Question: Make futures margin table similar to the class handout using oil futures spreadsheet Oil_CLZ19.xls. Suppose that initial margin is 4,275 USD and a maintenance margin

Make futures margin table similar to the class handout using oil futures spreadsheet Oil_CLZ19.xls. Suppose that initial margin is 4,275 USD and a maintenance margin 3,750 USD per contract. You sell short 2 contracts at the close on January 9, 2018 and buy back at the close on January 28, 2019. Oil futures point value is 1000$. When are the margin calls?

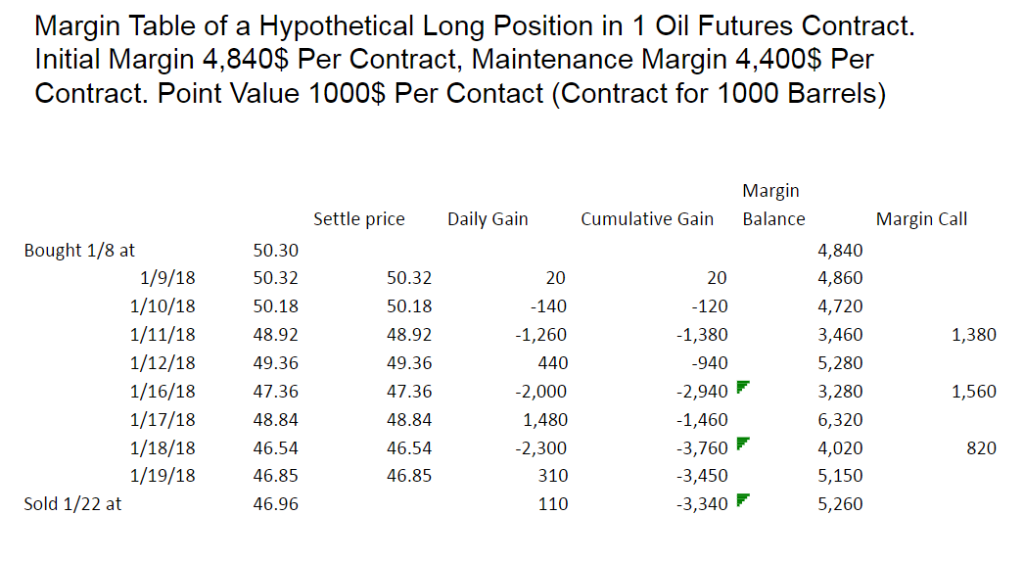

Margin Table of a Hypothetical Long Position in 1 Oil Futures Contract. Initial Margin 4,840$ Per Contract, Maintenance Margin 4,400$ Per Contract. Point Value 1000$ Per Contact (Contract for 1000 Barrels) Margin Cumulative Gain Balance Settle price Daly Gain Margin Call 50.30 50.32 50.18 48.92 49.36 47.36 48.84 46.54 46.85 46.96 4,840 4,860 4,720 3,460 5,280 3,280 6,320 4,020 5,150 5,260 Bought 1/8 at 1/9/18 1/10/18 50.32 50.18 48.92 49.36 47.36 48.84 46.54 46.85 20 140 1,260 440 2,000 1,480 2,300 310 110 20 -120 1,380 940 2,940 1,460 3,760 3,450 3,340 1,380 1,560 820 1/12/18 1/16/18 1/18/18 1/19/18 Sold 1/22 at Margin Table of a Hypothetical Long Position in 1 Oil Futures Contract. Initial Margin 4,840$ Per Contract, Maintenance Margin 4,400$ Per Contract. Point Value 1000$ Per Contact (Contract for 1000 Barrels) Margin Cumulative Gain Balance Settle price Daly Gain Margin Call 50.30 50.32 50.18 48.92 49.36 47.36 48.84 46.54 46.85 46.96 4,840 4,860 4,720 3,460 5,280 3,280 6,320 4,020 5,150 5,260 Bought 1/8 at 1/9/18 1/10/18 50.32 50.18 48.92 49.36 47.36 48.84 46.54 46.85 20 140 1,260 440 2,000 1,480 2,300 310 110 20 -120 1,380 940 2,940 1,460 3,760 3,450 3,340 1,380 1,560 820 1/12/18 1/16/18 1/18/18 1/19/18 Sold 1/22 at

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts