Question: maining Time: 55 minutes, 39 seconds Question Completion Status: SA QUESTION 21 6 points On 1 July 2014 NSW Lid purchased manufacturing equipment for 705,000

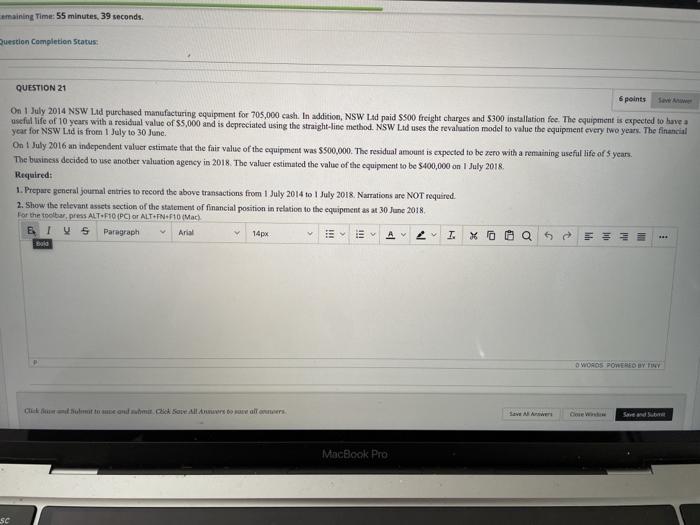

maining Time: 55 minutes, 39 seconds Question Completion Status: SA QUESTION 21 6 points On 1 July 2014 NSW Lid purchased manufacturing equipment for 705,000 cash. In addition, NSW Led paid $500 freight charges and $300 installation fee. The equipment is expected to have a useful life of 10 years with a residual value of $5,000 and is depreciated using the straight-line method. NSW Led uses the revaluation model to value the equipment every two years. The financial year for NSW Lad is from 1 July to 30 June. On 1 July 2016 an independent value estimate that the finir value of the equipment was $500,000. The residual amount is expected to be zero with a remaining useful life of years, The business decided to use another valuation agency in 2018. The value estimated the value of the equipment to be $400,000 on 1 July 2018 Required: 1. Prepare general journal entries to record the above transactions from 1 July 2014 to 1 July 2018. Narrations are NOT required. 2. Show the relevant assets section of the statement of financial position in relation to the equipment as at 30 June 2018 For the toolbar, press ALT=F10 (PC) O ALT+FN+F10(Mac) & TVS Paragraph 14px A T. Bala Arial WORDS POLOBYTY Come and Se All Aro al MacBook Pro SC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts