Question: MAKE CORRECTION IN CELL 10 AND QUESTION 2 FROM FINAL QUESTION! THANK YOU X Instructions During the year, Hepworth Company earned a net income of

MAKE CORRECTION IN CELL 10 AND QUESTION 2 FROM FINAL QUESTION! THANK YOU

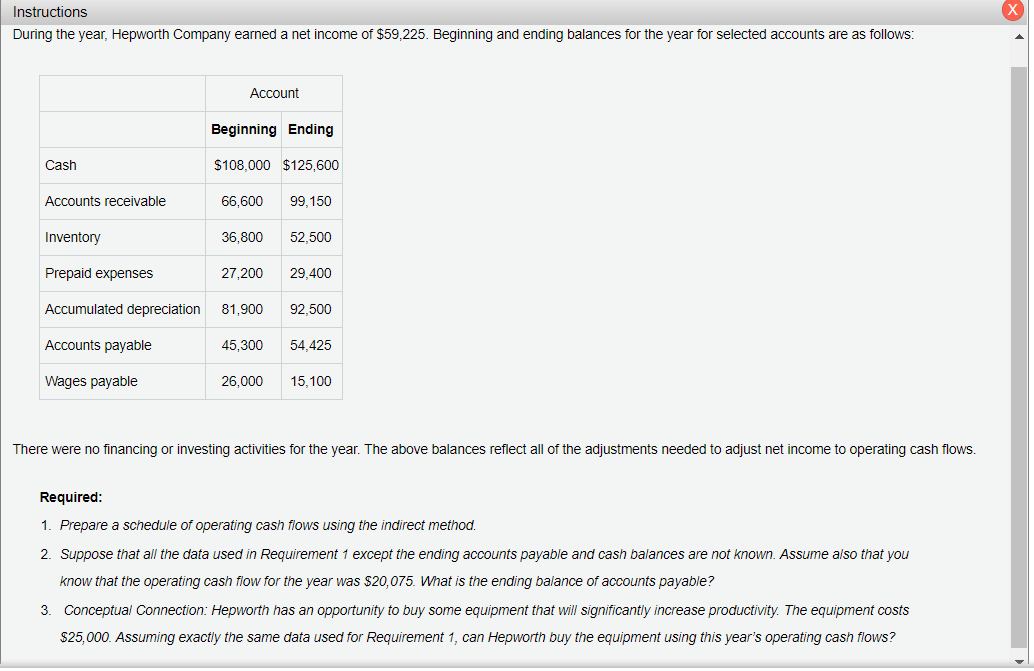

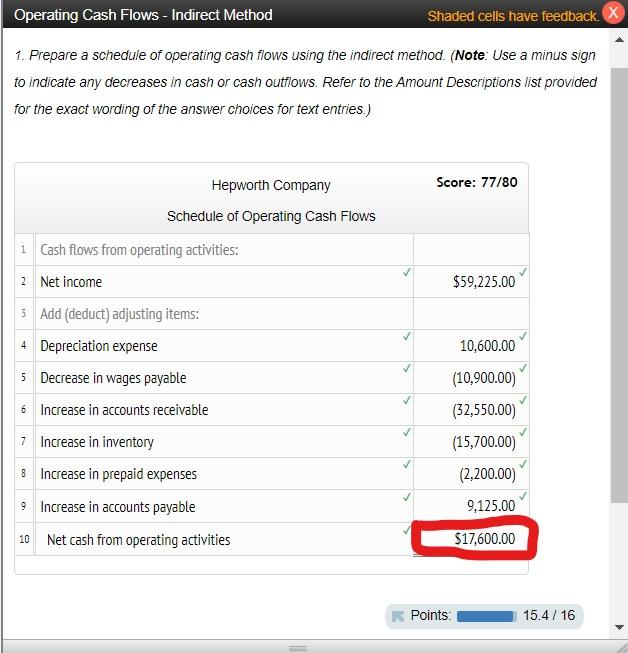

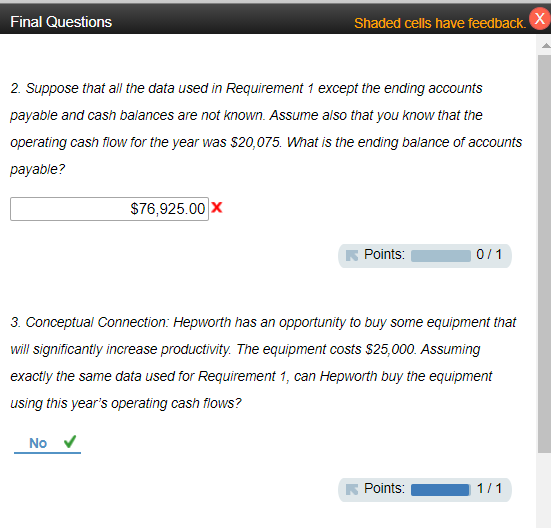

X Instructions During the year, Hepworth Company earned a net income of $59.225. Beginning and ending balances for the year for selected accounts are as follows: Account Beginning Ending Cash $108,000 $125,600 Accounts receivable 66,600 99,150 Inventory 36,800 52,500 Prepaid expenses 27,200 29,400 Accumulated depreciation 81,900 92,500 Accounts payable 45,300 54,425 Wages payable 26,000 15.100 There were no financing or investing activities for the year. The above balances reflect all of the adjustments needed to adjust net income to operating cash flows. Required: 1. Prepare a schedule of operating cash flows using the indirect method. 2. Suppose that all the data used in Requirement 1 except the ending accounts payable and cash balances are not known. Assume also that you know that the operating cash flow for the year was $20,075. What is the ending balance of accounts payable? 3. Conceptual Connection: Hepworth has an opportunity to buy some equipment that will significantly increase productivity. The equipment costs $25,000. Assuming exactly the same data used for Requirement 1, can Hepworth buy the equipment using this year's operating cash flows? Operating Cash Flows - Indirect Method Shaded cells have feedback. X 1. Prepare a schedule of operating cash flows using the indirect method. (Note: Use a minus sign to indicate any decreases in cash or cash outfiows. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.) Score: 77/80 Hepworth Company Schedule of Operating Cash Flows 1 Cash flows from operating activities: 2 Net income $59,225.00 10,600.00 3 Add (deduct) adjusting items: 4 Depreciation expense 5 Decrease in wages payable 6 Increase in accounts receivable 7 Increase in inventory (10,900.00) (32,550.00) (15,700.00) (2,200.00) 8 Increase in prepaid expenses 9,125.00 9 Increase in accounts payable 10 Net cash from operating activities $17,600.00 Points: 15.4 / 16 Final Questions Shaded cells have feedback. X 2. Suppose that all the data used in Requirement 1 except the ending accounts payable and cash balances are not known. Assume also that you know that the operating cash flow for the year was $20,075. What is the ending balance of accounts payable? $76,925.00 X Points: 0/1 3. Conceptual Connection: Hepworth has an opportunity to buy some equipment that will significantly increase productivity. The equipment costs $25,000. Assuming exactly the same data used for Requirement 1, can Hepworth buy the equipment using this year's operating cash flows? No Points: 1/1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts