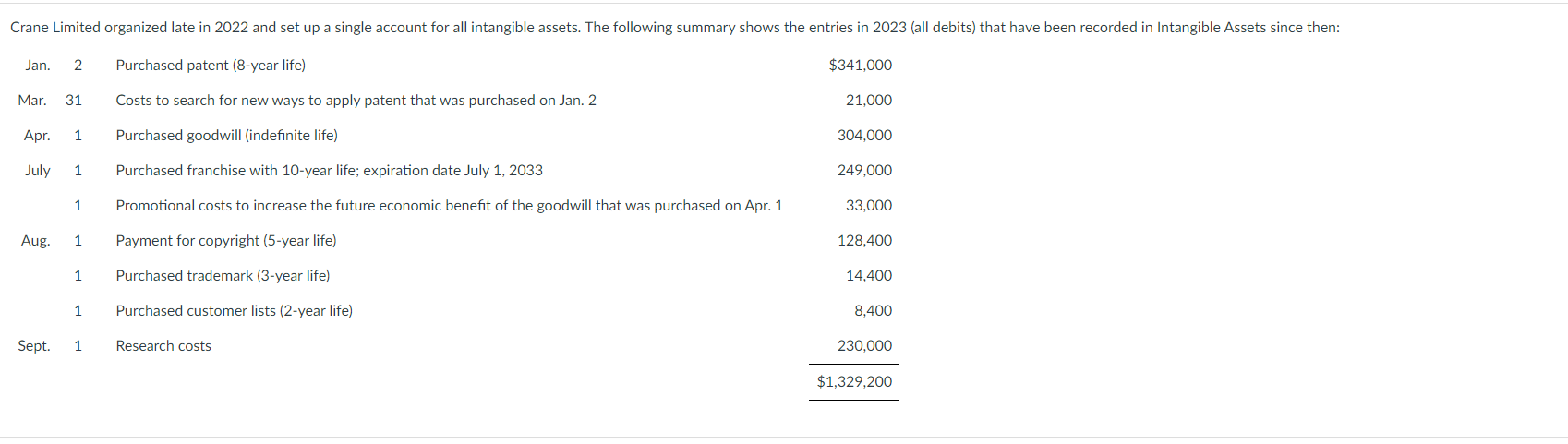

Question: Make the entry as at December 31, 2023, for any necessary amortization so that all balances are accurate as at that date. Crane Limited organized

Make the entry as at December 31, 2023, for any necessary amortization so that all balances are accurate as at that date.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock