Question: make the answers clear show section a alone and section b alone and c, d Q5. (CLO3) All techniques with NPV profile - Mutually exclusive

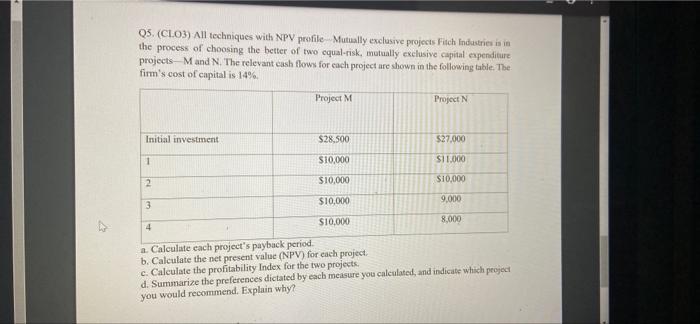

Q5. (CLO3) All techniques with NPV profile - Mutually exclusive projects Fitch Industries is in the process of choosing the better of two equal-risk, mutually exclusive capital expenditure projects M and N. The relevant cash flows for each project are shown in the following table. The firm's cost of capital is 14%. Project M Project N Initial investment $28,500 $27,000 1 $10,000 $11,000 2 $10,000 $10,000 3 $10,000 9,000 4 $10,000 8,000 a. Calculate each project's payback period. b. Calculate the net present value (NPV) for each project. c. Calculate the profitability Index for the two projects. d. Summarize the preferences dictated by each measure you calculated, and indicate which project you would recommend. Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts