Question: Make sure to show all calculation - as always, use Excel fu A friend of yours is considering buying or building a new home. Upon

Make sure to show all calculation as always, use Excel fu

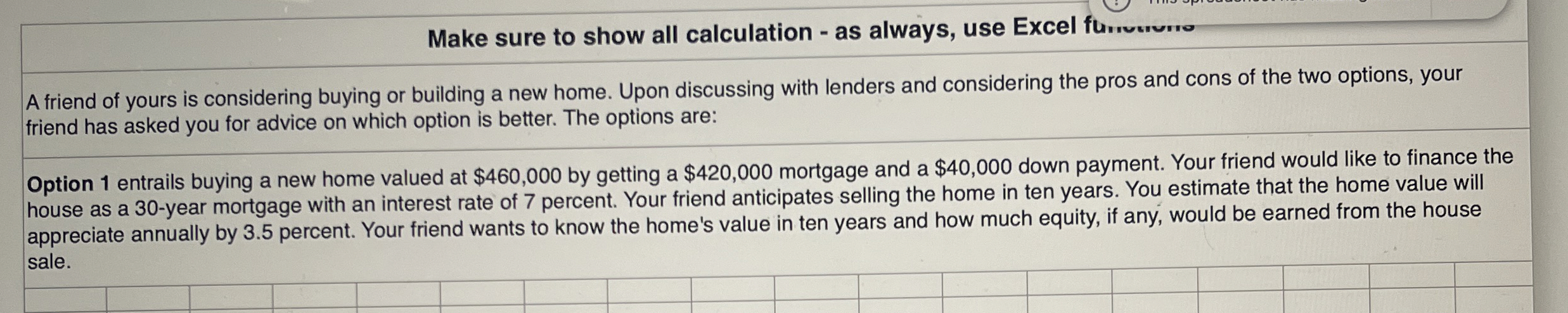

A friend of yours is considering buying or building a new home. Upon discussing with lenders and considering the pros and cons of the two options, your friend has asked you for advice on which option is better. The options are:

Option entrails buying a new home valued at $ by getting a $ mortgage and a $ down payment. Your friend would like to finance the house as a year mortgage with an interest rate of percent. Your friend anticipates selling the home in ten years. You estimate that the home value will appreciate annually by percent. Your friend wants to know the home's value in ten years and how much equity, if any, would be earned from the house sale.Make sure to show all calculation as always, use Excel fu

A friend of yours is considering buying or building a new home. Upon discussing with lenders and considering the pros and cons of the two options, your friend has asked you for advice on which option is better. The options are:

Option entrails buying a new home valued at $ by getting a $ mortgage and a $ down payment. Your friend would like to finance the house as a year mortgage with an interest rate of percent. Your friend anticipates selling the home in ten years. You estimate that the home value will appreciate annually by percent. Your friend wants to know the home's value in ten years and how much equity, if any, would be earned from the house sale.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock