Question: Make a clear solution in each item WYENARD Supplies, Inc., has an 8 percent return on total *2/2 assets of $300,000 and a net profit

Make a clear solution in each item

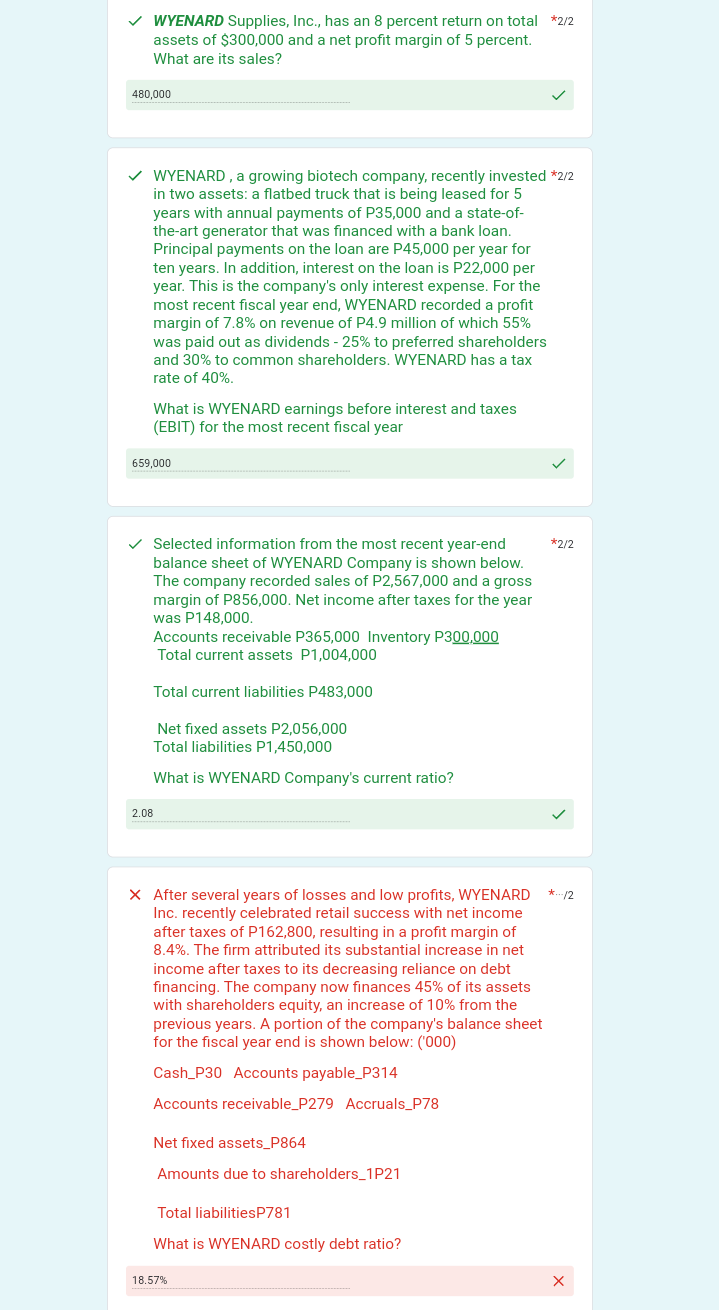

WYENARD Supplies, Inc., has an 8 percent return on total *2/2 assets of $300,000 and a net profit margin of 5 percent. What are its sales? 480,000 WYENARD, a growing biotech company, recently invested *2/2 in two assets: a flatbed truck that is being leased for 5 years with annual payments of P35,000 and a state-of- the-art generator that was financed with a bank loan. Principal payments on the loan are P45,000 per year for ten years. In addition, interest on the loan is P22,000 per year. This is the company's only interest expense. For the most recent fiscal year end, WYENARD recorded a profit margin of 7.8% on revenue of P4.9 million of which 55% was paid out as dividends - 25% to preferred shareholders and 30% to common shareholders. WYENARD has a tax rate of 40%. What is WYENARD earnings before interest and taxes (EBIT) for the most recent fiscal year 659,000 Selected information from the most recent year-end balance sheet of WYENARD Company is shown below. The company recorded sales of P2,567,000 and a gross margin of P856,000. Net income after taxes for the year was P148,000. Accounts receivable P365,000 Inventory P300,000 Total current assets P1,004,000 Total current liabilities P483,000 Net fixed assets P2,056,000 Total liabilities P1,450,000 What is WYENARD Company's current ratio? 2.08 X After several years of losses and low profits, WYENARD *.../2 Inc. recently celebrated retail success with net income after taxes of P162,800, resulting in a profit margin of 8.4%. The firm attributed its substantial increase in net income after taxes to its decreasing reliance on debt financing. The company now finances 45% of its assets with shareholders equity, an increase of 10% from the previous years. A portion of the company's balance sheet for the fiscal year end is shown below: ('000) Cash P30 Accounts payable_P314 Accounts receivable_P279 Accruals_P78 Net fixed assets_P864 Amounts due to shareholders_1P21 Total liabilitiesP781 What is WYENARD costly debt ratio? *2/2 18.57% X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts