Question: Make sure your answer is completely correct and accurate Imagine a firm with the first year FCF of $22M. You expect the FCFs to grow

Make sure your answer is completely correct and accurate

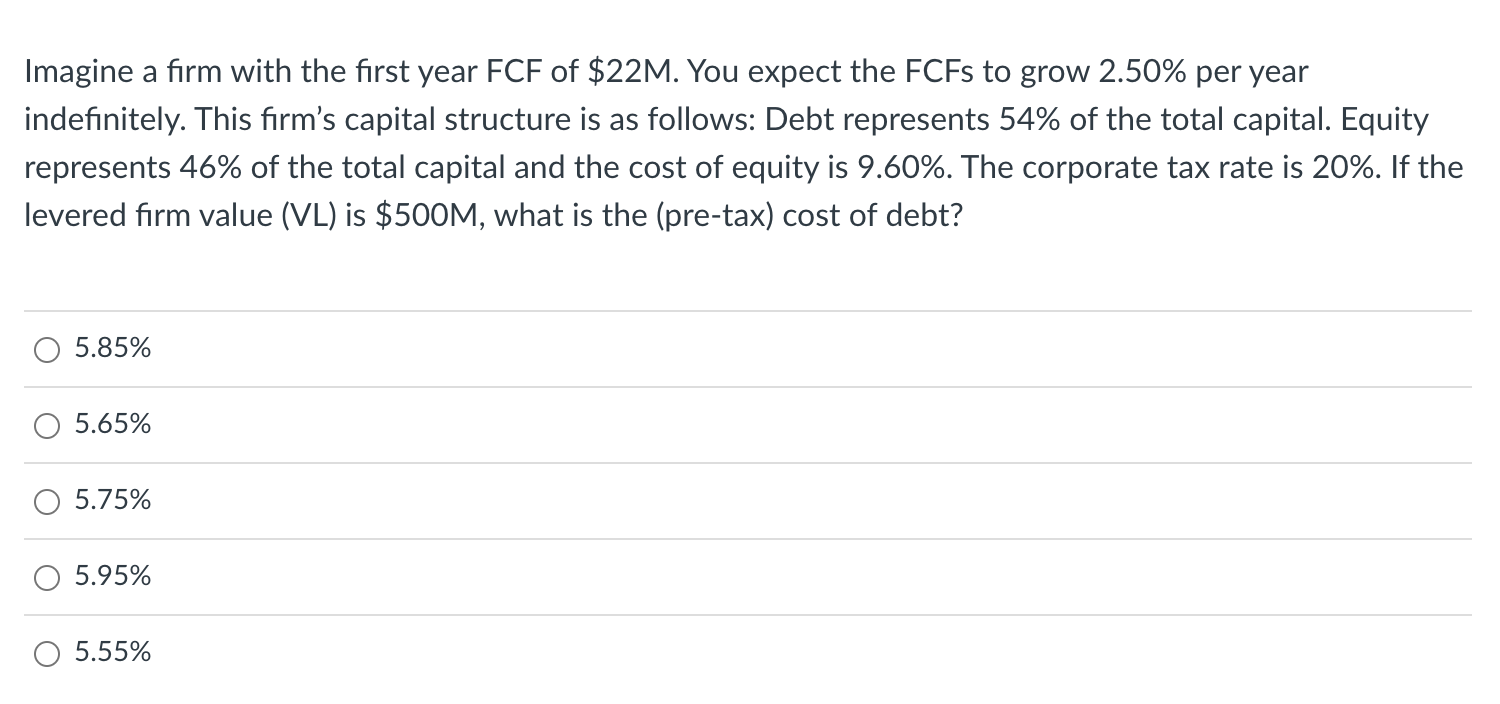

Imagine a firm with the first year FCF of $22M. You expect the FCFs to grow 2.50% per year indefinitely. This firm's capital structure is as follows: Debt represents 54% of the total capital. Equity represents 46% of the total capital and the cost of equity is 9.60%. The corporate tax rate is 20%. If the levered firm value (VL) is $500M, what is the (pre-tax) cost of debt? \begin{tabular}{l} 5.85% \\ \hline 5.65% \\ \hline 5.75% \\ \hline 5.95% \\ \hline 5.55% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts