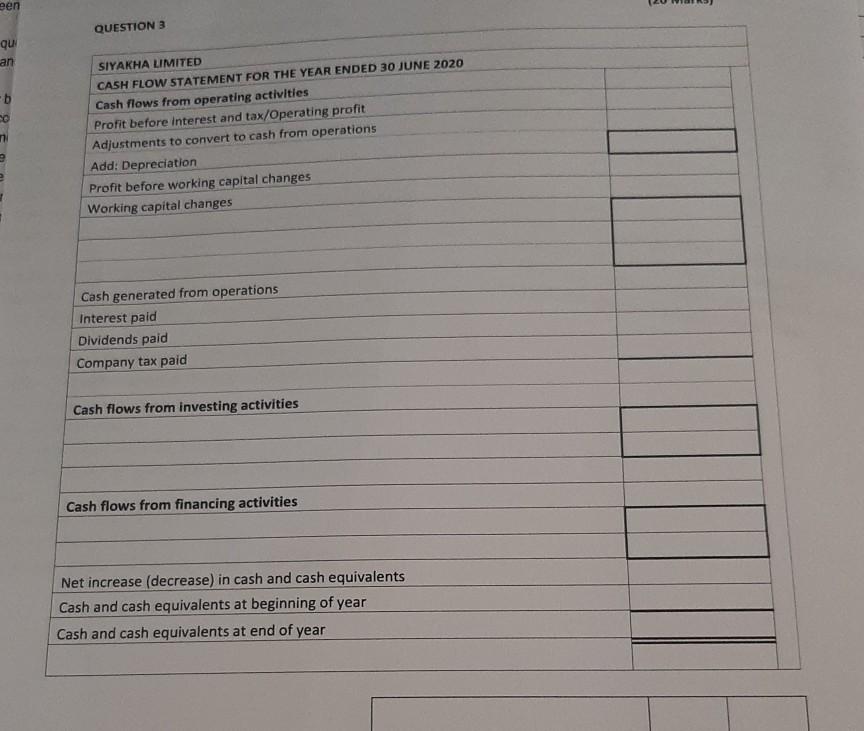

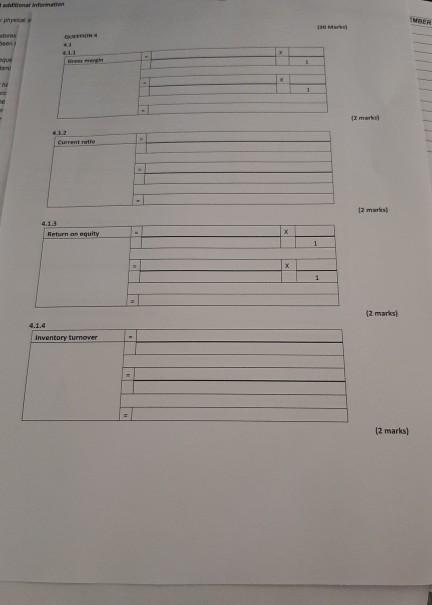

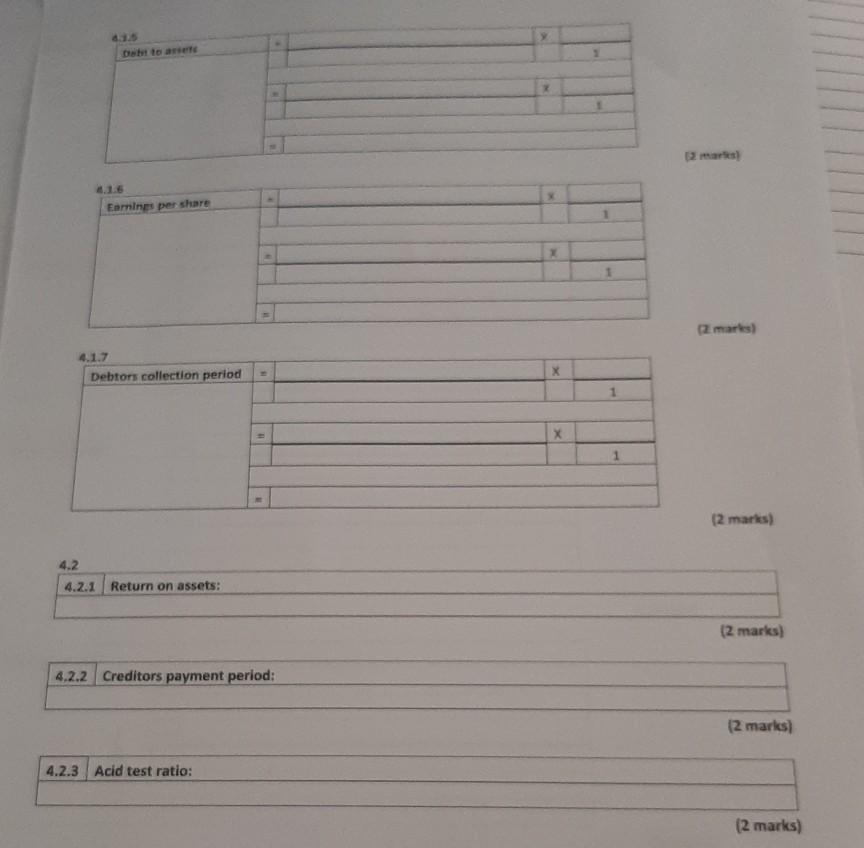

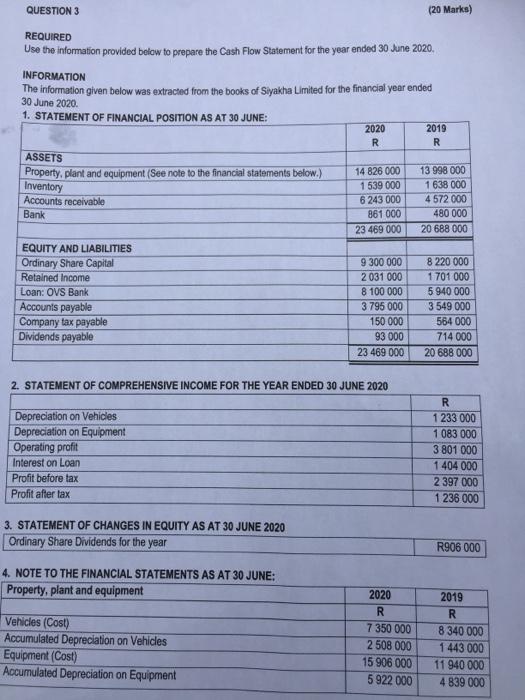

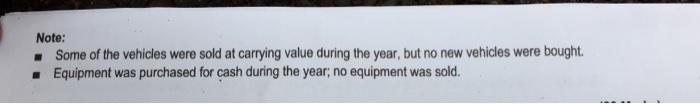

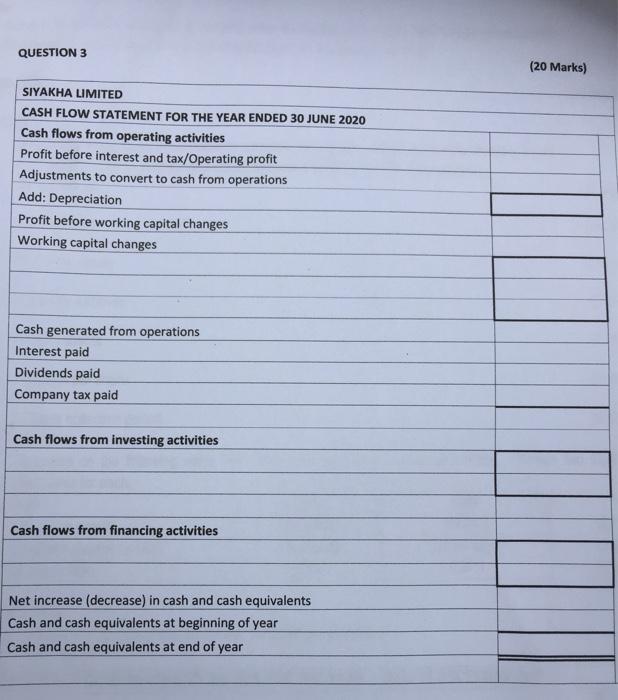

Mahal QUESTION REQUIRED INFORMATION The given below where to the famed they 30 June STATEMENT OF FINANCIAL POSTONAS ATINE: 2000 F 2018 ASSETS Paper plant and equipment (e not to translatimea below Inventory Ascorts receivable Fans 1426 1539000 520000 BB 000 23 DO TESCO 4572000 030000 20 000 EQUITY AND LIABILITIES Ordinary Share Capital Reta ned noorte Loan: OVS Bank Accounts payable Company tax payable Dividends payable 300000 2031000 6 100 000 3795 000 150 000 93 000 23 469 000 TO 000 5540 000 3549 000 564 000 714000 26.08000 2 STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 Depreciation on Vehicles Depreciation on Equipment Operating profil Interest an Loan Profit before tax Profil after tax R 1233 000 1083 000 3801000 1400000 2 397 000 1236 000 R906 000 3. STATEMENT OF CHANGES IN EQUITY AS AT 30 JUNE 2020 Ordinary Share Dividends for the year 4. NOTE TO THE FINANCIAL STATEMENTS AS AT 30 JUNE: Property, plant and equipment Vehicles (Cost) Accumulated Depreciation on Vehicles Equipment (Cost) Accumulated Depreciation on Equipment 2020 R 7350 000 2 508 000 15 936 000 5 922 000 2019 R 8 340 000 1443 000 11 940 000 4 839 000 Note Some of the whicles were told trying our news Ement was purchased for the rol QUESTION 4 REQUIRED Use the information provided wiow to all the towing ratios for the new and 31 December 2015 (Where weres answers to two decimal places 4.1.1 Gen margin 2 41.2 Current ratio 4.13 Return on equity 4.1.4 Inventory turnover 4.1.5 Debt to asset 12 mars 416 Earnings per share 4.17 Debtors collection period 42 Comment on the following ratios that have been calculated to Mersatilid. Providin two significant comments for each Ratio 2019 2018 20 25% 12.manis) 4.2.1 Return on assets 2 422 Creditors payment period 59 56 days 68.32 days 12 marts 4.23 Acid test ratio 0.87 296.1 INFORMATION Excerpts of the financial data of Mersal Limited for 2019 are as follows: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2019 Sales Cost of sales Operating profit Interest expense Profit before tax Profit after tex R 6600 000 4 614 000 1 448000 240 000 1 206000 868 320 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2019 R ASSETS Non-current assets Inventories Accounts receivable Cash 3 840 000 342 000 1440 000 624 000 6 246 000 EQUITY AND LIABILITIES Ordinary share capital Retained eamings Long-term loan Accounts payable 600 000 516 000 4254 000 876 000 6 246 000 Additional information 1. Inventories on 31 December 2018 amounted to R276 000. 2. All purchases and sales of inventory are on credit. 3. 250 000 ordinary shares have been issued by the company. 4. The credit terms offered by suppliers are 60 days. een QUESTION 3 qu an -b n SIYAKHA LIMITED CASH FLOW STATEMENT FOR THE YEAR ENDED 30 JUNE 2020 Cash flows from operating activities Profit before interest and tax/Operating profit Adjustments to convert to cash from operations Add: Depreciation Profit before working capital changes Working capital changes Cash generated from operations Interest paid Dividends paid Company tax paid Cash flows from investing activities Cash flows from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year BER sort M 1 Current rate 12 muri 4.13 Feturn an equity 1 (2 marks 4.1.4 Inventory turnover [2 marks toare 016 Earnings per share 4.1.7 Debtors collection period [2 marks) 4.2 4.2.1 Return on assets: (2 marks) 4.2.2 Creditors payment period: (2 marks) 4.2.3 Acid test ratio: (2 marks) QUESTION 3 (20 Marks) REQUIRED Use the information provided below to prepare the Cash Flow Statement for the year ended 30 June 2020. INFORMATION The information given below was extracted from the books of Siyakha Limited for the financial year ended 30 June 2020 1. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE: 2020 2019 R R ASSETS Property, plant and equipment (See note to the financial statements below.) Inventory Accounts receivable Bank 14 826 000 1 539 000 6 243 000 861 000 23 469 000 13 998 000 1 638 000 4572 000 480 000 20 688 000 EQUITY AND LIABILITIES Ordinary Share Capital Retained Income Loan: OVS Bank Accounts payable Company tax payable Dividends payable 9 300 000 2 031 000 8 100 000 3 795 000 150 000 93 000 23 469 000 8 220 000 1 701 000 5 940 000 3549 000 564 000 714 000 20 688 000 2. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 Depreciation on Vehicles Depreciation on Equipment Operating profit Interest on Loan Profit before tax Profit after lax R 1 233 000 1 083 000 3 801 000 1 404 000 2 397 000 1236 000 3. STATEMENT OF CHANGES IN EQUITY AS AT 30 JUNE 2020 Ordinary Share Dividends for the year R906 000 4. NOTE TO THE FINANCIAL STATEMENTS AS AT 30 JUNE: Property, plant and equipment Vehicles (Cost) Accumulated Depreciation on Vehicles Equipment (Cost) Accumulated Depreciation on Equipment 2020 R 7 350 000 2 508 000 15 906 000 5 922 000 2019 R 8 340 000 1443 000 11 940 000 4 839 000 Note: . Some of the vehicles were sold at carrying value during the year, but no new vehicles were bought Equipment was purchased for cash during the year, no equipment was sold. QUESTION 3 (20 Marks) SIYAKHA LIMITED CASH FLOW STATEMENT FOR THE YEAR ENDED 30 JUNE 2020 Cash flows from operating activities Profit before interest and tax/Operating profit Adjustments to convert to cash from operations Add: Depreciation Profit before working capital changes Working capital changes Cash generated from operations Interest paid Dividends paid Company tax paid Cash flows from investing activities Cash flows from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts