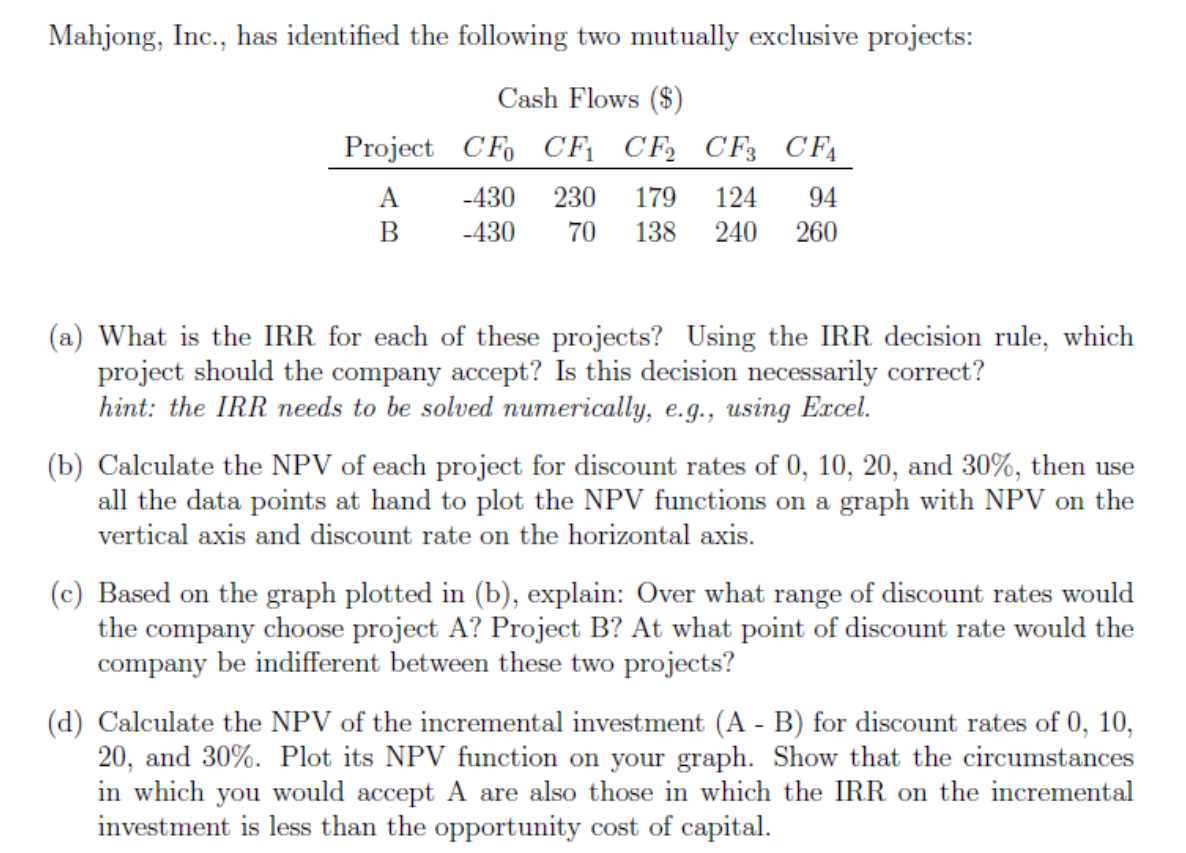

Question: Mahjong, Inc., has identified the following two mutually exclusive projects: Cash Flows ($) Project CF CF CF CF CF4 A B -430 -430 230 70

Mahjong, Inc., has identified the following two mutually exclusive projects: Cash Flows ($) Project CF CF CF CF CF4 A B -430 -430 230 70 179 138 124 240 94 260 (a) What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? hint: the IRR needs to be solved numerically, e.g., using Excel. (b) Calculate the NPV of each project for discount rates of 0, 10, 20, and 30%, then use all the data points at hand to plot the NPV functions on a graph with NPV on the vertical axis and discount rate on the horizontal axis. (c) Based on the graph plotted in (b), explain: Over what range of discount rates would the company choose project A? Project B? At what point of discount rate would the company be indifferent between these two projects? (d) Calculate the NPV of the incremental investment (A - B) for discount rates of 0, 10, 20, and 30%. Plot its NPV function on your graph. Show that the circumstances in which you would accept A are also those in which the IRR on the incremental investment is less than the opportunity cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts