Question: make sure to have allocation rate clearly defined as a. and b. Rooney Company produces commercial gardening equipment. Since production is highly automated, the company

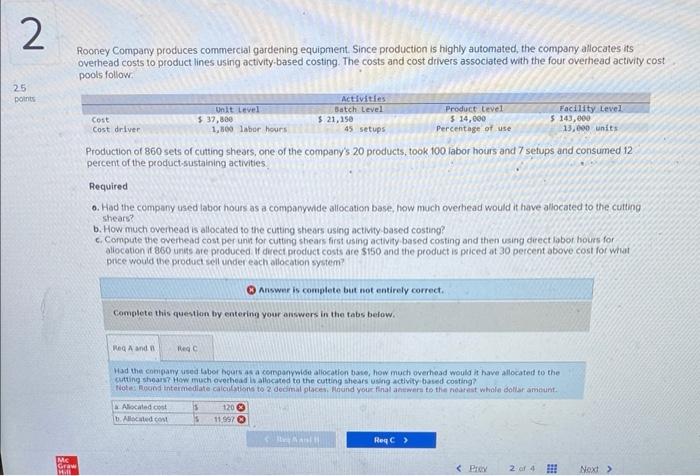

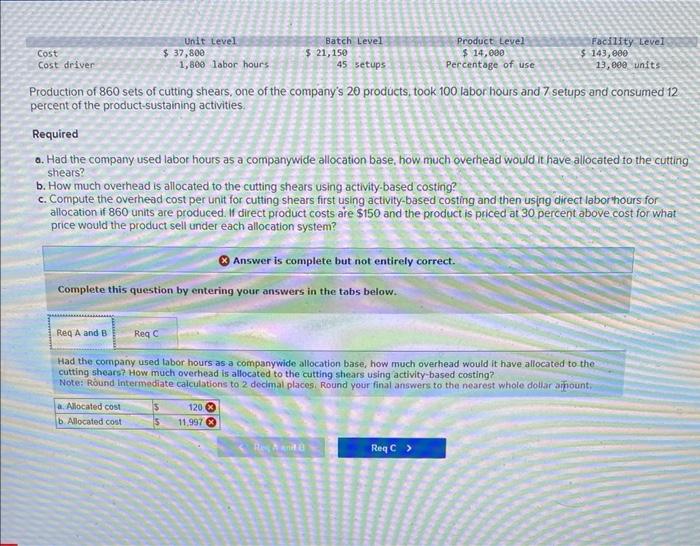

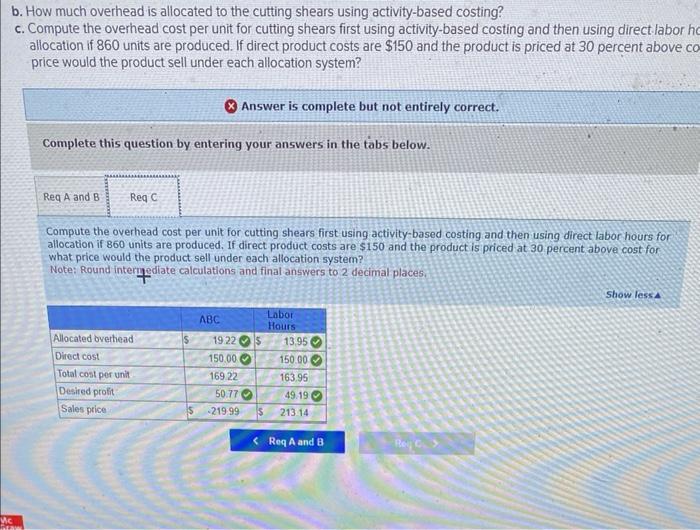

Rooney Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Production of 860 sets of cutting shears, one of the company's 20 products, took 100 labor hours and 7 setups and consumed 12 percent of the productsustaining activities. Required 0. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity based costing and then using direct labor houns for aliocation it 860 uniss are produced If diect product costs are $150 and the product is priced ot 30 percent above cost for whit price would the product sell under ech allocation system? Answne is complete but not entirely correct. Complete this question try entering your answers in the tabs below. Had the cobipany used wber hours as a compannmife allocation baic, how much overhead would it have allocated to the gutuing shoars How muct ovechoad lv allocated to the cutting shears uning a divity based costing? Production of 860 sets of cutting shears, one of the company's 20 products, took 100 labor hours and 7 setups and consumed 12 percent of the product-sustaining activities. Required a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct labor hours for allocation if 860 units are produced. If direct product costs are $150 and the product is priced at 30 percent above cost for what price would the product sell under each allocation system? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? How much overhead is allocated to the cutting shears using activity-based costing? Note: Round intermediate calculations to 2 decimal places. Round your final answers to the nearest whole dollar anhount: b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct/labor h allocation if 860 units are produced. If direct product costs are $150 and the product is priced at 30 percent above c price would the product sell under each allocation system? x Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct labor hours for allocation if 860 units are produced. If direct product costs are $150 and the product is priced at 30 percent above cost for what price would the product sell under each allocation system? Note: Round interyediate calculations and final answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts