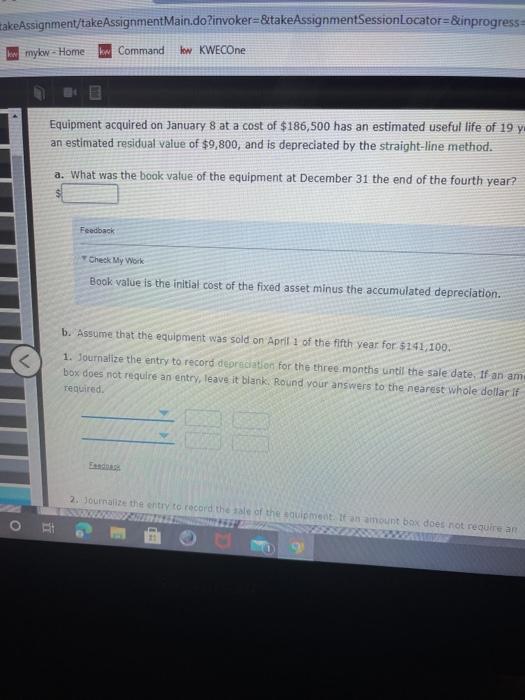

Question: makeAssignment/take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress= mykw - Home kw Command low KWECOne Equipment acquired on January 8 at a cost of $186,500 has an estimated useful life of

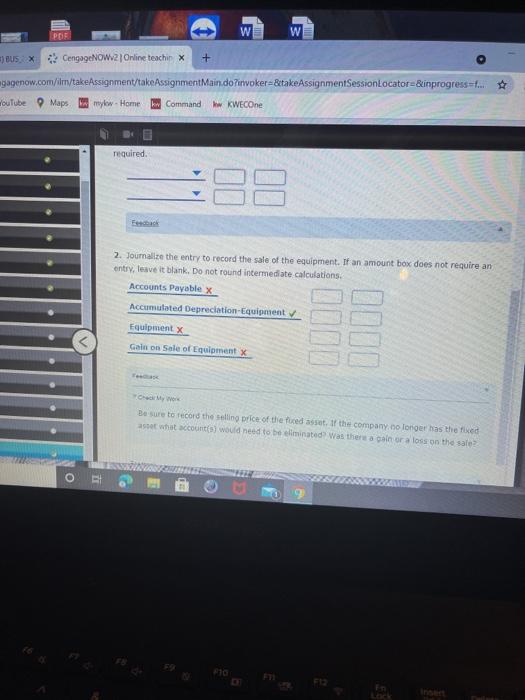

makeAssignment/take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress= mykw - Home kw Command low KWECOne Equipment acquired on January 8 at a cost of $186,500 has an estimated useful life of 19. y an estimated residual value of $9,800, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year? Feedback Check My Work Book value is the initial cost of the fixed asset minus the accumulated depreciation. b. Assume that the equipment was sold on April 1 of the fifth year for $241,100. 1. Journalize the entry to record depreciation for the three months until the sale date. If an am box does not require an entry, leave it blank. Round your answers to the nearest whole dollar if required 2. Journalist the entry to record the role of the soul ment. It an amount box does not require an 10 POE W W Busx CengageNOW2 Online teachin X + gagenow.com/ilm/takeAssignment/takeAssignment Main.do?invokera&takeAssignmentSessionLocator=&inprogress=f.. ouTube Maps Amylow. Home Command w KWECOne required. 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations Accounts Payable x Accumulated Depreciation Equipment Equipment Galon Sale of Equipment x Be sure to record the selling price of the fue asset. If the company no longer has the face as what account) would need to be minated was there a pain or a loss on the sale OP E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts