Question: Make a tax return form 1 0 4 0 use 2 0 2 4 tax rules [ The following information applies to the questions displayed

Make a tax return form use tax rules

The following information applies to the questions displayed below.

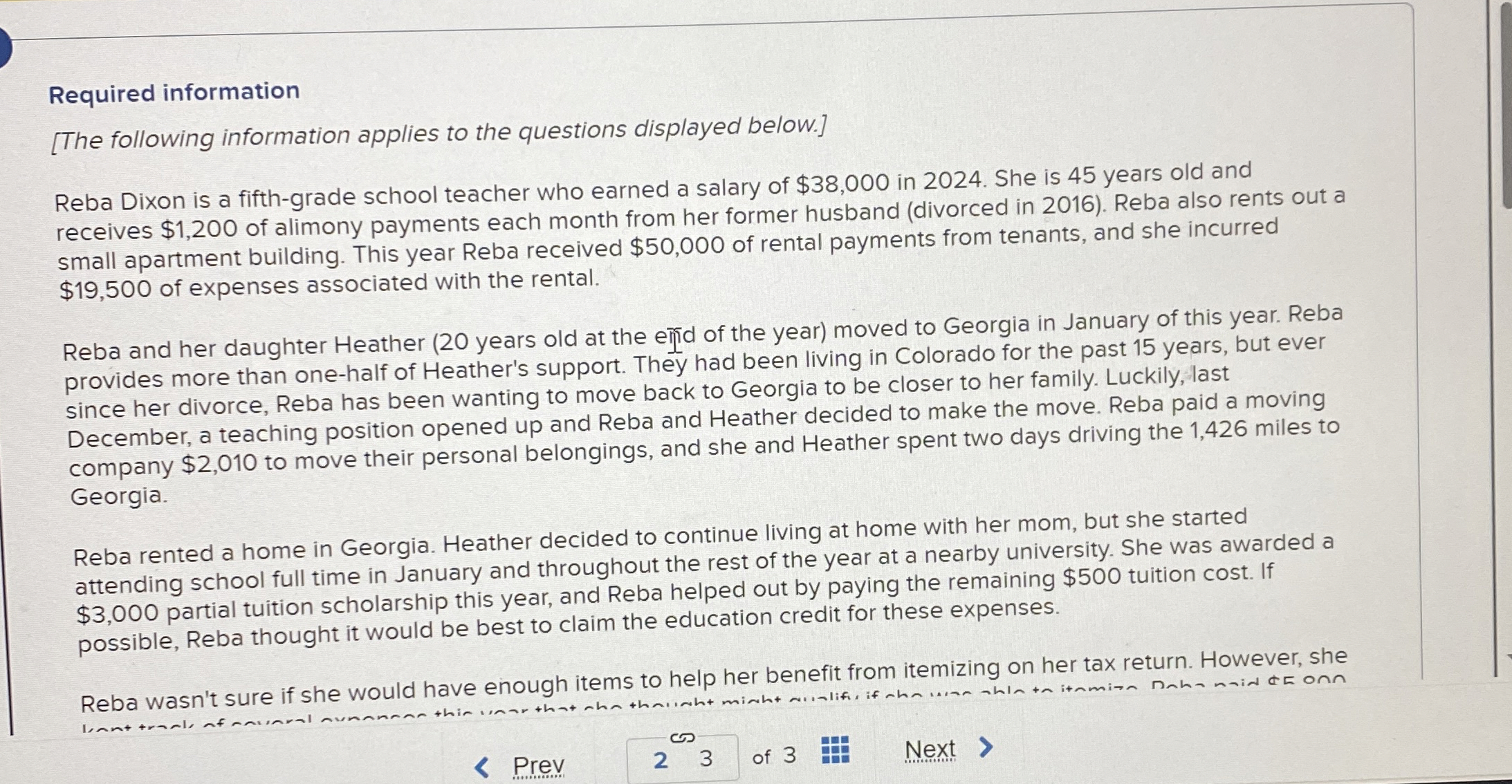

Reba Dixon is a fifthgrade school teacher who earned a salary of $ in She is years old and

receives $ of alimony payments each month from her former husband divorced in Reba also rents out a

small apartment building. This year Reba received $ of rental payments from tenants, and she incurred

$ of expenses associated with the rental.

Reba and her daughter Heather years old at the efid of the year moved to Georgia in January of this year. Reba

provides more than onehalf of Heather's support. They had been living in Colorado for the past years, but ever

since her divorce, Reba has been wanting to move back to Georgia to be closer to her family. Luckily, last

December, a teaching position opened up and Reba and Heather decided to make the move. Reba paid a moving

company $ to move their personal belongings, and she and Heather spent two days driving the miles to

Georgia.

Reba rented a home in Georgia. Heather decided to continue living at home with her mom, but she started

attending school full time in January and throughout the rest of the year at a nearby university. She was awarded a

$ partial tuition scholarship this year, and Reba helped out by paying the remaining $ tuition cost. If

possible, Reba thought it would be best to claim the education credit for these expenses.

Reba wasn't sure if she would have enough items to help her benefit from itemizing on her tax return. However, she

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock