Question: management accounting 1 . Answer fully with explaination. Tq QUESTION 2 Luboil Ltd uses a process system to jointly produce its three main products, (Products

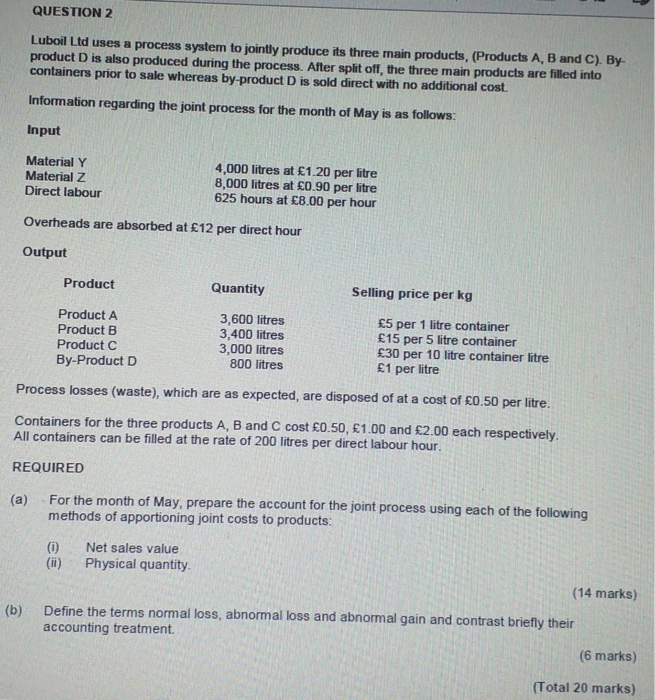

QUESTION 2 Luboil Ltd uses a process system to jointly produce its three main products, (Products A, B and C). By product D is also produced during the process. After split off, the three main products are filled into containers prior to sale whereas by-product D is sold direct with no additional cost. Information regarding the joint process for the month of May is as follows: Input Material y Material Z Direct labour 4,000 litres at 1.20 per litre 8,000 litres at 0.90 per litre 625 hours at 8.00 per hour Overheads are absorbed at 12 per direct hour Output Product Quantity Selling price per kg Product A Product B Product C By-Product D 3,600 litres 3,400 litres 3,000 litres 800 litres 5 per 1 litre container 15 per 5 litre container 30 per 10 litre container litre 1 per litre Process losses (waste), which are as expected, are disposed of at a cost of 0.50 per litre. Containers for the three products A, B and C cost 0.50, 1.00 and 2.00 each respectively. All containers can be filled at the rate of 200 litres per direct labour hour. REQUIRED (a) For the month of May, prepare the account for the joint process using each of the following methods of apportioning joint costs to products: (0) Net sales value (ii) Physical quantity. (14 marks) Define the terms normal loss, abnormal loss and abnormal gain and contrast briefly their accounting treatment. (6 marks) (b) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts