Question: make sure they are both correct, I am only allowed one try, thank you Revenues generated by a new fad product are forecast as follows:

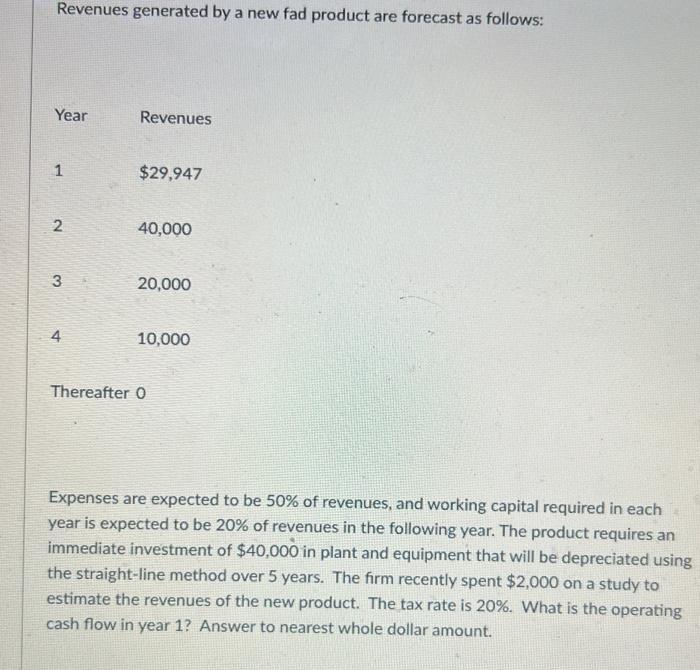

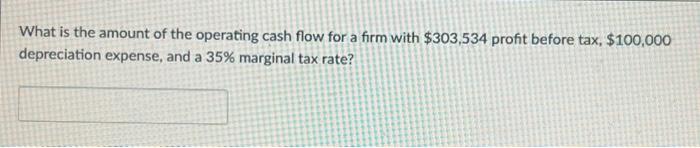

Revenues generated by a new fad product are forecast as follows: Thereafter 0 Expenses are expected to be 50% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $40,000 in plant and equipment that will be depreciated using the straight-line method over 5 years. The firm recently spent $2,000 on a study to estimate the revenues of the new product. The tax rate is 20%. What is the operating cash flow in year 1? Answer to nearest whole dollar amount. What is the amount of the operating cash flow for a firm with $303,534 profit before tax, $100,000 depreciation expense, and a 35% marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts