Question: Make Bank Reconciliation Statement 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

Make Bank Reconciliation Statement

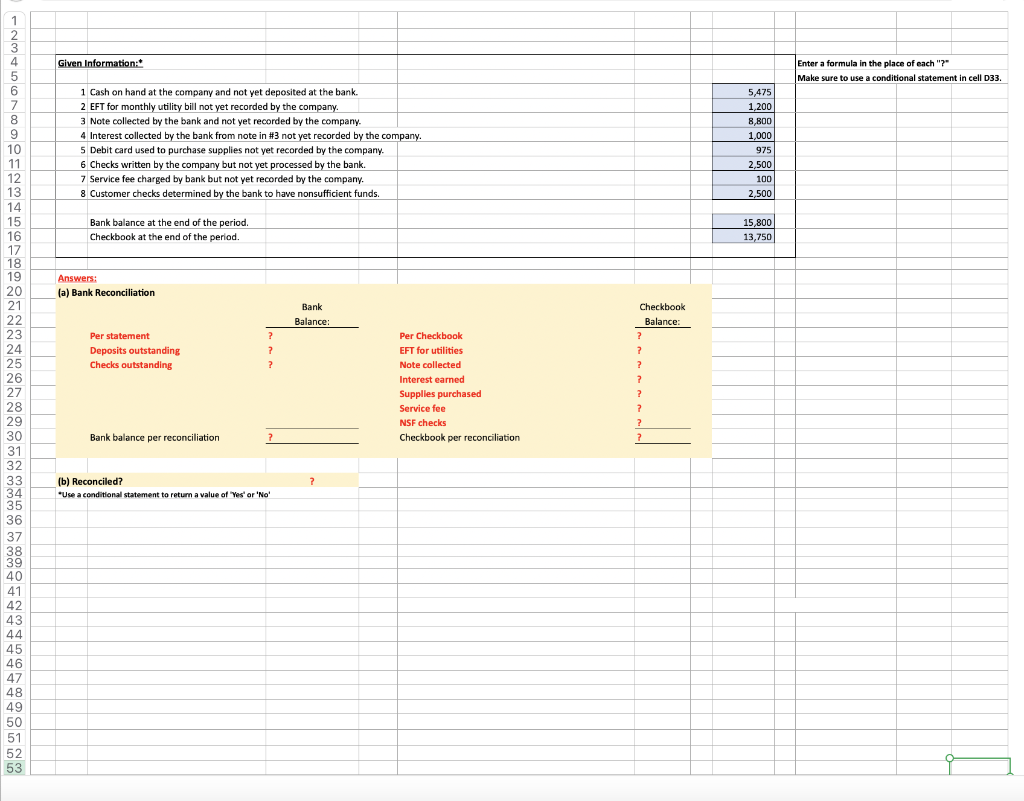

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 Given Information: 1 Cash on hand at the company and not yet deposited at the bank. 2 EFT for monthly utility bill not yet recorded by the company. 3 Note collected by the bank and not yet recorded by the company. 4 Interest collected by the bank from note in # 3 not yet recorded by the company. 5 Debit card used to purchase supplies not yet recorded by the company. 6 Checks written by the company but not yet processed by the bank. 7 Service fee charged by bank but not yet recorded by the company. 8 Customer checks determined by the bank to have nonsufficient funds. Bank balance at the end of the period. Checkbook at the end of the period. Answers: (a) Bank Reconciliation Per statement Deposits outstanding Checks outstanding Bank balance per reconciliation ? ? ? ? (b) Reconciled? *Use a conditional statement to return a value of 'Yes' or 'No' Bank Balance: ? Per Checkbook EFT for utilities Note collected Interest earned Supplies purchased Service fee NSF checks Checkbook per reconciliation Checkbook Balance: ? ? ? ? ? ? ? ? 5,475 1,200 8,800 1,000 975 2,500 100 2,500 15,800 13,750 Enter a formula in the place of each "?" Make sure to use a conditional statement in cell D33.

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Answer Deposits outstanding EFT for utilities 1200 needs to be subtracted from the checkbook balance ... View full answer

Get step-by-step solutions from verified subject matter experts