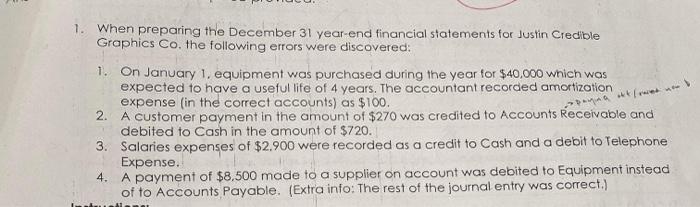

Question: make the correcting entry Q free 1. When preparing the December 31 year-end financial statements for Justin Credible Graphics Co. the following errors were discovered:

Q free 1. When preparing the December 31 year-end financial statements for Justin Credible Graphics Co. the following errors were discovered: 1. On January 1, equipment was purchased during the year for $40,000 which was expected to have a useful life of 4 years. The accountant recorded amortization expense (in the correct accounts) as $100. 2. A customer payment in the amount of $270 was credited to Accounts Receivable and debited to Cash in the amount of $720. 3. Salaries expenses of $2,900 were recorded as a credit to Cash and a debit to Telephone Expense. 4. A payment of $8.500 made to a supplier on account was debited to Equipment instead of to Accounts Payable. (Extra info: The rest of the journal entry was correct.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts