Question: Make ajournal entries with given data TURN 1 Pentonville Road $120 house TURN 2 free space TURN 3 Marylebone Station $200 railroad TURN 4 Leicester

Make ajournal entries with given data

TURN 1

Pentonville Road $120 house

TURN 2

free space

TURN 3

Marylebone Station $200 railroad

TURN 4

Leicester Square $260 house

TURN 5

Liverpool St Station $200 railroad

TURN 6

Salary Revenue passing go $200

Old Kent Road $60 house

TURN 7

payThe angel, islington $6 rent expense

TURN 8

pass

TURN 9

Strand $220 house

TURN 10

pass

TURN 11

receive rent $22 Leicester Square

TURN 12

Park Lane $350 Buildings-Houses

TURN 13

passing go Salary Revenue $200

TURN 14

chance card, passing go Salary Revenue $200

Kings Cross Station $200 Buildings-Houses

TURN 15

free space

TURN 16

recive $8 Pentonville Road Buildings-Houses

Income tax refund $20

TURN 17

Fleet Street $220 Buildings-Houses

TURN 18

pay $26 rent Regent

TURN 19

Chance card collect go $200 Salary Revenue

pay $6 euston road

TURN 20

Electric Company $140

TURN 21

Bow Street $180 Buildings-Houses

TURN 22

pay $20 trafalgar sqaure

TURN 23

Recive $8 Pentonville Road

TURN 24

pay 26 regent street

TURN 25

recive $14 Bow Street

TURN26

Pay $100 tax

Ending balance $38 CASH

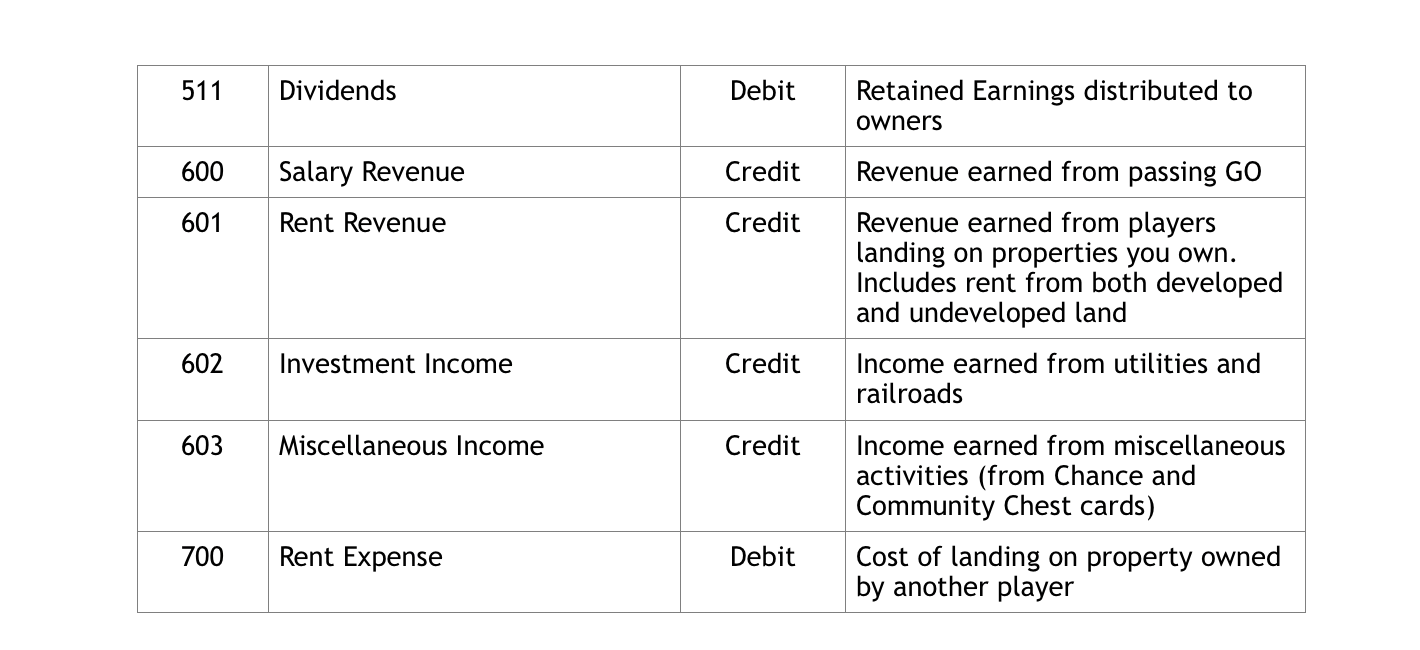

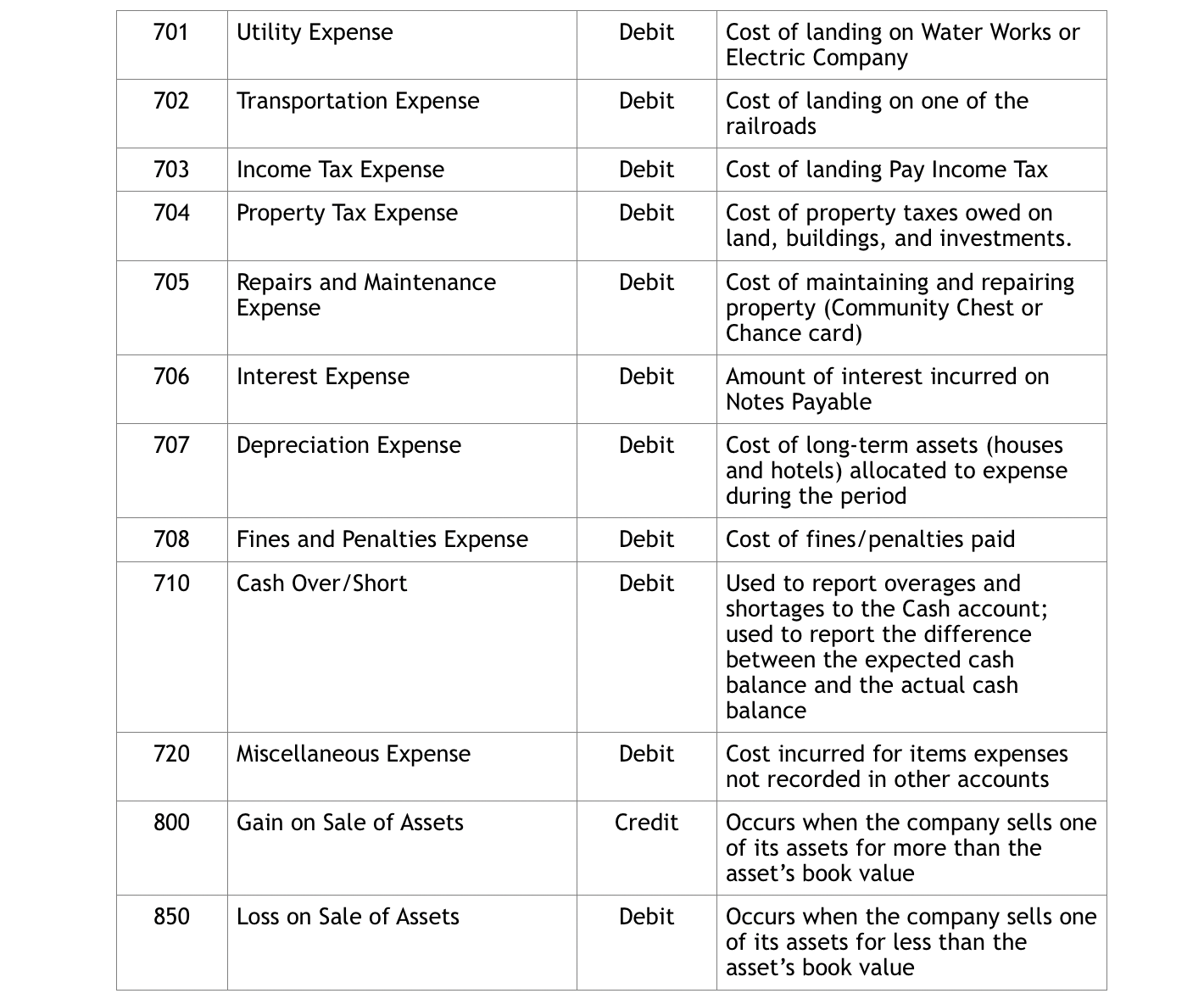

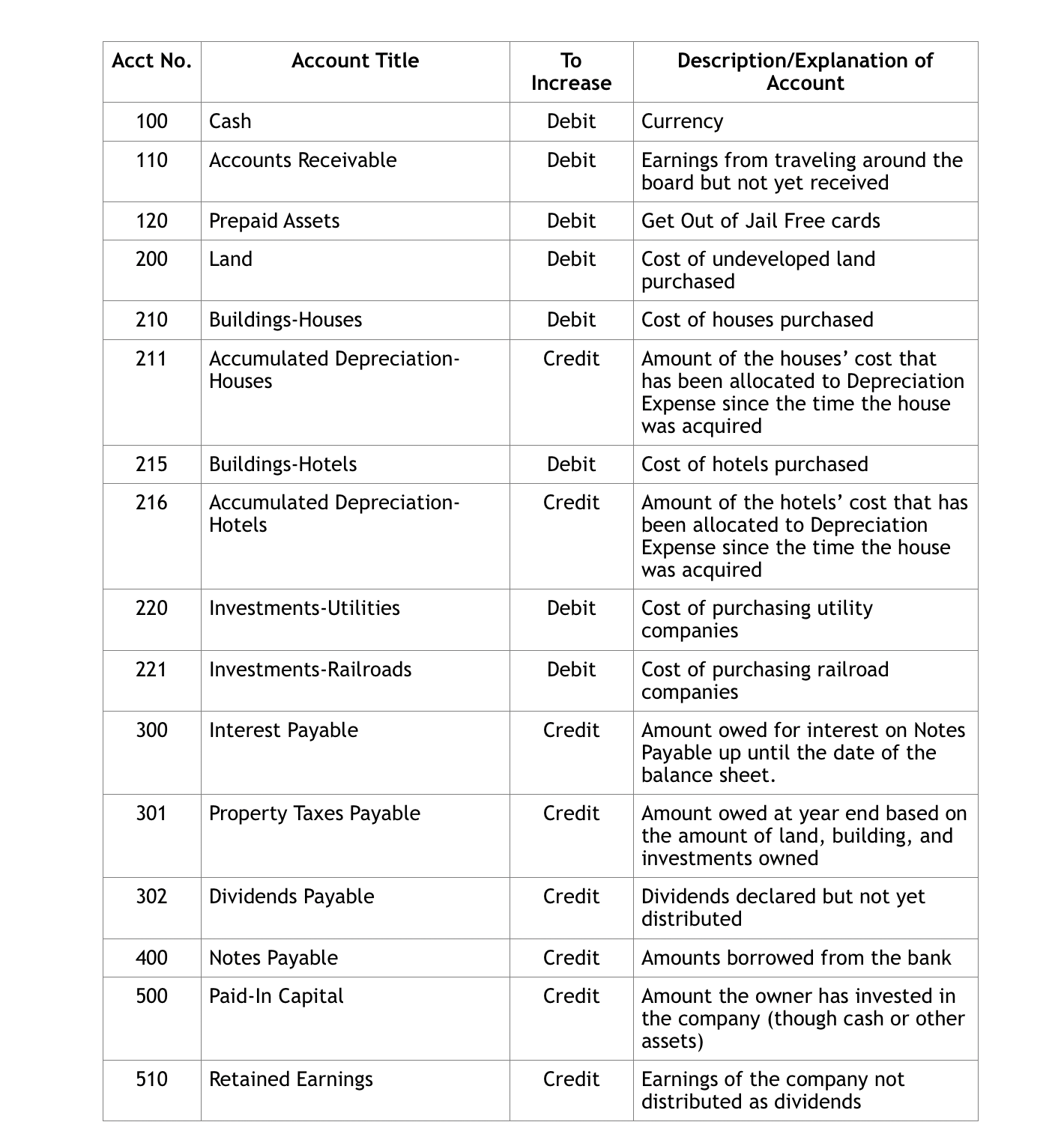

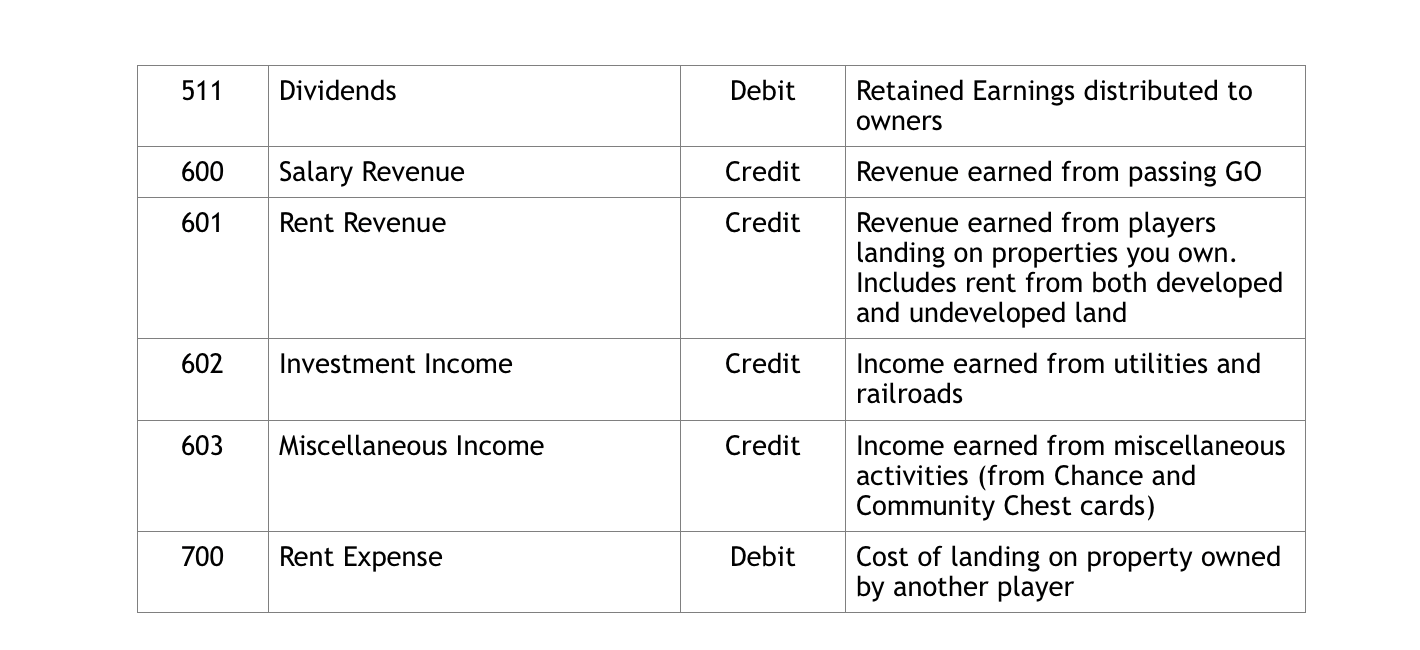

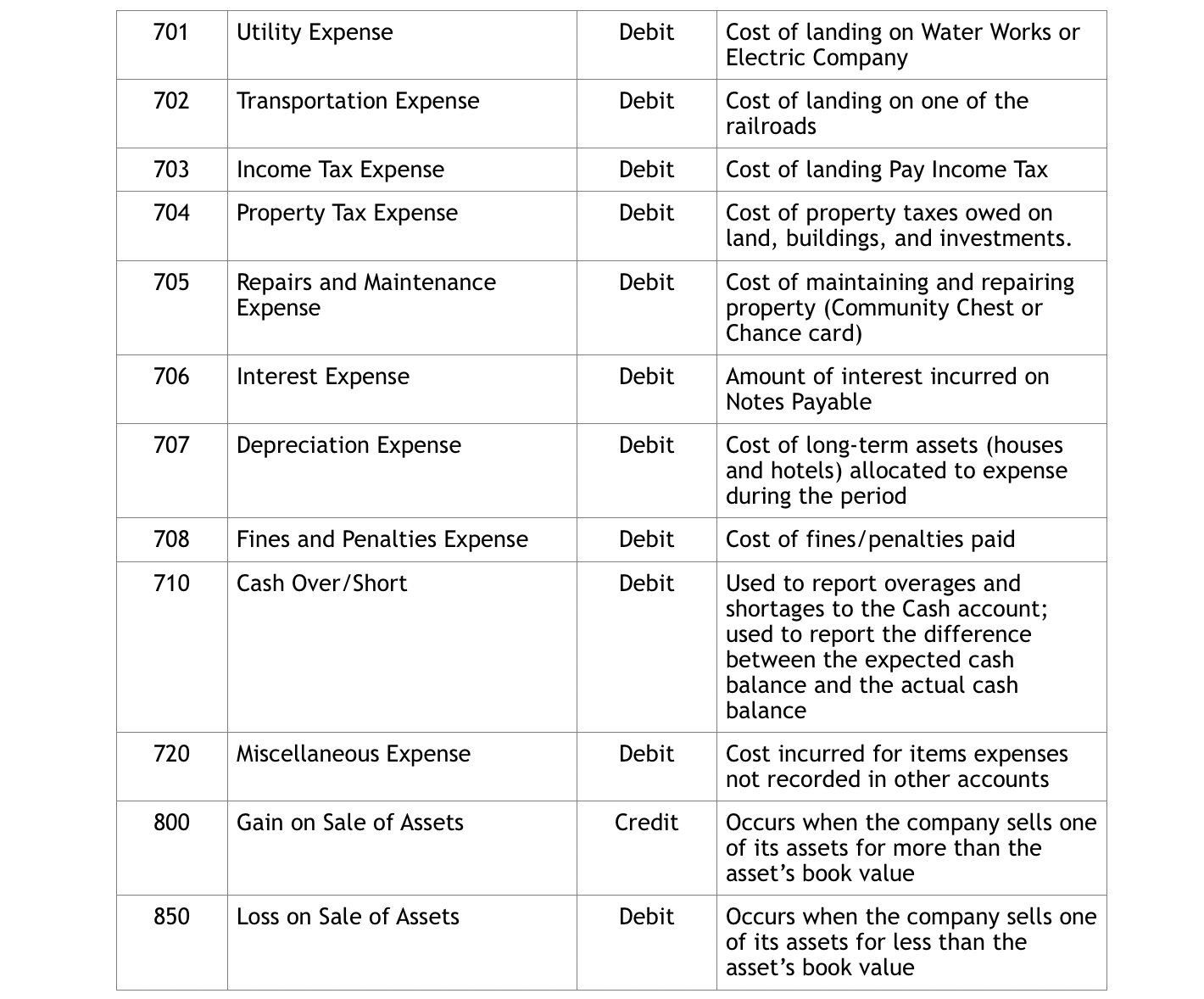

Acct No. Account Title To DescriptionlExplanation of Increase Account 100 Cash Debit Currency 110 Accounts Receivable Debit Earnings from traveling around the board but not yet received 120 Prepaid Assets Debit Get Out of Jail Free cards 200 Land Debit Cost of undeveloped land purchased 210 Buildings-Houses Debit Cost of houses purchased 211 Accumulated Depreciation- Credit Amount of the houses' cost that Houses has been allocated to Depreciation Expense since the time the house was acquired 215 Buildings-Hotels Debit Cost of hotels purchased 216 Accumulated Depreciation- Credit Amount of the hotels' cost that has Hotels been allocated to Depreciation Expense since the time the house was acquired 220 Investments-Utilities Debit Cost of purchasing utility companies 221 Investments-Railroads Debit Cost of purchasing railroad companies 300 Interest Payable Credit Amount owed for interest on Notes Payable up until the date of the balance sheet. 301 Property Taxes Payable Credit Amount owed at year end based on the amount of land, building, and investments owned 302 Dividends Payable Credit Dividends declared but not yet distributed 400 Notes Payable Credit Amounts borrowed from the bank 500 Paid-In Capital Credit Amount the owner has invested in the company (though cash or other assets) 510 Retained Earnings Credit Earnings of the company not distributed as dividends 511 Dividends Debit Retained Earnings distributed to owners 600 Salary Revenue Credit Revenue earned from passing GO 601 Rent Revenue Credit Revenue earned from players landing on properties you own. Includes rent from both developed and undeveloped land 602 Investment Income Credit Income earned from utilities and railroads 603 Miscellaneous Income Credit Income earned from miscellaneous activities (from Chance and Community Chest cards) 700 Rent Expense Debit Cost of landing on property owned by another player 701 Utility Expense Debit Cost of landing on Water Works or Electric Company 702 Transportation Expense Debit Cost of landing on one of the railroads 703 Income Tax Expense Debit Cost of landing Pay Income Tax 704 Property Tax Expense Debit Cost of property taxes owed on land, buildings, and investments. 705 Repairs and Maintenance Debit Cost of maintaining and repairing Expense property (Community Chest or Chance card) 706 Interest Expense Debit Amount of interest incurred on Notes Payable 707 Depreciation Expense Debit Cost of long-term assets (houses and hotels) allocated to expense during the period 708 Fines and Penalties Expense Debit Cost of fines/ penalties paid 710 Cash Over! Short Debit Used to report overages and shortages to the Cash account; used to report the difference between the expected cash balance and the actual cash balance 720 Miscellaneous Expense Debit Cost incurred for items expenses not recorded in other accounts 800 Gain on Sale of Assets Credit Occurs when the company sells one of its assets for more than the asset's book value 850 Loss on Sale of Assets Debit Occurs when the company sells one of its assets for less than the asset's book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts