Question: Man Question 9 Devon purchases Stock T when it is trading at 50 per share. He is concerned with the risk of the stock price

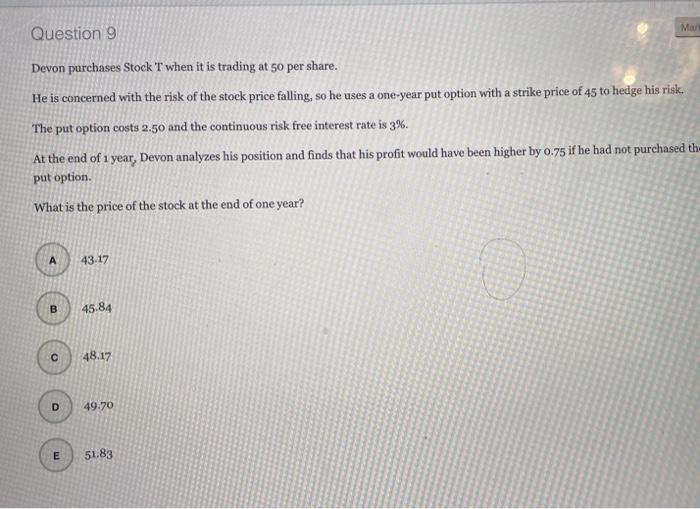

Man Question 9 Devon purchases Stock T when it is trading at 50 per share. He is concerned with the risk of the stock price falling, so he uses a one-year put option with a strike price of 45 to hedge his risk. The put option costs 2.50 and the continuous risk free interest rate is 3%. At the end of 1 year, Devon analyzes his position and finds that his profit would have been higher by 0.75 if he had not purchased th- put option. What is the price of the stock at the end of one year? 43.17 45.84 48.17 49.70 51.83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts