Question: Assumptions: 1. Zosia sets up a company. She brings in a share capital of 300,000 in cash. Zosia deposits part of the cash into

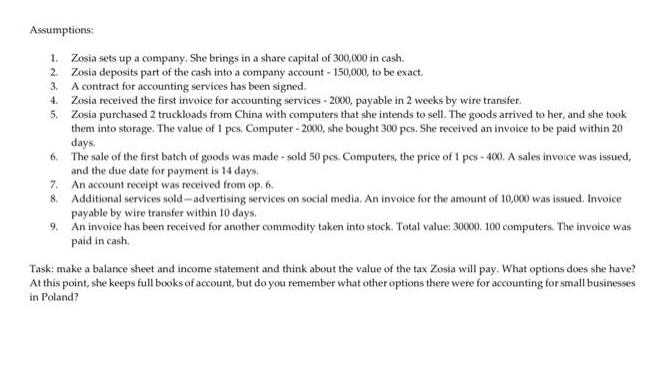

Assumptions: 1. Zosia sets up a company. She brings in a share capital of 300,000 in cash. Zosia deposits part of the cash into a company account - 150,000, to be exact. 3. A contract for accounting services has been signed. 2. Zosia received the first invoice for accounting services - 2000, payable in 2 weeks by wire transfer. Zosia purchased 2 truckloads from China with computers that she intends to sell. The goods arrived to her, and she took them into storage. The value of 1 pcs. Computer - 2000, she bought 300 pcs. She received an invoice to be paid within 20 days. 6. The sale of the first batch of goods was made-sold 50 pcs. Computers, the price of 1 pcs-400. A sales invoice was issued, and the due date for payment is 14 days. An account receipt was received from op. 6. Additional services sold-advertising services on social media. An invoice for the amount of 10,000 was issued. Invoice payable by wire transfer within 10 days. 4. 5. 7. 8. 9, An invoice has been received for another commodity taken into stock. Total value: 30000. 100 computers. The invoice was paid in cash. Task: make a balance sheet and income statement and think about the value of the tax Zosia will pay. What options does she have? At this point, she keeps full books of account, but do you remember what other options there were for accounting for small businesses in Poland?

Step by Step Solution

3.34 Rating (175 Votes )

There are 3 Steps involved in it

Answer 1 General guidance The answer provided below has been developed in a ... View full answer

Get step-by-step solutions from verified subject matter experts