Question: ! MAKE SURE IT IS RIGHT ON THE FIRST TRY BECAUSE I WILL DISLIKE IT IF NOT! THANKS! WE PAY FOR ACCURATE ANSWERS ! !

MAKE SURE IT IS RIGHT ON THE FIRST TRY BECAUSE I WILL DISLIKE IT IF NOT! THANKS! WE PAY FOR ACCURATE ANSWERS

Required information

The following information applies to the questions displayed below.

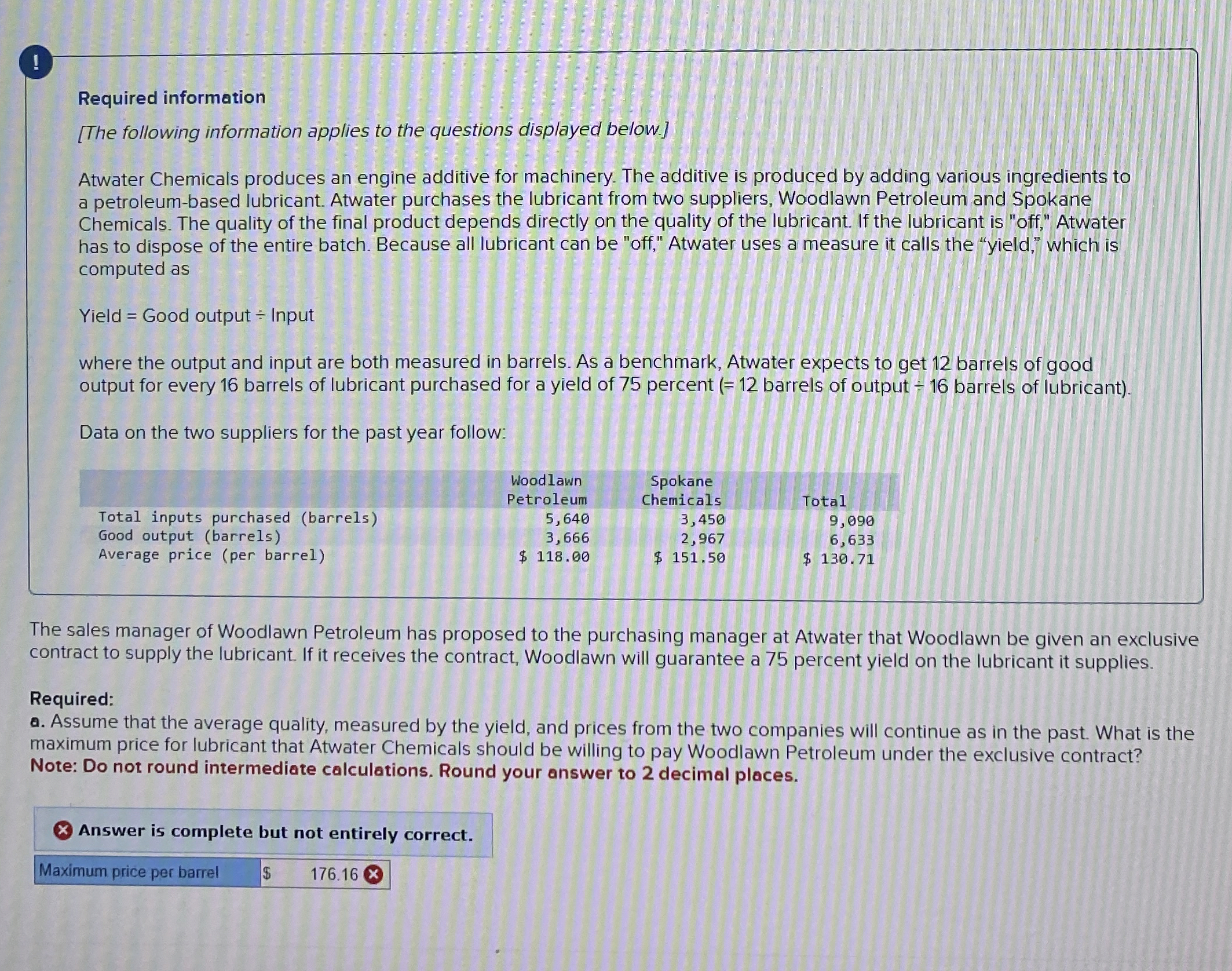

Atwater Chemicals produces an engine additive for machinery. The additive is produced by adding various ingredients to a petroleumbased lubricant. Atwater purchases the lubricant from two suppliers, Woodlawn Petroleum and Spokane Chemicals. The quality of the final product depends directly on the quality of the lubricant. If the lubricant is "off," Atwater has to dispose of the entire batch. Because all lubricant can be "off," Atwater uses a measure it calls the "yield," which is computed as

Yield Good output Input

where the output and input are both measured in barrels. As a benchmark, Atwater expects to get barrels of good output for every barrels of lubricant purchased for a yield of percent barrels of output barrels of lubricant

Data on the two suppliers for the past year follow:

tabletableWoodlawnPetroleumtableSpokaneChemicalsTotalTotal inputs purchased barrelsGood output barrelsAverage price per barrel$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock