Question: Making changes to a firm's credit policy involves trade-offs. Assuming that all other factors remain constant, which of the following are outcomes expected to result

Making changes to a firm's credit policy involves trade-offs. Assuming that all other factors remain constant, which of the following are outcomes expected to result from an increase in a firm's cash discount? Check all that apply.

A. An increase in the firm's credit sales, a speeding up of customer payments, and a reduction in the firm's receivables investment

B. An increase in the creditworthiness of the firm's customers

C. A decrease in the creditworthiness of the firm's customers

D. An increase in the cost of the discounts given

Virginia Hydroponics Company (VHC), a wholesaler of seeds and plant nursery products, currently sells on terms of net 45 to its customers but is experiencing a days sales outstanding (DSO) of 105 days. In an effort to reduce this delay, VHC's management is considering implementing its first cash discount. The revised credit terms, 1/25 net 45, are expected to reduce its DSO to 75 days. VHC expects 12% of its customers to take the discount, but it does not expect its inventory level to change as a result of the policy change.

VHC has annual sales of $2,500,000 and incurs variable costs of 65%. Sales and the level of variable costs are not expected to change with the alteration in credit policy. VHC wants to earn a pretax return of 12% on its receivables investment. Given this data, answer the following questions. (Note: Use 365 days as the length of a year. Do not round intermediate calculations. Round all final answers to the nearest dollar.)

A. What is the expected incremental change in VHC's average receivables balance? ___226027/154109/206479___?

B. How much cost savings is generated by the reduction in the receivables investment? ___24657/27123/18493___?

C. How much in cash discounts will be sacrificed by VHC? __2250/3000/3300_____?

D. What is the net change in VHC's pretax earnings? ___23823/16243/21657_____?

E. Should the company make the change to its credit policy? _______?

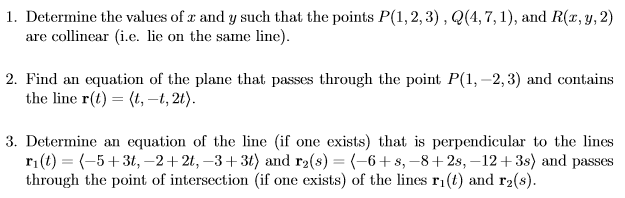

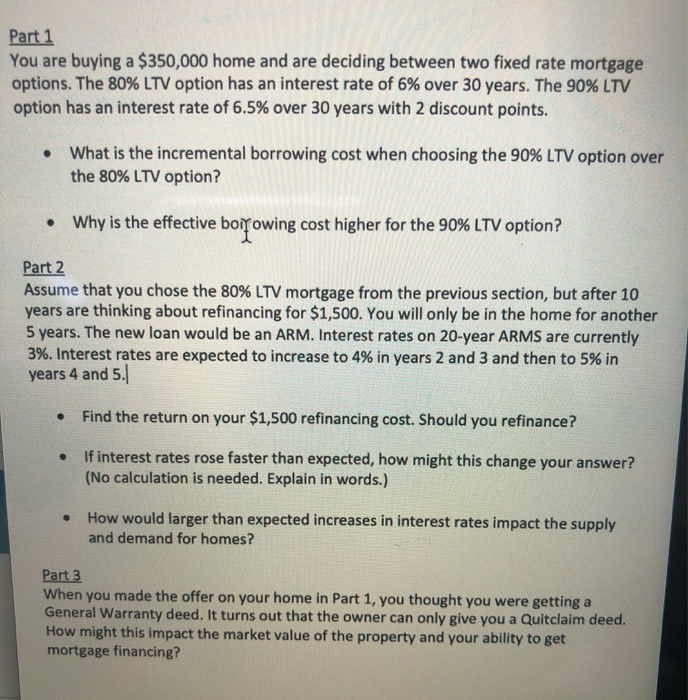

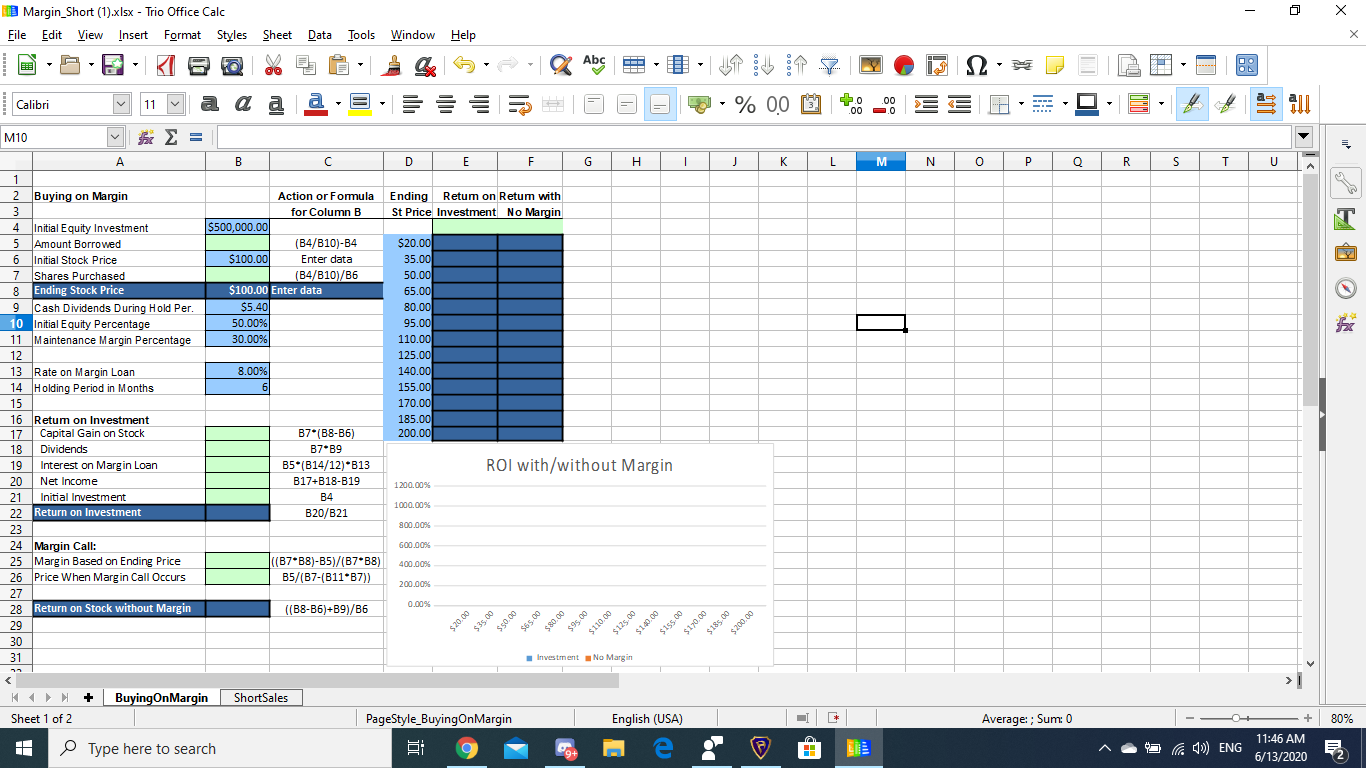

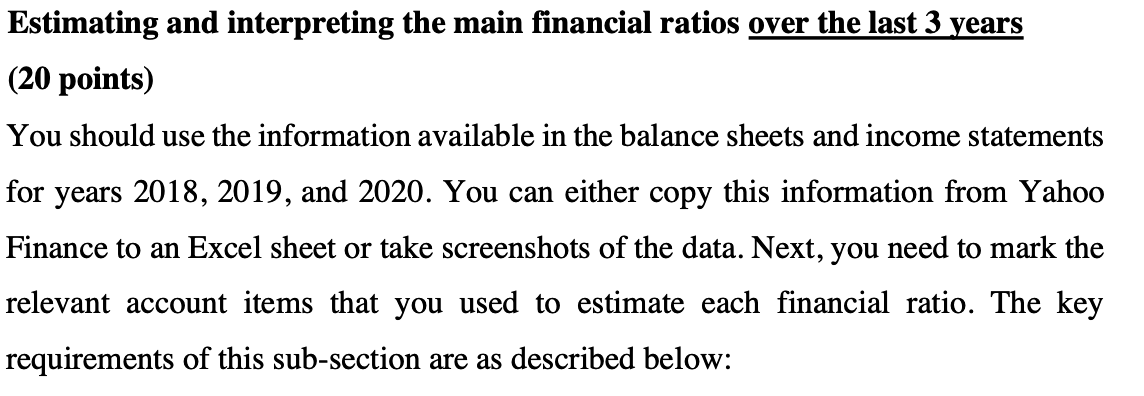

1. Determine the values else and 1; such that the points 1311,13}, QH, 7, 1}, and R[1:, y, 2} are collinear (Le. lie on the same line). 2. Find an equation of the plane that paeeee through the point P( 1, 2, 3) and contains the line 1'13} = {t1 t12t}. 3+ Determine an equation of the line (if one exiata} that is perpendicular to the lines r16.) = {5 + 3t, 2 + 2t, 3 + 3t} and rate} = {6 + a, 3 + 23, 12 + 33} and passes through the point of intersection (if one exists} of the lines r1(t} and [e]. Part 1 You are buying a $350,000 home and are deciding between two fixed rate mortgage options. The 80% LTV option has an interest rate of 6% over 30 years. The 90% LTV option has an interest rate of 6.5% over 30 years with 2 discount points. . What is the incremental borrowing cost when choosing the 90% LTV option over the 80% LTV option? . Why is the effective borrowing cost higher for the 90% LTV option? Part 2 Assume that you chose the 80% LTV mortgage from the previous section, but after 10 years are thinking about refinancing for $1,500. You will only be in the home for another 5 years. The new loan would be an ARM. Interest rates on 20-year ARMS are currently 3%. Interest rates are expected to increase to 4% in years 2 and 3 and then to 5% in years 4 and 5.| Find the return on your $1,500 refinancing cost. Should you refinance? . If interest rates rose faster than expected, how might this change your answer? (No calculation is needed. Explain in words.) . How would larger than expected increases in interest rates impact the supply and demand for homes? Part 3 When you made the offer on your home in Part 1, you thought you were getting a General Warranty deed. It turns out that the owner can only give you a Quitclaim deed. How might this impact the market value of the property and your ability to get mortgage financing?Margin_Short (1).xlsx - Trio Office Calc X File Edit View Insert Format Styles Sheet Data Tools Window Help X is Calibri 11 ~ ~ % 00 .00 1 -.0 M10 A B C D E F G H I J K L M N 0 P Q R S T U 1 2 Buying on Margin Action or Formula Ending Retum on Return with 3 for Column B St Price Investment No Margin 4 Initial Equity Investment $500,000.00 5 Amount Borrowed (B4/B10)-B4 $20.00 6 Initial Stock Price $100.00 Enter data 35.00 7 Shares Purchase B4/B10)/B6 50.00 8 Ending Stock Price $100.00 Enter data 65.00 9 Cash Dividends During Hold Per. $5.40 80.00 10 Initial Equity Percentage 50.00% 95.00 11 Maintenance Margin Percentage 30.00% 110.00 12 125.00 13 Rate on Margin Loan 8.00% 140.00 14 Holding Period in Months 155.00 15 170.00 16 Retum on Investment 185.00 17 Capital Gain on Stock 87*(B8-B6) 200.00 18 Dividends 19 Interest on Margin Loan B5*(B14/12)*B13 ROI with/without Margin 20 Net Income B17+B18-B19 1200.00%% 21 Initial Investment BA 1000.00% 22 Return on Investment B20/B21 23 800.00% 24 Margin Call: 600.00%% 25 Margin Based on Ending Price (87*B8)-85)/(B7*68) 100.0 0%% 26 Price When Margin Call Occurs B5/(87-(B11*87)) 200.00% 27 28 Return on Stock without Margin ((B8-86)+89)/B6 0.00% 29 $ 20.0 $35.00 S$0,00 $ 80.0 S95.0 $110.00 125.00 S140,00 Sass.00 $170.00 S185, 0 $ 200.00 30 31 Investment . No Margin HIM+ BuyingOnMargin ShortSales Sheet 1 of 2 PageStyle_Buying OnMargin English (USA) I G Average: ; Sum: 0 - + 80% Type here to search e 11:46 AM A 6 7 )ENG 6/13/2020Estimating and interpreting the main nancial ratios over the last 3 years (20 points) You should use the information available in the balance sheets and income statements for years 2018, 2019, and 2020. You can either copy this information from Yahoo Finance to an Excel sheet or take screenshots of the data. Next, you need to mark the relevant account items that you used to estimate each nancial ratio. The key requirements of this sub-section are as described below