Question: Make a recommendation regarding whether ABC's bonds should be upgraded, downgraded, or remain stable. In your reasoning, please be sure to (a) quote the information

Make a recommendation regarding whether ABC's bonds should be upgraded, downgraded, or remain stable.

In your reasoning, please be sure to

(a) quote the information (e.g., financial data and ratios, etc.) from the case to support your conclusion and

(b) discuss what could have happened to ABC Corporation (e.g., business expansion, mergers and acquisitions, and competition, etc.).

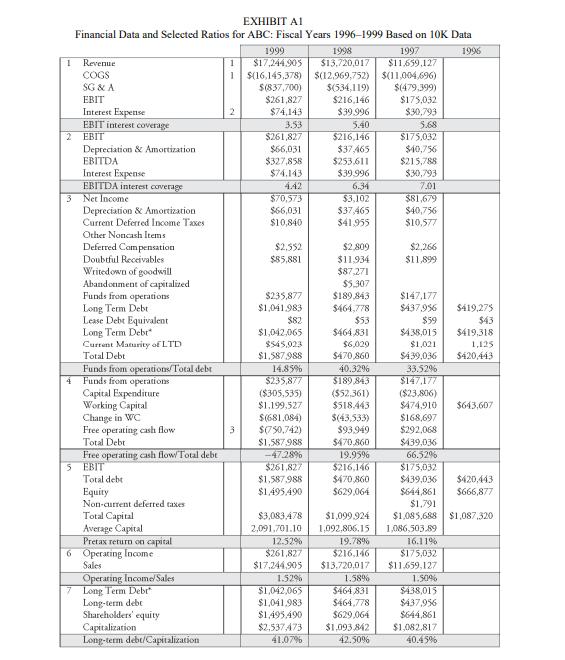

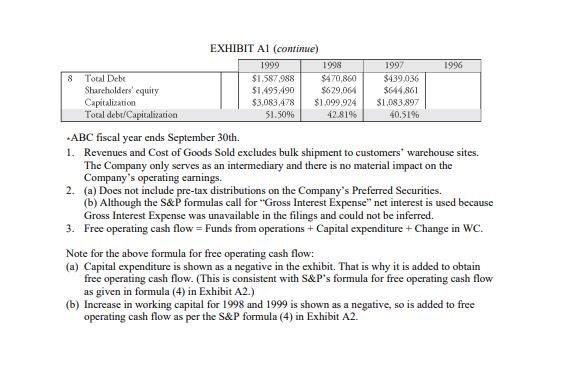

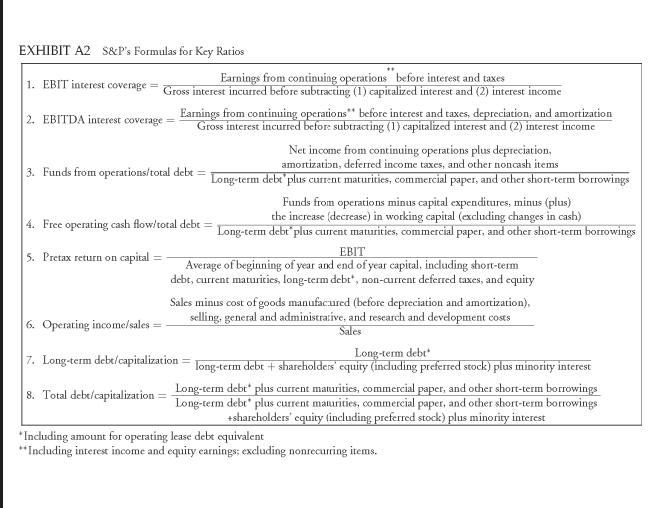

ABC Corporation is a supply channel management company that provides pharmaceuticals, medical-surgical supplies, and specialty products. The company also provides information management solutions and outsourcing services, as well as develops disease-specific treatment protocols and pharmaco-economic initiatives to assist in the reduction of health care costs. Exhibit Al shows the financial data for the 1996-1999 fiscal years and various financial ratios. (The financial ratios are shaded in the exhibit.) The company's fiscal year ends on September 30th. Since each rating agency uses slightly different inputs for the ratios it computes, we have included the ratio definitions used by S&P in Exhibit A2. The original corporate bond rating was BBB+. S&P reviewed the company's credit rating in December 1999. Based on the traditional financial ratio analysis, would you recommend ABC Corporation be upgraded, downgraded, or remain stable? And why? Be sure to discuss what could have happened to ABC.

Step by Step Solution

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Based on the provided financial data and selected ratios for ABC Corporation we can analyze the companys credit rating using traditional financial rat... View full answer

Get step-by-step solutions from verified subject matter experts