Question: Make a classified balance sheet for the restaurant. Be sure to classify assets into current and long-term and classify liabilities into current and long term.

Make a classified balance sheet for the restaurant. Be sure to classify assets into current and long-term and classify liabilities into current and long term. In preparation of this statement, make sure that you reflect the restaurant owners taking 10% of the current year net income as dividend. The retained earnings carried over from the previous year (2018) should be equal to $100,000. Thelast account that you populate will most likely involve a "plug" to keep your balance sheet in balance. Remember, the balance sheet must balance. All numbers (on all statements) should be reviewed for believability. Below your balance sheet, show the calculation on how you get the ending balance of retained earnings based on the beginning retained earnings, net income, and dividend.

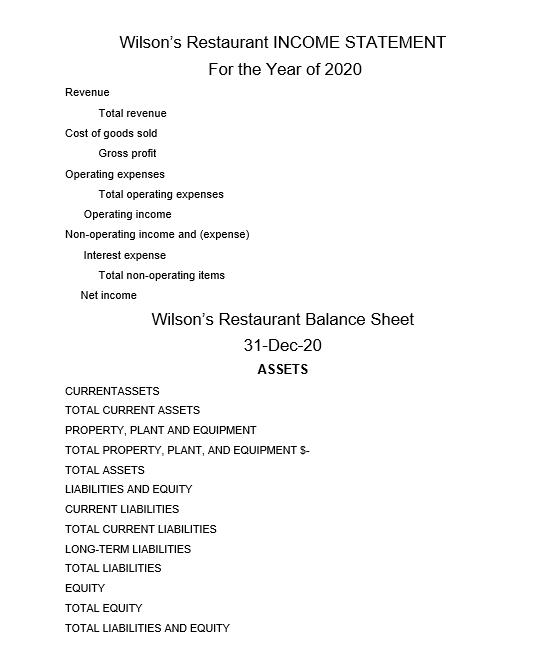

Wilson's Restaurant INCOME STATEMENT For the Year of 2020 Revenue Total revenue Cost of goods sold Gross profit Operating expenses Total operating expenses Operating income Non-operating income and (expense) Interest expense Total non-operating items Net income Wilson's Restaurant Balance Sheet 31-Dec-20 ASSETS CURRENTASSETS TOTAL CURRENT ASSETS PROPERTY, PLANT AND EQUIPMENT TOTAL PROPERTY, PLANT, AND EQUIPMENT S- TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES TOTAL CURRENT LIABILITIES LONG-TERM LIABILITIES TOTAL LIABILITIES EQUITY TOTAL EQUITY TOTAL LIABILITIES AND EQUITY

Step by Step Solution

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Income Statement Balance Sheet Balance of Retained Ea... View full answer

Get step-by-step solutions from verified subject matter experts