Question: make sure to answer fast and correcetly. 1st pic is just info that will help you with questions. Question 1 Not yet answered Points out

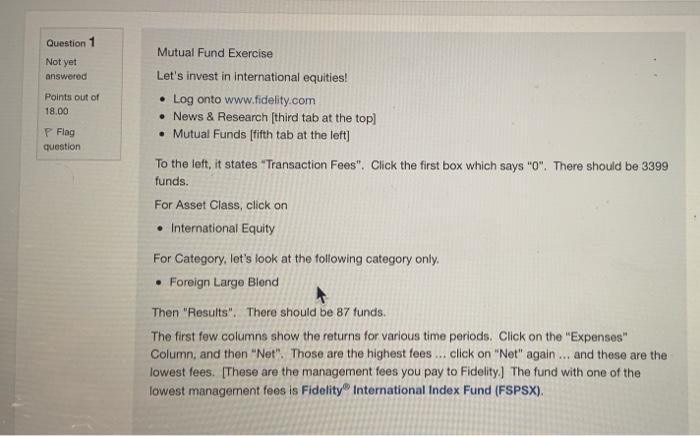

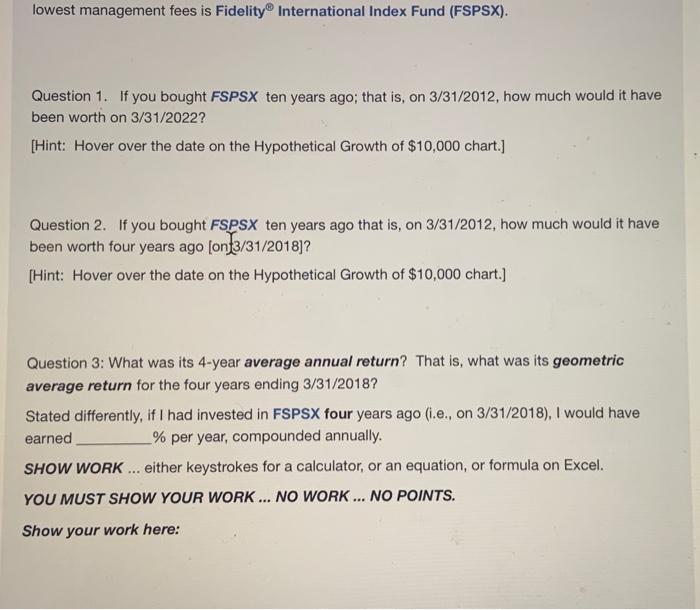

Question 1 Not yet answered Points out of 18.00 P Flag question Mutual Fund Exercise Let's invest in international equities! Log onto www.fidelity.com News & Research (third tab at the top] Mutual Funds (fifth tab at the left] To the left, it states "Transaction Fees". Click the first box which says "O". There should be 3399 funds. For Asset Class, click on International Equity For Category, let's look at the following category only Foreign Large Blend . Then "Results". There should be 87 funds. The first few columns show the returns for various time periods. Click on the "Expenses" Column, and then "Net". Those are the highest fees ... click on "Net" again... and these are the lowest fees. [These are the management fees you pay to Fidelity.) The fund with one of the lowest management fees is Fidelity International Index Fund (FSPSX). lowest management fees is Fidelity International Index Fund (FSPSX). Question 1. If you bought FSPSX ten years ago; that is, on 3/31/2012, how much would it have been worth on 3/31/2022? [Hint: Hover over the date on the Hypothetical Growth of $10,000 chart.] Question 2. If you bought FSPSX ten years ago that is, on 3/31/2012, how much would it have been worth four years ago [on|3/31/2018]? [Hint: Hover over the date on the Hypothetical Growth of $10,000 chart.) Question 3: What was its 4-year average annual return? That is, what was its geometric average return for the four years ending 3/31/2018? Stated differently, if I had invested in FSPSX four years ago (i.e., on 3/31/2018), I would have earned % per year, compounded annually. SHOW WORK ... either keystrokes for a calculator, or an equation, or formula on Excel. YOU MUST SHOW YOUR WORK ... NO WORK ... NO POINTS. Show your work here: Question 1 Not yet answered Points out of 18.00 P Flag question Mutual Fund Exercise Let's invest in international equities! Log onto www.fidelity.com News & Research (third tab at the top] Mutual Funds (fifth tab at the left] To the left, it states "Transaction Fees". Click the first box which says "O". There should be 3399 funds. For Asset Class, click on International Equity For Category, let's look at the following category only Foreign Large Blend . Then "Results". There should be 87 funds. The first few columns show the returns for various time periods. Click on the "Expenses" Column, and then "Net". Those are the highest fees ... click on "Net" again... and these are the lowest fees. [These are the management fees you pay to Fidelity.) The fund with one of the lowest management fees is Fidelity International Index Fund (FSPSX). lowest management fees is Fidelity International Index Fund (FSPSX). Question 1. If you bought FSPSX ten years ago; that is, on 3/31/2012, how much would it have been worth on 3/31/2022? [Hint: Hover over the date on the Hypothetical Growth of $10,000 chart.] Question 2. If you bought FSPSX ten years ago that is, on 3/31/2012, how much would it have been worth four years ago [on|3/31/2018]? [Hint: Hover over the date on the Hypothetical Growth of $10,000 chart.) Question 3: What was its 4-year average annual return? That is, what was its geometric average return for the four years ending 3/31/2018? Stated differently, if I had invested in FSPSX four years ago (i.e., on 3/31/2018), I would have earned % per year, compounded annually. SHOW WORK ... either keystrokes for a calculator, or an equation, or formula on Excel. YOU MUST SHOW YOUR WORK ... NO WORK ... NO POINTS. Show your work here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts