Question: make project report on all Case Study: Total Productive Maintenance Dowell Limited is a leading Entity in the Fabrication Industry, and supplies Rolling Stocks extensively

make project report on all

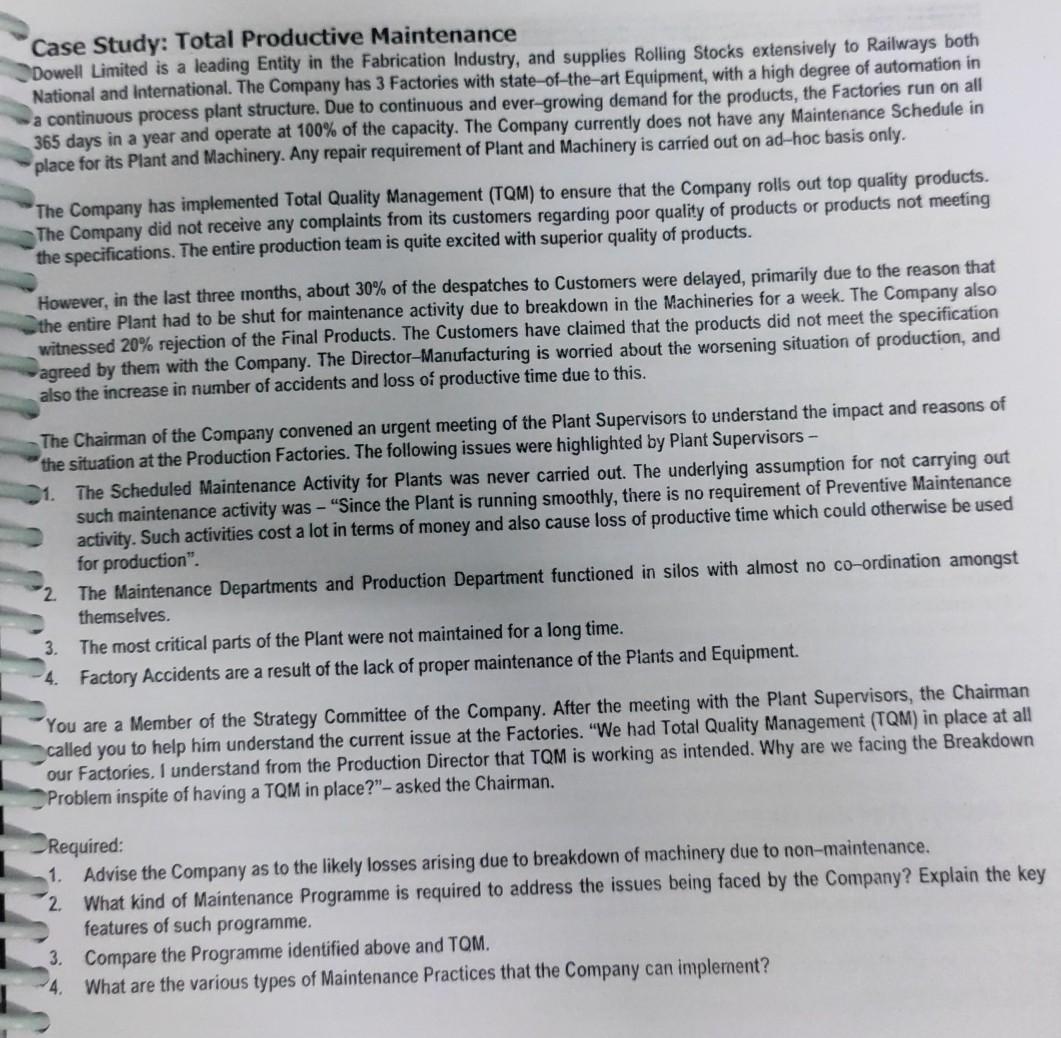

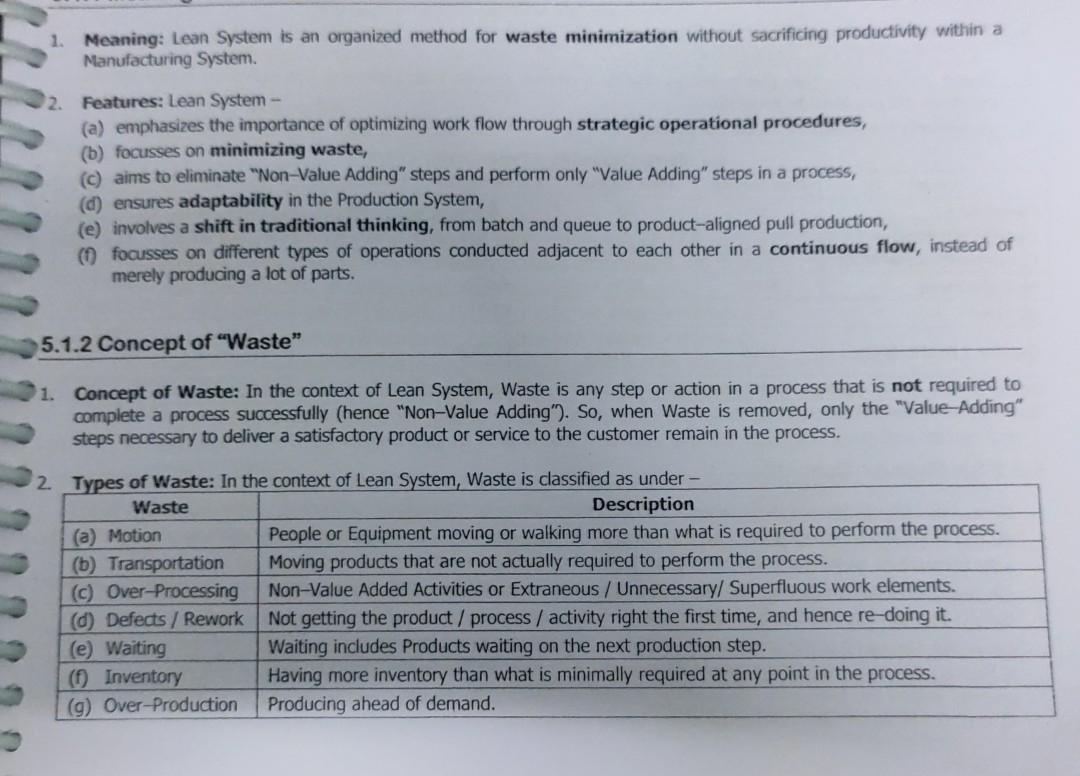

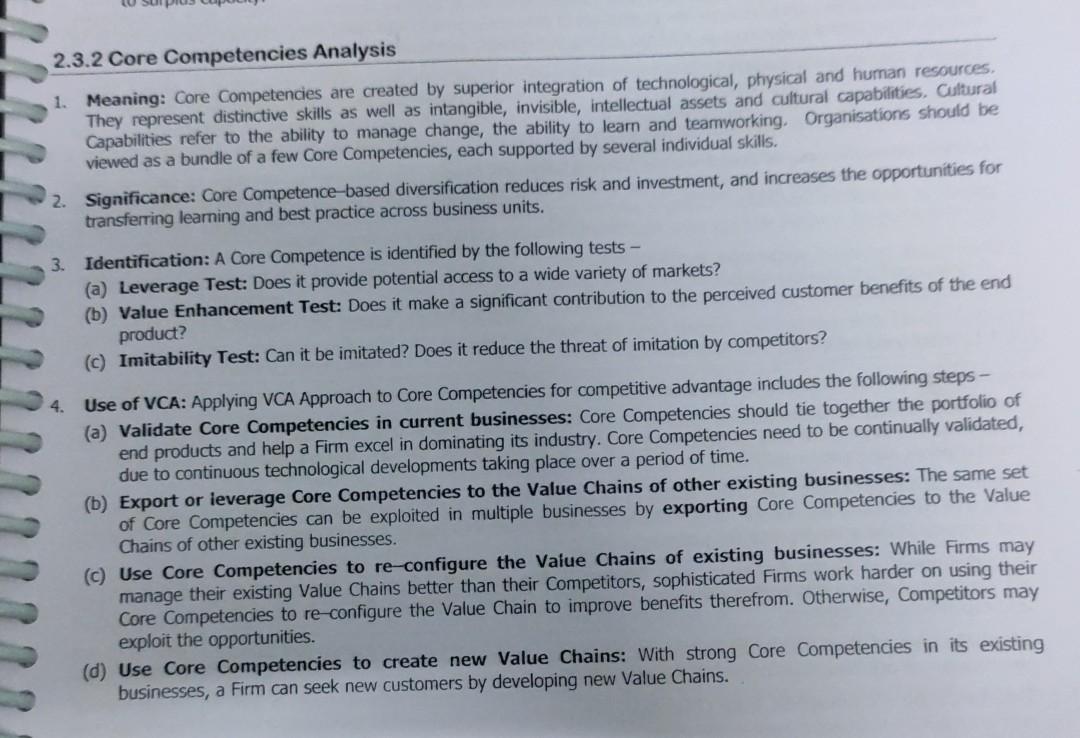

Case Study: Total Productive Maintenance Dowell Limited is a leading Entity in the Fabrication Industry, and supplies Rolling Stocks extensively to Railways both National and International. The Company has 3 Factories with state-of-the-art Equipment, with a high degree of automation in a continuous process plant structure. Due to continuous and ever-growing demand for the products, the Factories run on all 365 days in a year and operate at 100% of the capacity. The Company currently does not have any Maintenance Schedule in place for its Plant and Machinery. Any repair requirement of Plant and Machinery is carried out on ad-hoc basis only. The Company has implemented Total Quality Management (TQM) to ensure that the Company rolls out top quality products. The Company did not receive any complaints from its customers regarding poor quality of products or products not meeting the specifications. The entire production team is quite excited with superior quality of products. However, in the last three months, about 30% of the despatches to Customers were delayed, primarily due to the reason that the entire Plant had to be shut for maintenance activity due to breakdown in the Machineries for a week. The Company also witnessed 20% rejection of the Final Products. The Customers have claimed that the products did not meet the specification agreed by them with the Company. The Director-Manufacturing is worried about the worsening situation of production, and also the increase in number of accidents and loss of productive time due to this. The Chairman of the Company convened an urgent meeting of the Plant Supervisors to understand the impact and reasons of the situation at the Production Factories. The following issues were highlighted by Plant Supervisors - 1. The Scheduled Maintenance Activity for Plants was never carried out. The underlying assumption for not carrying out such maintenance activity was - "Since the plant is running smoothly, there is no requirement of Preventive Maintenance activity. Such activities cost a lot in terms of money and also cause loss of productive time which could otherwise be used for production". 2. The Maintenance Departments and Production Department functioned in silos with almost no co-ordination amongst themselves. 3. The most critical parts of the Plant were not maintained for a long time. 4. Factory Accidents are a result of the lack of proper maintenance of the plants and Equipment. You are a Member of the Strategy Committee of the Company. After the meeting with the Plant Supervisors, the Chairman called you to help him understand the current issue at the Factories. "We had Total Quality Management (TQM) in place at all our Factories, I understand from the Production Director that TQM is working as intended. Why are we facing the Breakdown Problem inspite of having a TQM in place?"- asked the Chairman. Required: 1. Advise the Company as to the likely losses arising due to breakdown of machinery due to non-maintenance. 2. What kind of Maintenance Programme is required to address the issues being faced by the Company? Explain the key features of such programme. 3. Compare the Programme identified above and TOM. 4. What are the various types of Maintenance Practices that the Company can implernent? 1 Meaning: Lean System is an organized method for waste minimization without sacrificing productivity within a Manufacturing System. 2. Features: Lean System - (a) emphasizes the importance of optimizing work flow through strategic operational procedures, (b) focusses on minimizing waste, (c) aims to eliminate "Non-Value Adding" steps and perform only "Value Adding" steps in a process, (d) ensures adaptability in the Production System, (e) involves a shift in traditional thinking, from batch and queue to product-aligned pull production, ( focusses on different types of operations conducted adjacent to each other in a continuous flow, instead of merely producing a lot of parts. 5.1.2 Concept of "Waste" 1. Concept of Waste: In the context of Lean System, Waste is any step or action in a process that is not required to complete a process successfully (hence "Non-Value Adding"). So, when Waste is removed, only the "Value-Adding" steps necessary to deliver a satisfactory product service to the customer remain in the process. 2 Types of Waste: In the context of Lean System, Waste is classified as under - Waste Description (a) Motion People or Equipment moving or walking more than what is required to perform the process. (b) Transportation Moving products that are not actually required to perform the process. (c) Over-Processing Non-Value Added Activities or Extraneous / Unnecessary/ Superfluous work elements. (d) Defects / Rework Not getting the product/process / activity right the first time, and hence re-doing it. (e) Waiting Waiting includes Products waiting on the next production step. () Inventory Having more inventory than what is minimally required at any point in the process. (9) Over-Production Producing ahead of demand. 2.3.2 Core Competencies Analysis 1. Meaning: Core Competencies are created by superior integration of technological, physical and human resources, They represent distinctive skills as well as intangible, invisible, intellectual assets and cultural capabilities. Cultural Capabilities refer to the ability to manage change, the ability to learn and teamworking. Organisations should be viewed as a bundle of a few Core Competencies, each supported by several individual skills. 2. Significance: Core Competence-based diversification reduces risk and investment, and increases the opportunities for transferring learning and best practice across business units. 3. Identification: A Core Competence is identified by the following tests - (a) Leverage Test: Does it provide potential access to a wide variety of markets? (b) Value Enhancement Test: Does it make a significant contribution to the perceived customer benefits of the end product? (C) Imitability Test: Can it be imitated? Does it reduce the threat of imitation by competitors? 4. Use of VCA: Applying VCA Approach to Core Competencies for competitive advantage includes the following steps (a) Validate Core Competencies in current businesses: Core Competencies should tie together the portfolio of end products and help a Firm excel in dominating its industry. Core Competencies need to be continually validated, due to continuous technological developments taking place over a period of time. (b) Export or leverage Core Competencies to the Value Chains of other existing businesses: The same set of Core Competencies can be exploited in multiple businesses by exporting Core Competencies to the Value Chains of other existing businesses. (C) Use Core Competencies to re-configure the Value Chains of existing businesses: While Firms may manage their existing Value Chains better than their Competitors, sophisticated Firms work harder on using their Core Competencies to re-configure the Value Chain to improve benefits therefrom. Otherwise, Competitors may exploit the opportunities. (d) Use Core Competencies to create new Value Chains: With strong Core Competencies in its existing businesses, a Firm can seek new customers by developing new Value Chains. 3. Determine the best sustainable differentiation, a Firm must determine what atti Firm's resources and skills, the more sustainable is its Differ 2.2.6 Vertical Linkage Analysis Vertical Linkage Analysis is a much broader application of Internal Cost and Differentiation Anal materials to the disposal and/or recycling of the product. It involves the following steps - upstream and downstream volue creating processes throughout the industry. It considers all links from the 1. Identity the Industry's Value Chain and assign Costs, Revenues and Assets to value-creating processes: (a) The Form should kdentify the Vertical Linkages in the industry Value Chain, e.g. the Petroleum Industry consists of (1) Casts, Revenues and Assets of each value creating process may be determined based on Relevant Cost approach, numerous vahe creating processes or activities, including exploration, production, refining, marketing and e of Market Priors, Transfer Prices, Current Replacement Cost of Assets, etc. The Information Systems to identify distribution, which defines is Value Chain and analyse these subtle relationships should be developed. 2. Diagnose the Cost Drivers for each value-creating process: Different Cost Determinants (Cost Drivers) should he Identified for each value-creating process. Direct labour based measures or Operating Hours or other suitable measure may be kentified, for each value creating process. 3. Evaluate the Opportunities for sustainable Competitive advantage: are unavailable or unreliable. (a) Using Benchmarking processes and by understanding how other Companies compete in each process of the industry Value Chain, a Firm can use the qualitative analysis to seek out competitive niches, even if financial data (b) To evaluate the opportunities for competitive advantage in the global marketplace, Firms should consider aspects like a country's values, political climate, environmental concerns, trade relations, tax laws, inflation rates and currency fluctuations 2.3 Strategic Framework of VCA Industry Structure, Core Competencies & Segmentation Analyses 2.3.1 Industry Structure Analysis It is a 5-factor model to organise information about an Industry Structure to evaluate its potential attractiveness. Under this model, the profitability of an industry or market (measured by the long-term ROI of the average Firm) depends largely on the following 5 factors that influence profitability. 1. Bargaining Power of Buyers: The degree of Buyer Power generally depends on - (a) Customer Concentration (higher concentration of customers means greater negotiation leverage), (b) Propensity for Customers to integrate backward (higher propensity for backward integration means greater bargaining leverage), (9) Costs of switching Suppliers (lower switching costs means greater leverage for the Buyer), and (d) Number of Alternative Suppliers (higher alternatives indicate greater customer leverage). 2 Bargaining Power of Suppliers: (a) Just as powerful Buyers can squeeze profits by putting downward pressure on prices, Suppliers squeeze profits by increasing input costs. The factors that determine Buyers Power (listed above) also determine the Suppliers Power. (b) The Bargaining Power of Suppliers and Buyers relative to the Firm depends on the relationships between their Value Chains. (c) Identifying the specific activities involved and the nature of their strengths and relationships can give important insights into the power balance between the Buyer and Seller, and how it may be altered for the Firm's benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts